As a seasoned crypto investor with a knack for spotting trends and patterns, I find myself intrigued by the insights shared by analysts like Charles Edwards and Checkmate. The historical data presented suggests that Q3 is traditionally a challenging period for Bitcoin investors, but it also underscores the potential bullish momentum that Q4 could bring.

A financial expert has shared insights suggesting that the toughest times might have passed for Bitcoin, and it’s possible that the fourth quarter could witness a resurgence of optimistic trends if past events serve as a guide.

Q3 Has Historically Been The Worst Time For Bitcoin Investors

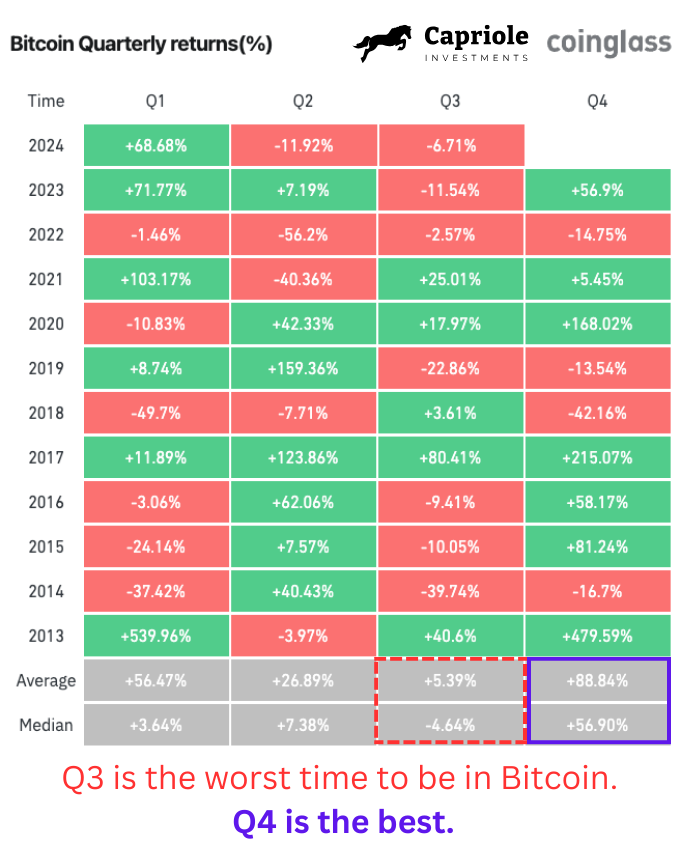

In a recent update on platform X, Charles Edwards, founder of Capriole Investments, discussed the challenging period that Bitcoin investors are currently experiencing. Here’s the table provided by the analyst, which summarizes the quarterly performance of Bitcoin over its entire lifespan:

Historically, it’s common to see a downturn for Bitcoin during the third quarter, with the typical return for the month averaging about 5%, and the midpoint (median) return being roughly -4%.

From a broader viewpoint, it’s often the case that the second quarter (Q2) shows less favorable performance compared to other quarters. However, it’s important to note that the average and median returns for Q2, which stand at approximately +27% and +7%, respectively, are significantly superior to those of Q3.

Conversely, we find ourselves in Q4, the latter part of the current year. It’s been a particularly prosperous period for Bitcoin, with average and median returns soaring to approximately +89% and +57% respectively.

Should you find yourself still present, kudos! You’ve weathered what seemed like the most challenging period for Bitcoin trading. The brightest days are yet to come,” says Edwards in his post addressing BTC traders.

In the previous year, the value of cryptocurrency surged by nearly 57% during this same period. As we near the end of Q3, it’s yet to be determined how Bitcoin prices will behave in Q4 this coming season.

