As a seasoned analyst with over two decades of experience in financial markets, I have witnessed countless market fluctuations and trends. The recent surge in Ethereum price has certainly piqued my interest, but the rising exchange inflow is a cause for concern.

Discussions about Ethereum‘s price have been prevalent in the world of cryptocurrencies lately, as it has faced considerable bearish trends in recent weeks. Interestingly, despite this, Ethereum appears to be on the road to recovery after posting its first positive weekly performance in over a month.

Lately, there’s been a noticeable movement of Ethereum tokens into centralized exchanges within the last 24 hours. One might wonder if this trend could potentially slow down the upward momentum that Ethereum prices have recently demonstrated.

Here’s How Rising Exchange Inflow Affects Ethereum Price

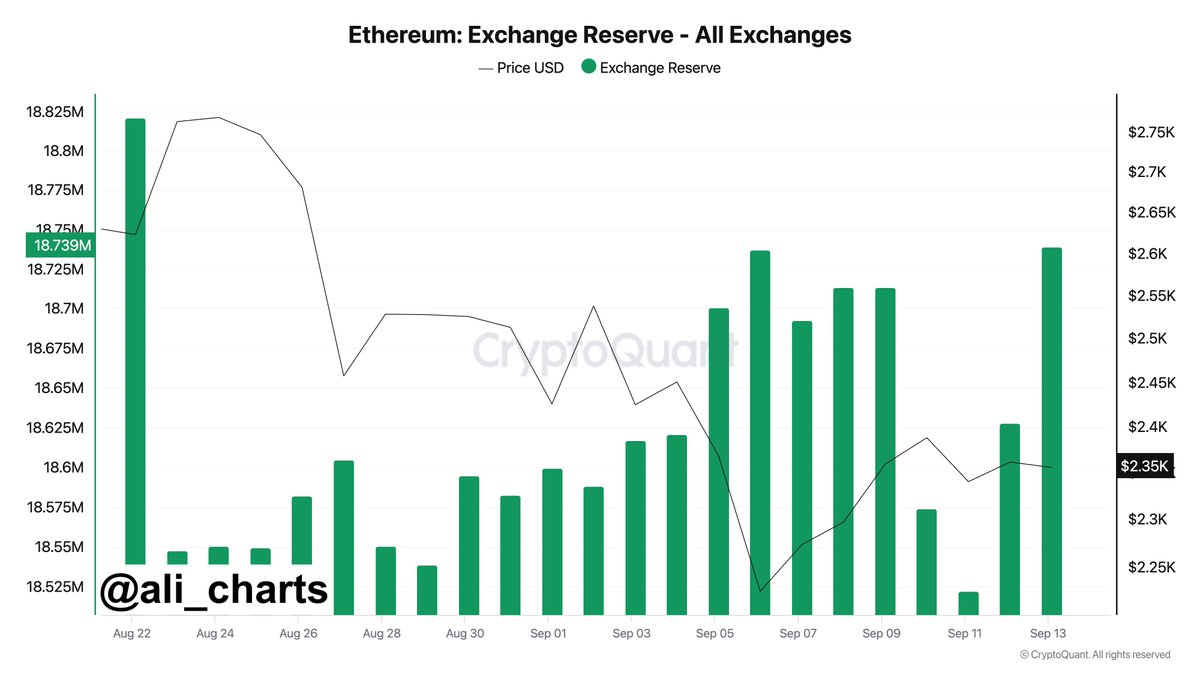

Ali Martinez, a well-known voice in the crypto world, recently shared an observation on the X platform: It appears that Ethereum investors have been transferring their holdings to centralized trading platforms over the past day. This conclusion is drawn from data collected by the CryptoQuant exchange reserve metric, which keeps track of the overall supply of a specific cryptocurrency across all exchanges.

Generally speaking, as investors deposit more Ether into a centralized exchange than they withdraw, the value of this particular metric tends to rise. Conversely, if the reserve metric decreases, it suggests that the token holders are transferring their assets away from cryptocurrency exchanges.

Transferring investments from personal, self-managed wallets to centralized trading platforms is usually done so investors can utilize the platform’s offerings, such as selling assets. Consequently, a rise in the exchange reserve indicator frequently indicates growing selling demand, or pressure.

Based on information from CryptoQuant, over 112,000 Ethers, valued roughly at $257.6 million, were shifted to cryptocurrency trading platforms within the past day. This large-scale transfer of Ether could potentially lead to a decrease in Ethereum’s price due to increased selling pressure.

Given its current precarious state, increasing inflows into exchanges might potentially slow down Ethereum’s recent price surge. However, it’s important to mention that this hasn’t appeared to impact ETH‘s value in the last 24 hours. In fact, quite the opposite is happening as the cryptocurrency has risen by over 3% and is aiming to break through the $2,500 mark.

Are Investors Fleeing The Market?

Recent on-chain statistics indicate a potential mass exit by investors from the Bitcoin and Ethereum markets. As per analyst Ali Martinez, approximately $2.6 billion worth of these two prominent cryptocurrencies have been withdrawn within the past week.

This information stems from the market realized value net position change metric provided by Glassnode, which suggests a trend of investors potentially selling their Ethereum tokens, lending some credence to an idea previously proposed.

Additionally, such a drain of funds might potentially cause further issues within the cryptocurrency market, particularly affecting the values of Bitcoin and Ethereum.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The Babadook Theatrical Rerelease Date Set in New Trailer

- The games you need to play to prepare for Elden Ring: Nightreign

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

2024-09-14 22:16