As a seasoned analyst with over two decades of experience in traditional finance and digital assets, I have seen my fair share of market trends and cycles. The performance of DeFi lending protocol Aave in Q3 has caught my attention, outperforming its peers while the broader market was in decline.

In Q3, the decentralized finance (DeFi) lending protocol Aave demonstrated superior performance compared to its peers. From mid-June onwards, the value of Aave increased significantly by 71%, surpassing $140. On the other hand, competitors such as Maker (now known as Sky), which declined 31%, and Uniswap, which dropped 38% over the same period, underperformed. Lido, a staking platform, was the poorest performer in the sector with a massive 50% decrease in Q3.

Photo: TradingView

The group consisting of MKR, LDO, and UNI followed Ethereum‘s (ETH) broader drop. In fact, ETH, often referred to as the gauge for DeFi’s health, declined by 35% over the same period. However, investors in other top DeFi coins faced losses during this quarter, except for AAVE. The question then arises: what factors are contributing to AAVE’s growth and separation from ETH’s downturn?

What Makes AAVE an Outlier?

As per Kinji Steimetz, a research analyst at cryptocurrency research company Messari, the surge in AAVE can be attributed to both broader market trends and DeFi-specific factors. Steimetz pointed out that the decreasing traditional finance (TradFi) interest rates would make decentralized finance (DeFi) rates more attractive.

A significant event for cryptocurrency enthusiasts was the proposed fee adjustment announcement made in July, which some financial analysts consider a potential growth catalyst for AAVE. This change could potentially boost AAVE’s worth and the benefits received by its owners.

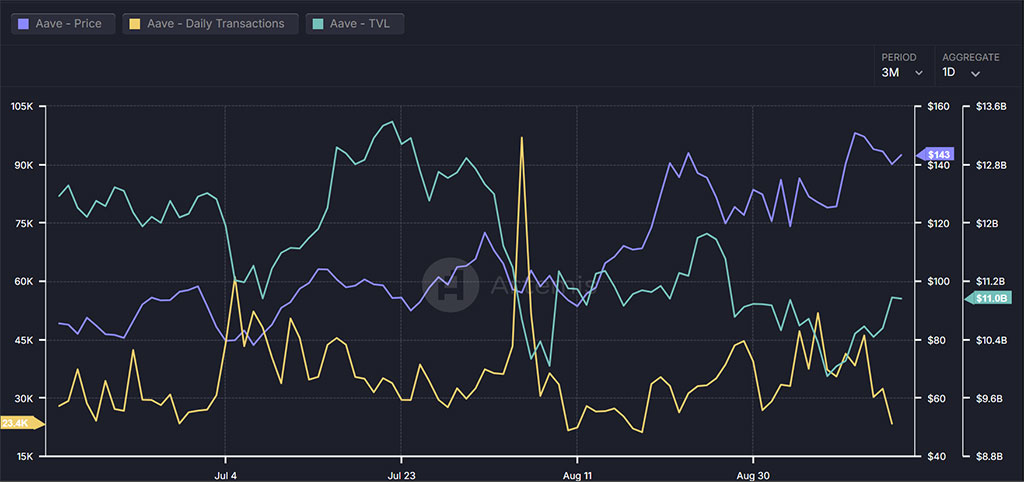

Indeed, the update on the fee proposal significantly boosted the AAVE network’s activity, evidenced by an increase in the number of daily active addresses.

Photo: Artemis

Moreover, notable figures such as Vitalik Buterin, co-founder of Ethereum, have employed the protocol, while Donald Trump intends to collaborate with it for upcoming DeFi ventures. This endorsement has strengthened faith in AAVE and ignited considerable curiosity, as evidenced by a surge in social attention according to Kaiko data.

Photo: Kaiko

Ultimately, Steimtz highlighted the issue of scarcity due to pressure on the supply side for AAVE, since nearly all its token stockpile had been released.

Once the tokens have been almost entirely released, you can confidently invest without fretting over an excess of available supply,” Steimtz noted.

Based on Token Unlocks’ statistics, approximately 92% of AAVE tokens, amounting to around 14.67 million coins, have been released so far. With a total supply set at 16 million AAVE tokens, this suggests that roughly 8%, or about 1.33 million tokens, remain locked and will be gradually released in the future.

Photo: TradingView

AAVE’s price surpassed $140 on charts and came close to its peak in March at $153, making it one of the leading tokens that managed to reach its March highs despite the declines in Q3 and Q2. With RSI readings at 56, there was a potential for further growth as the token had yet to reach overbought levels.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-09-16 19:00