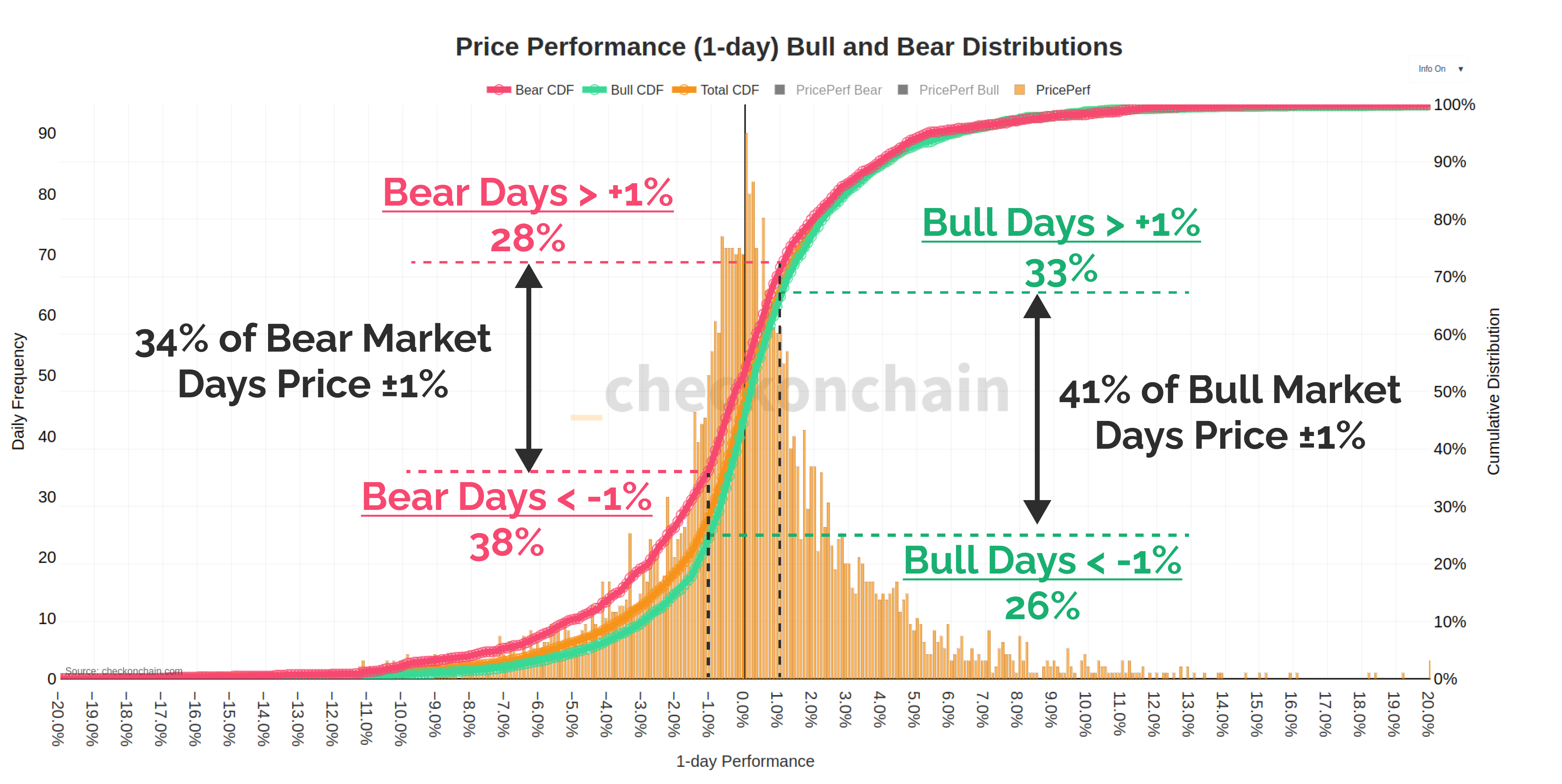

Discussing historical trends, Checkmate recently delved into how the distribution of daily price movements has varied between bear and bull markets, as presented in a Reddit post on the subject.

Here is the chart shared by the analyst:

According to the graph, approximately 28% of bear market days show the asset increasing by over 1%, while around 38% of these days see it decreasing by more than 1%. The remaining 34% of days exhibit the cryptocurrency staying within a range of 1% above or below its previous day’s value.

In times of optimism, about one-third (33%) of Bitcoin’s days show an increase exceeding +1%, and approximately a quarter (26%) experience a decline surpassing -1%. For the majority of days (41%), the asset remains relatively stable or unchanged.

The symmetry between the three types of days is interesting, but what stands out is how the distributions are almost the same between bear and bull markets.

According to Checkmate, day traders face a challenging situation where approximately one-third of the trading days result in market rallies, another third experience sell-offs, while the remaining third see no significant movement.

BTC Price

Over the past day, Bitcoin has experienced a significant surge in optimistic energy, pushing its value over 5% higher, reaching approximately $60,900.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Etheria Restart Codes (May 2025)

- Green County map – DayZ

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-09-18 12:04