As a seasoned analyst with years of experience in studying market trends and investor behavior, I find myself closely watching Ethereum’s current retest of the significant on-chain demand zone between $2,292 to $2,359. With my extensive background in analyzing cost basis distribution and its impact on market movements, I can’t help but feel a sense of anticipation about how this could play out.

A financial expert detailed the potential consequences if Ethereum fails to maintain its current crucial support area. This situation might lead to a significant drop in Ethereum’s value, potentially bringing it down to around $1,800.

Ethereum Is Currently Retesting A Major On-Chain Support Zone

In a recent article on X, analyst Ali Martinez shares insights on the current investor cost basis distribution of Ethereum, drawing upon data from market intelligence platform IntoTheBlock.

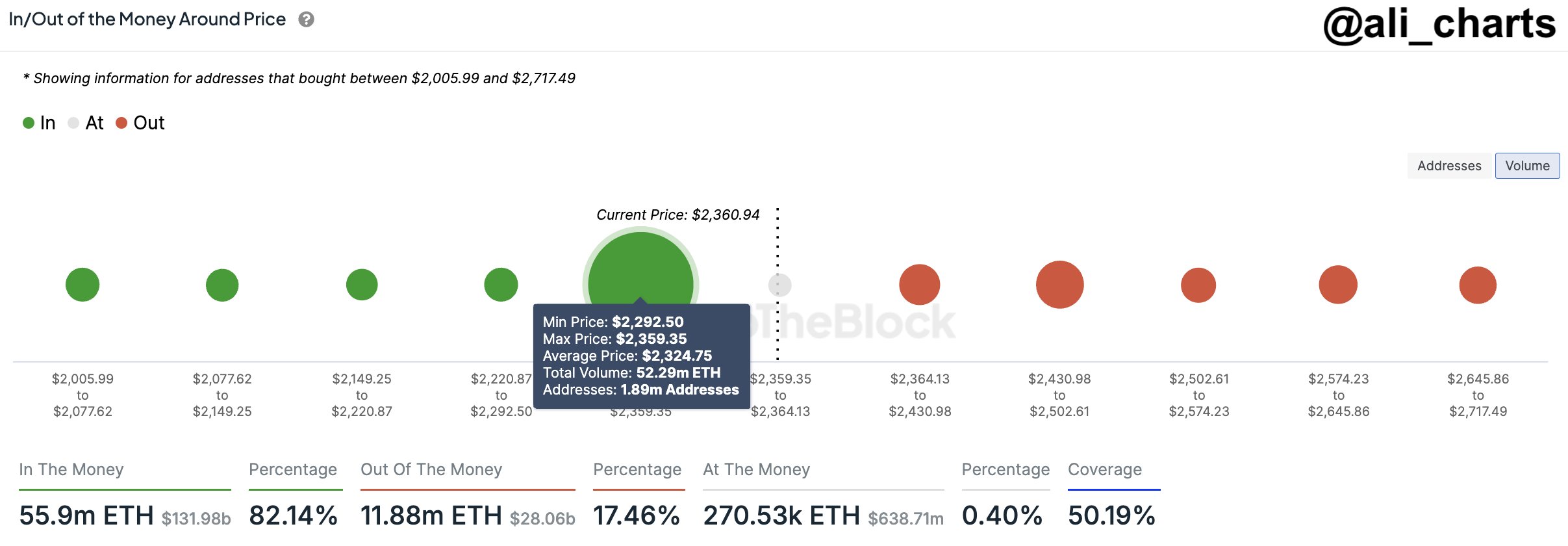

In the provided graph, each dot signifies the last ETH purchase made by investors or addresses within the specified price bracket. Notably, the dot in the $2,292 to $2,359 range appears notably larger than others, indicating a significant amount of purchases took place around these prices.

As a researcher examining the Ethereum market, I’ve discovered that approximately 1.9 million addresses have amassed nearly 52.3 million ETH within a specific range. Given that Ethereum is currently retesting this range, these investors are essentially at the point where they would recover their initial investment.

As a crypto investor, I can’t stress enough the significance of my cost basis in my investment strategy. Therefore, when there’s a retest of this crucial level, I find myself more inclined to consider making some adjustments. However, for those ranges that represent the acquisition level for only a few holders, the market reaction following a retest may not have much impact on the broader crypto market.

When I encounter large demand zones, where prices have fluctuated significantly, a retest could lead to noticeable volatility in the value of my Ethereum holdings. Given that the current Ethereum price range falls into this category, I remain vigilant and ready to adjust my investment strategy accordingly.

To explain how a retest of a significant demand zone might impact the cryptocurrency market, we need to look at investor behavior. When a retest occurs from above, meaning it involves investors who had previously been in profit prior to the test, it tends to trigger a buying response within the market.

This is due to the belief among these holders that the asset could increase in value again in the future. Buying more at their current cost could seem like a lucrative prospect. Given Ethereum’s recent testing of the $2,292 to $2,359 range, it might show resilience and potentially rebound.

As a researcher examining the market trends, I’ve noticed that if a break below the current demand zone occurs, there could potentially be trouble for the cryptocurrency’s price. From my analysis of the chart, it appears that the prices below this demand zone represent the cost basis for only a few investors. Therefore, they may not have sufficient influence to halt a potential downward trend in the asset.

According to the expert’s analysis, if the current price range (demand zone) is breached, there might be a significant drop in Ethereum (ETH), potentially causing it to fall around $1,800. This predicted decline represents a drop of over 21% from its current value for ETH.

In the upcoming days, it’s yet to be determined how the cost of Ethereum will unfold and whether its on-chain support area will stay robust.

ETH Price

Following its recent upward trend over the past few days, Ethereum has returned to around $2,300, falling within the previously mentioned price bracket.

Read More

2024-09-16 18:04