As a researcher with years of experience navigating the volatile and dynamic crypto market, I find the recent surge in inflows to be both intriguing and encouraging. After weeks of turbulence, this sudden uptick seems like a breath of fresh air, akin to finding an oasis in the heart of the Sahara.

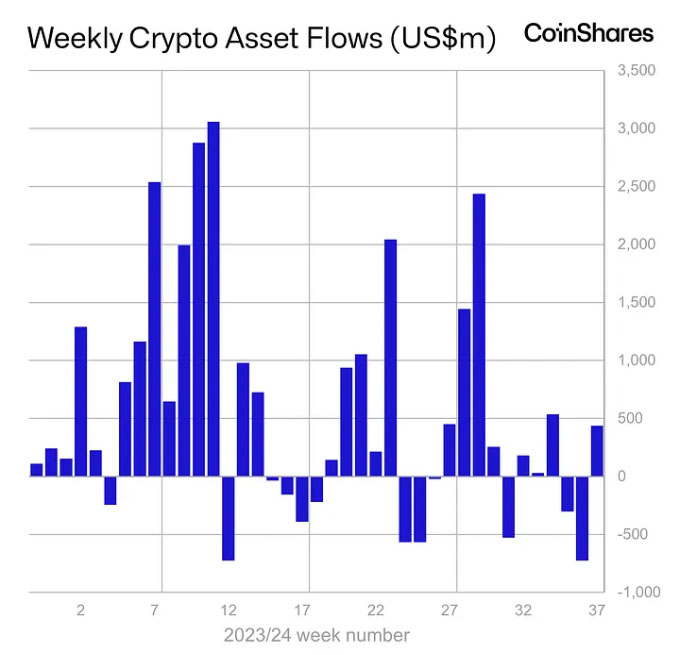

In mid-September 2024, the cryptocurrency market underwent an unexpected shift after a continuous drop over several weeks. During the second week of this month, investment products saw a significant increase of approximately $436 million. This surge signifies a drastic change following almost $1.2 billion in withdrawals during the previous weeks. The increased activity could be due to speculation about a potential 50-basis-point reduction in interest rates by the Federal Reserve, scheduled for announcement on September 18th.

Source: CoinShares

As an analyst, I observed a notable influence on market sentiment from the comments made by former New York Fed President Bill Dudley. His astute insights have bolstered investor confidence, leading many to reconsider their investment strategies, notably in Bitcoin. Notably, James Butterfill, head of research at CoinShares, highlighted that this shift has substantially impacted the direction of capital flows.

Bitcoin Takes the Lead with $436 Million Inflows

Bitcoin

BTC

$58 062

24h volatility:

-3.4%

Market cap:

$1.15 T

Vol. 24h:

$30.31 B

, once again, stands as the top gainer, securing $436 million in inflows, effectively reversing a streak of 10 consecutive days of outflows that totaled $1.18 billion. On the flip side, short Bitcoin products designed for bearish bets on the cryptocurrency saw outflows of $8.5 million after weeks of positive momentum, signaling a growing bullish sentiment among traders.

Even as Bitcoin prospered, Ethereum encountered difficulties. The second-largest cryptocurrency by market value saw a $19 million decrease in investments. This downturn was primarily due to worries about the Ethereum’s layer-1 protocol, particularly following the “Dencun” update, which has sparked debates about profitability within Ethereum-centric systems.

Regionally, the United States led with a substantial $416 million investment, while Switzerland and Germany followed closely behind with $27 million and $10.6 million respectively. However, despite this significant influx, the trading volume in Exchange-Traded Funds (ETFs) remained stable, totaling just $8 billion for the week – significantly lower than the year-to-date average of $14.2 billion.

As an analyst, I’ve observed an exciting development: Not only have cryptocurrencies seen an uptick in investments, but also equities tied to blockchain technology. Specifically, there was a $105 million inflow into these sectors. This surge can be attributed to the launch of new ETFs on the US market, signaling a heightened investor confidence in the broader realm of blockchain and crypto assets.

Ethereum Faces Outflows while Solana Shines

Meanwhile, Solana

SOL

$130.9

24h volatility:

-3.2%

Market cap:

$61.28 B

Vol. 24h:

$2.25 B

continued its streak of positive inflows, marking the fourth consecutive week of capital inflow with $3.8 million. Solana’s consistent performance starkly contrasts Ethereum’s recent challenges and indicates increasing interest in alternative layer-1 solutions.

The increase in investments into crypto products and blockchain stocks indicates a return of market confidence. It’s predicted that the potential interest rate decrease by the Federal Reserve will ease financial restrictions, potentially boosting the digital asset sector even more. Despite Ethereum encountering challenges, the overall cryptocurrency landscape appears poised to capitalize on economic trends.

While the investment world holds its breath for the Federal Reserve’s verdict, there’s a sense of uncertainty hanging over the market right now. However, recent data suggests a glimmer of hope, and it appears that Bitcoin is leading the charge in this new surge of optimism.

Read More

2024-09-16 17:36