As a seasoned researcher with over a decade of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. Today, watching Bitcoin surge by 5% after the Fed’s unexpected rate cut is like witnessing a well-choreographed dance between traditional finance and the digital economy.

Bitcoin‘s price surged beyond its previous barrier at around $60,500, fueled by the Federal Reserve’s interest rate cut of 0.50%. This move propelled Bitcoin towards a potential target of $62,500.

-

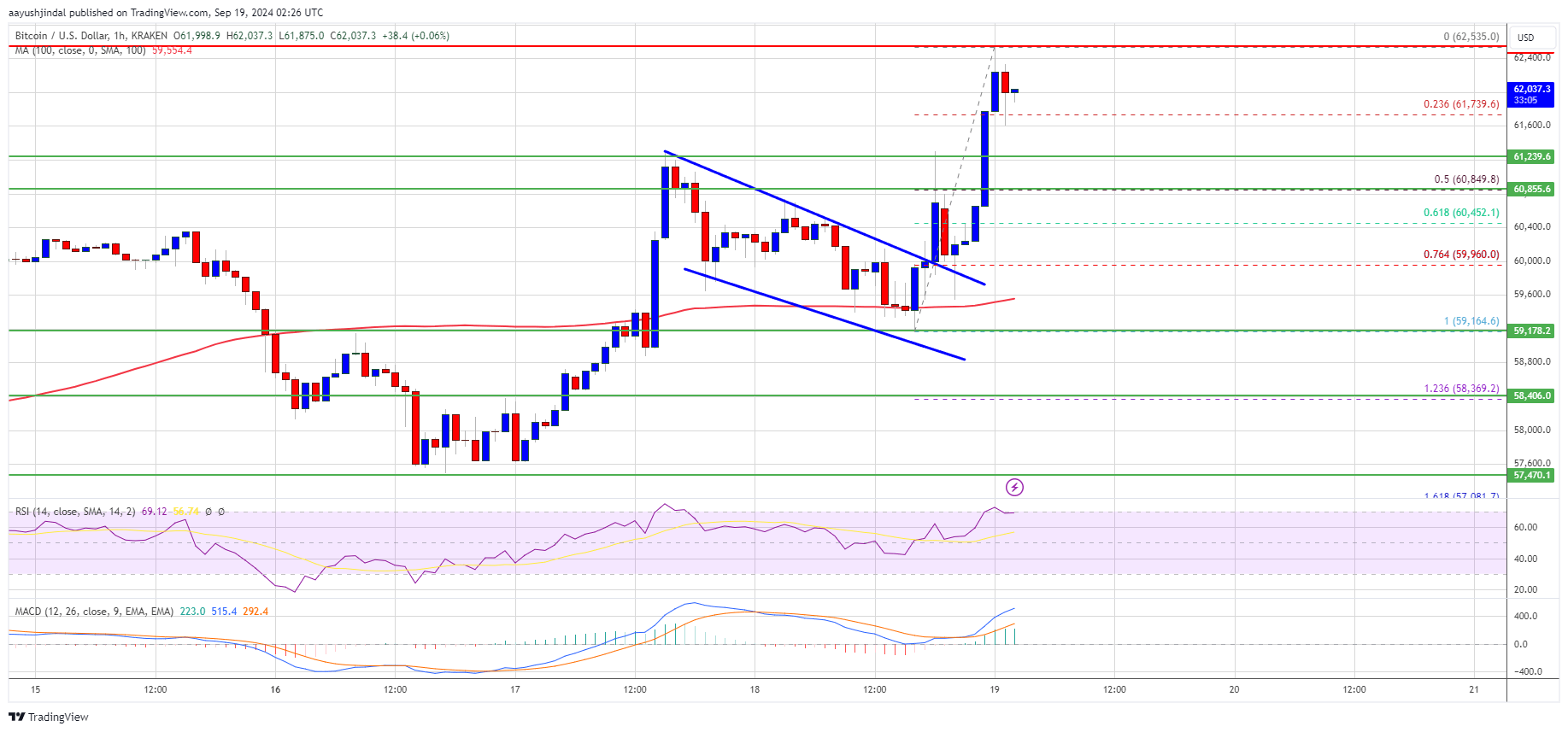

Bitcoin is gaining pace above the $60,200 resistance zone.

The price is trading above $60,500 and the 100 hourly Simple moving average.

There was a break above a short-term declining channel with resistance at $60,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

The pair could extend gains if it stays above the $60,500 support zone.

Bitcoin Price Surges By 5%

The cost of Bitcoin held steady above the $58,500 threshold, leading to a foundation for further growth beyond the $60,000 barrier that was initially a hurdle. This upward trend came about after the Federal Reserve unexpectedly reduced interest rates by 0.50%.

Above the $60,500 mark, there was a significant surge, breaking through a temporary downtrend pattern with resistance at $60,000 on the hourly Bitcoin-USD chart. The price reached the resistance zone of $62,500, peaking at $62,535 before consolidating its gains.

The price momentarily dropped below the $62,000 mark, touching the 23.6% Fibonacci retracement point of the rally that started at the $59,164 low and peaked at $62,535.

Currently, Bitcoin is being traded at a price point above $60,500 and is also following its 100-hour Simple Moving Average. As it moves upward, potential obstacles for the price could be found around the $62,200 mark. The primary resistance lies at approximately $62,500 level. Overcoming this resistance might pave the way for a steady growth trend in the upcoming trading sessions.

If we surpass $63,200, it may lead to further increases, potentially taking us towards the next potential resistance at $64,500 for testing.

Are Dips Supported In BTC?

If Bitcoin fails to rise above the $62,500 resistance zone, it could start a downside correction. Immediate support on the downside is near the $61,750 level.

As a researcher, I’ve identified a significant support level at approximately $61,250. Currently, the price is approaching the vicinity of $60,850 or the 50% Fibonacci retracement level of the recent upward trend from the $59,164 swing low to the $62,535 high. If we see further losses, it’s likely that the price will trend towards the near-term support at $60,000.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $61,250, followed by $60,850.

Major Resistance Levels – $62,500, and $63,200.

Read More

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- The Babadook Theatrical Rerelease Date Set in New Trailer

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Cardi B Sparks Dating Rumors With Stefon Diggs After Valentine’s Outing

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- What Does Mickey 17’s Nightmare Mean? Dream Explained

2024-09-19 05:46