As a seasoned crypto investor who has seen the ebb and flow of market trends, I find myself intrigued by the recent stagnation of Dogecoin’s open interest. It’s like watching a puppy that refuses to chase after its tail amidst a pack of energetic dogs.

As the market recovers, there’s been a surge in open interest for major assets. However, unlike these leading cryptocurrencies like Bitcoin and Solana, Dogecoin appears to be quiet and not mirroring this trend. This stagnation in open interest might suggest potential implications for Dogecoin’s future price movement. So, what could this lack of activity in open interest indicate for the meme coin’s value in the near future?

Dogecoin Open Interest Fails To Move

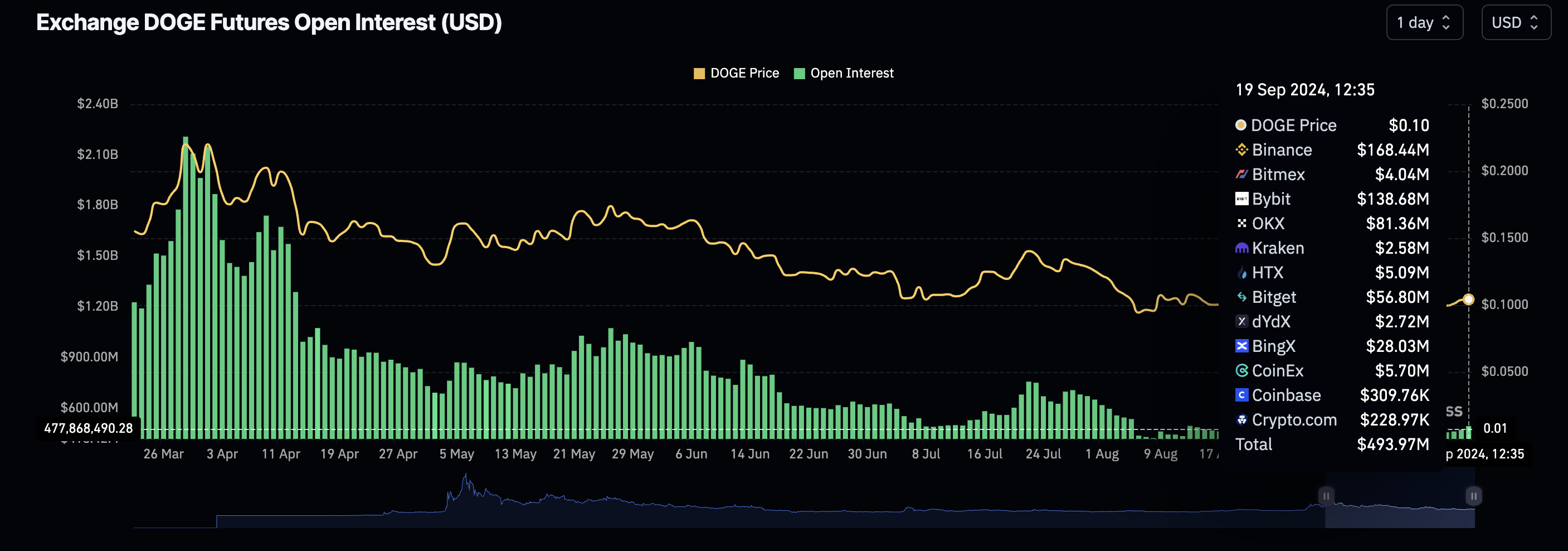

Based on information from Coinglass, Dogecoin’s open interest didn’t manage to exceed $500 million yet again. On Thursday, its open interest stood at approximately $493.97 million, falling short of its peak value. Interestingly, despite a 6.9% increase in the last 24 hours, Dogecoin’s open interest saw significant growth on platforms like OKX and Bitget.

As an analyst, I’ve observed a rise in Dogecoin’s open interest, yet it continues to trail behind its peak in August, which surpassed the $618 million mark. The relatively subdued activity since then implies that crypto traders may be focusing their efforts elsewhere rather than on Dogecoin.

It’s troubling to note that the current Dogecoin open interest is significantly lower than its record high in March 2024, with a decrease of over 70%. Back on March 29, 2024, the Dogecoin open interest peaked at $2.21 billion. However, since then, there has been a continuous drop in the open interest, which now stands at approximately $498 million – a decline of about 77% compared to its March levels.

Why This Decline Could Be Good For DOGE

In simpler terms, the open interest refers to the sum of all active option and future contracts related to a specific digital asset that are currently open in the market. Essentially, this figure indicates whether traders are heavily wagering on the rise or fall of a particular cryptocurrency.

Based on the data of Dogecoin, it seems traders’ attention has shifted away from the meme coin compared to before. Yet, this isn’t necessarily negative, as phases of low open interest have historically coincided with market bottoms. Low open interest provides a prime opportunity for investors to invest in the coin, as the price frequently drops alongside the open interest. As Bitcoin’s price recovers, it’s anticipated that Dogecoin’s price will follow suit. When the open interest starts to rise again, the DOGE price is likely to surge along with it.

In January 2024, a similar situation occurred, as the open interest hit a low of around $300 million. Yet, within a few months, the open interest increased by more than six times (630%), which led to a price jump of over 100% for Dogecoin.

If this situation repeats itself, it’s possible that the Dogecoin price may double again, surpassing the $0.2 mark. Given the anticipated bullish trend in the final quarter of the year, it could firmly establish itself above this level.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-09-20 22:16