As a seasoned crypto investor with years of experience navigating the volatile digital asset market, I’ve seen my fair share of bull and bear markets. The latest report by Steno Research has caught my attention, suggesting that Ethereum (ETH) could soon outperform other cryptocurrencies following the US Federal Reserve’s decision to cut interest rates.

Based on Steno Research’s findings, it seems that Ethereum (ETH) may soon outperform other cryptocurrencies in the market after the U.S. Federal Reserve (Fed) announced its decision to lower interest rates.

It’s Time For Ethereum To Shine Again

2024 hasn’t been a standout year for Ethereum (ETH) in terms of price growth. Compared to Bitcoin (BTC) and other cryptocurrencies like Solana (SOL) and Tron (TRX), ETH has not seen significant price increases, as it is currently trading at prices similar to those from early 2024.

Significantly, since the merger on September 15, 2022, the second-largest cryptocurrency in terms of market capitalization has dropped approximately 48% compared to Bitcoin.

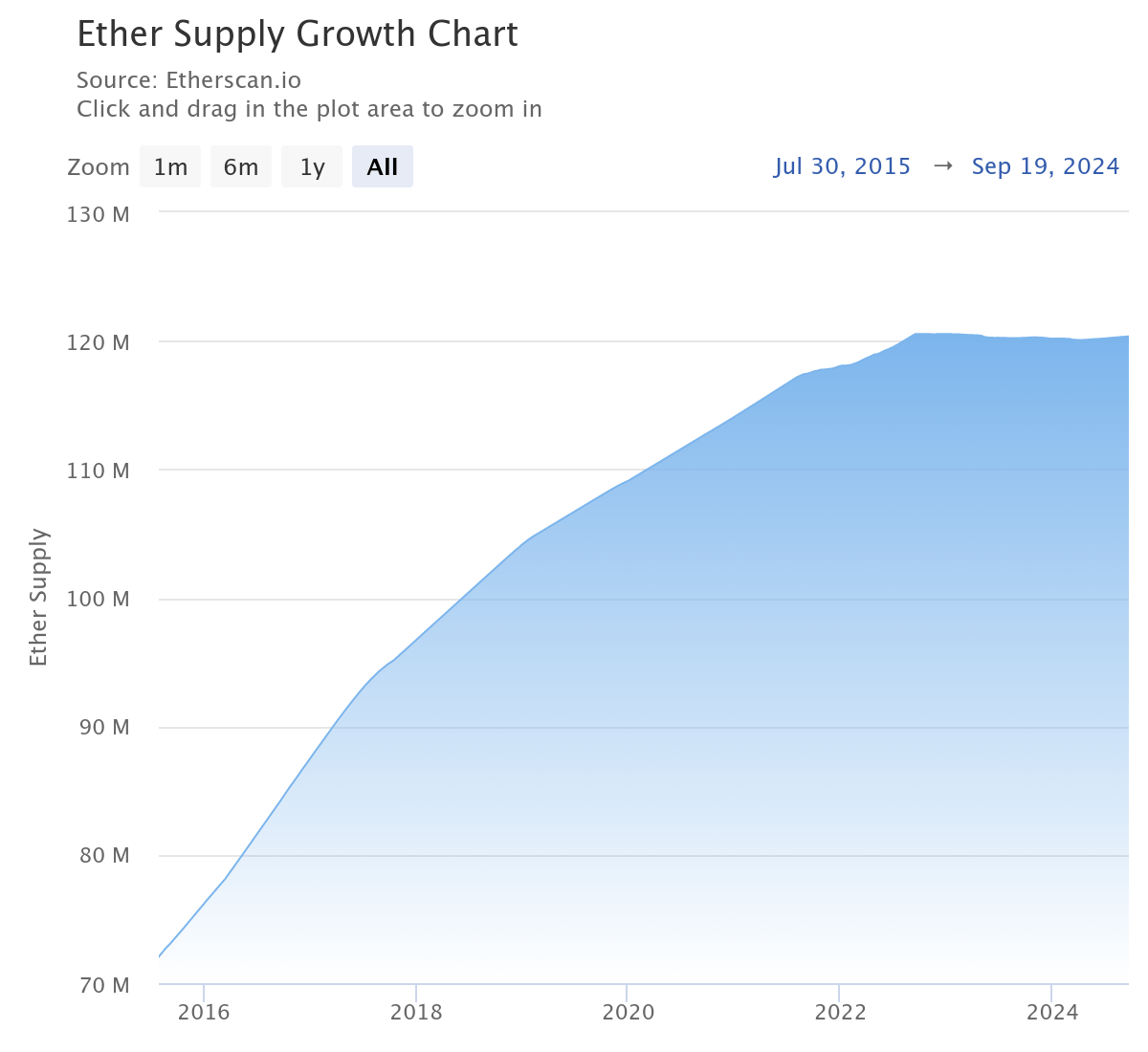

For those unfamiliar, the Ethereum merge marked a significant achievement for the top smart contract platform. It didn’t just switch its underlying system for validating transactions from Proof-of-Work (mining) to Proof-of-Stake (staking), but it also reduced the annual issuance of new ETH from 4% to 1%.

Consequently, the total Ethereum supply has decreased due to more Ether being destroyed from transaction costs than freshly minted Ether given to miners or stakers.

Ethereum’s unimpressive performance against Bitcoin can be confirmed from the following chart, where the ETH/BTC trading pair has fallen to 0.04, eroding all its gains against the flagship cryptocurrency since April 2021. However, a recent report by Steno Research opines that it’s time for Ethereum to come back.

Based on the findings of the report, a potential reduction in interest rates by the Fed could serve as a catalyst for an increase in the price of Ethereum over the next few months. The report points out that during the previous altcoin season, Ethereum significantly outperformed Bitcoin, nearly doubling its value compared to Bitcoin within just a couple of months.

This unexpected expansion is primarily fueled by a significant surge in blockchain transactions due to the escalating curiosity towards financial systems like Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and an upsurge in the production of stablecoins. On X, Mads Eberhardt, Senior Cryptocurrency Analyst at Steno Research, stated:

Lower interest rates lead to an increase in on-chain activity, which in turn boosts Ethereum’s transactional income. With more income coming in, the growth of Ether’s supply decreases due to reduced mining rewards and increased buying demand. As a result, the price of Ether tends to rise.

Several Reasons For Ethereum’s Underperformance

Furthermore, the document points out that Ethereum ETFs may surpass Bitcoin ETFs in performance. To delve into the primary factors contributing to Bitcoin’s dominance over Ethereum so far, Eberhardt highlights the following points:

The influence of U.S.-based spot ETFs on both bitcoin and ether, the continuous demand from MicroStrategy (MSTR), and a significant drop in Ethereum’s transaction-related income over the past few months.

Despite the headwinds it has faced, investor confidence in Ethereum continues to be strong. In a recent report, crypto exchange Bitwise’s CIO called Ethereum the ‘Microsoft of blockchains’, hinting it might come back by year-end after the November US presidential elections. ETH trades at $2,543 at press time, up 4.3% in the past 24 hours.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- The games you need to play to prepare for Elden Ring: Nightreign

- The Babadook Theatrical Rerelease Date Set in New Trailer

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

2024-09-21 01:16