As a seasoned crypto investor with a decade of experience under my belt, I must admit that Q2 2024 was indeed a rollercoaster ride for AVAX investors like myself. The significant decline in market capitalization and low revenue generation were certainly concerning, but as they say, every storm passes.

In terms of various benchmarks, Avalanche (AVAX) experienced a disappointing second quarter of 2024 due to a substantial drop in market capitalization and relatively low income production.

According to Messari’s latest report, Avalanche (AVAX) experienced a significant downturn following two consecutive quarters of growth. The market value decreased by approximately 40% within the past quarter and currently stands at $11.6 billion. However, it’s worth noting that despite this recent decline, AVAX’s ecosystem remains robust, as its market capitalization has increased by an impressive 157% compared to the same time frame in 2023, amounting to a current value of $4.5 billion.

State of @avax Q2

Key Update: Several partnerships announced, notable ones include @stripe, @homium, and @konami.

QoQ Metrics

– Staked AVAX 6%

– DeFi TVL (AVAX) 11%

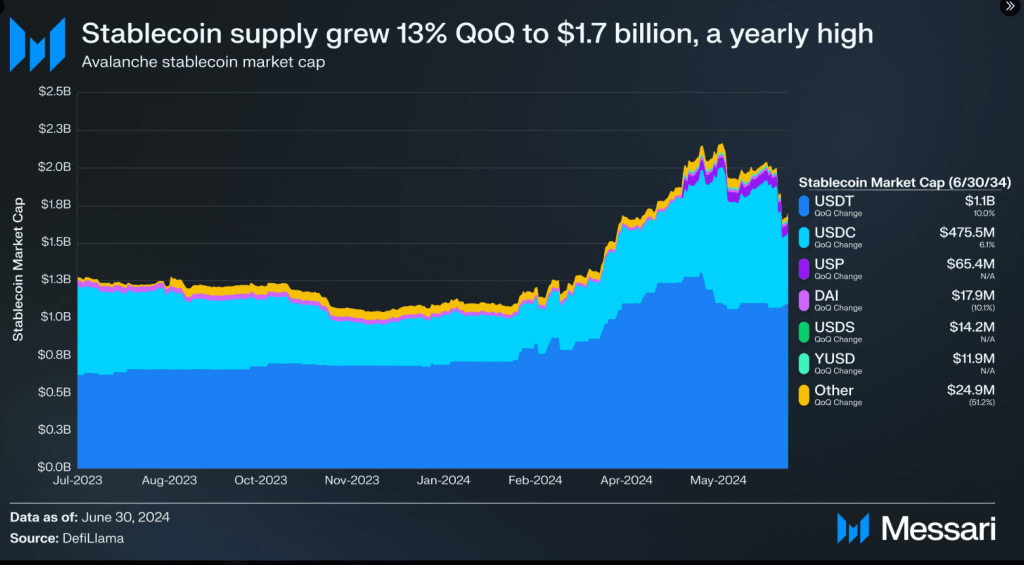

– Stables 13%

Read the full report

— Messari (@MessariCrypto) September 13, 2024

Price Forecast Shines Through The Dip

The downturn is causing distress within the broader market, but the outlook for Avalanche appears promising. In truth, predictions for its token suggest optimism for investors. According to CoinCheckup’s analysis, AVAX could experience a 70.68% increase over the next quarter, signaling a rebound from current prices.

The optimistic outlook is strengthened by long-term forecasts indicating a potential increase of 166% within the coming year. It appears that Avalanche (AVAX) could be on its way to recuperation, making it an enticing prospect for traders who closely follow the market trends.

Revenue Plunge And On-Chain Activity

For the Avalanche ecosystem, a decrease in revenue was a point of concern as its value dipped from approximately 176,700 AVAX in Q2 2024 to 96,200 AVAX over the same timeframe. This equated to a decline from $7.5 million to around $3.5 million in U.S. dollars.

The reduction in activity is observed across multiple chain-based transaction platforms. Yet, certain experts posit that increased engagement with these chain-based transactions might stimulate a quick resurgence in income growth in the near future.

In the face of these decreases, the Avalanche ecosystem’s staking sector remains strong, with a 6% rise in the number of AVAX tokens being staked as a result of new initiatives to strengthen staking. The allure of staking rewards continues to draw in new investors, even though the count of active validators has dropped by 7%. This trend suggests some apprehension among validators during these market fluctuations.

Network Stability

The number of transactions on Avalanche network varies, but it’s holding steady with around 11,262 transactions per unit of time, and an average block time of 1.61 seconds. This indicates a level of stability. Over 2% of the total coins have been transferred from wallets using the Elliptic Curve Digital Signature Algorithm. Although there have been declines, upcoming initiatives are anticipated to increase staking and future coin holdings.

It’s worth noting that while most networks saw a 57% decrease in average transactions, from 495,000 to 201,500, some protocols on Avalanche bucked this trend. Notably, Tether (USDT) and GMX showed an increase in transaction volumes, suggesting that certain sectors within the system are thriving even amidst the wider slowdown in the crypto market.

As a cryptocurrency investor, I’m excited about the possibility of AVAX experiencing a market rebound. If the predicted price surge happens, it could lead to increased attention and potential value for my AVAX assets.

The increase in certain protocol’s transaction volumes hints at deeper underlying factors – a clue that Avalanche could grow rapidly when the cryptocurrency market recovers. At this point, investors are eagerly watching to see how AVAX performs in both the near and mid-term.

Read More

- POPCAT PREDICTION. POPCAT cryptocurrency

- Who Is Finn Balor’s Wife? Vero Rodriguez’s Job & Relationship History

- General Hospital Cast: List of Every Actor Who Is Joining in 2025

- The White Lotus’ Aimee Lou Wood’s ‘Teeth’ Comments Explained

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Kingdom Come Deliverance 2: How To Clean Your Horse

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- Aaron Taylor-Johnson James Bond Casting Never Had ‘Any Real Movement’

- Who Is Cameron Mathison’s Ex-Wife? Vanessa’s Job & Relationship History

- Did WWE Superstars Liv Morgan & Raquel Rodriguez Attack Jade Cargill?

2024-09-16 21:04