As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of bull and bear runs. Having closely observed Bitcoin’s evolution since its inception, I find ARK Invest’s latest report intriguing.

According to ARK Invest’s recent report, while the overall condition of Bitcoin (BTC) appears strong, it’s important for two key price support points to hold steady if the upward trend is to continue.

Bitcoin’s Healthy On-Chain Metrics, What Does It Mean?

According to ARK Invest’s recent findings, Bitcoin needs a price increase to preserve its market structure. The report highlights that in August 2024, the price of BTC dropped by 8.7% to reach $58,972. The digital currency also failed to surpass its 200-day moving average, implying that the two crucial support levels at $52,000 and $46,000 are essential for Bitcoin’s continued bullish trend.

According to the report, even though Bitcoin has encountered some short-term challenges, its overall wellbeing within the network stays optimistic. In other words, the Bitcoin system shows a predominantly positive outlook when considering various key performance indicators like network security, activity levels, and user conduct.

The percentage of Bitcoins held for over 155 days by owners has risen by 3.3% compared to the previous month (MoM), but decreased only slightly by 0.23% when compared to the same time last year (YoY). Furthermore, the amount of Bitcoin supply that is locked-in has grown in both monthly (MoM) and annual (YoY) terms, increasing by 0.58% and 1.82%, respectively.

Bitcoin’s monthly transaction volume has dropped by 24.5%, and when compared to the same period last year, it’s down by 2.3%. This decrease is a sign of bearish activity on the blockchain. Yet, despite this single negative signal, Bitcoin’s overall health on the blockchain remains positive due to its other bullish indicators outweighing this one downturn.

“One crucial indicator supporting ARK Invest’s positive outlook on Bitcoin is its superiority in short-to-long term liquidations. This metric compares the number of short-term liquidations to long-term ones over the past 90 days, and it has reached a record low since the second quarter of 2023.

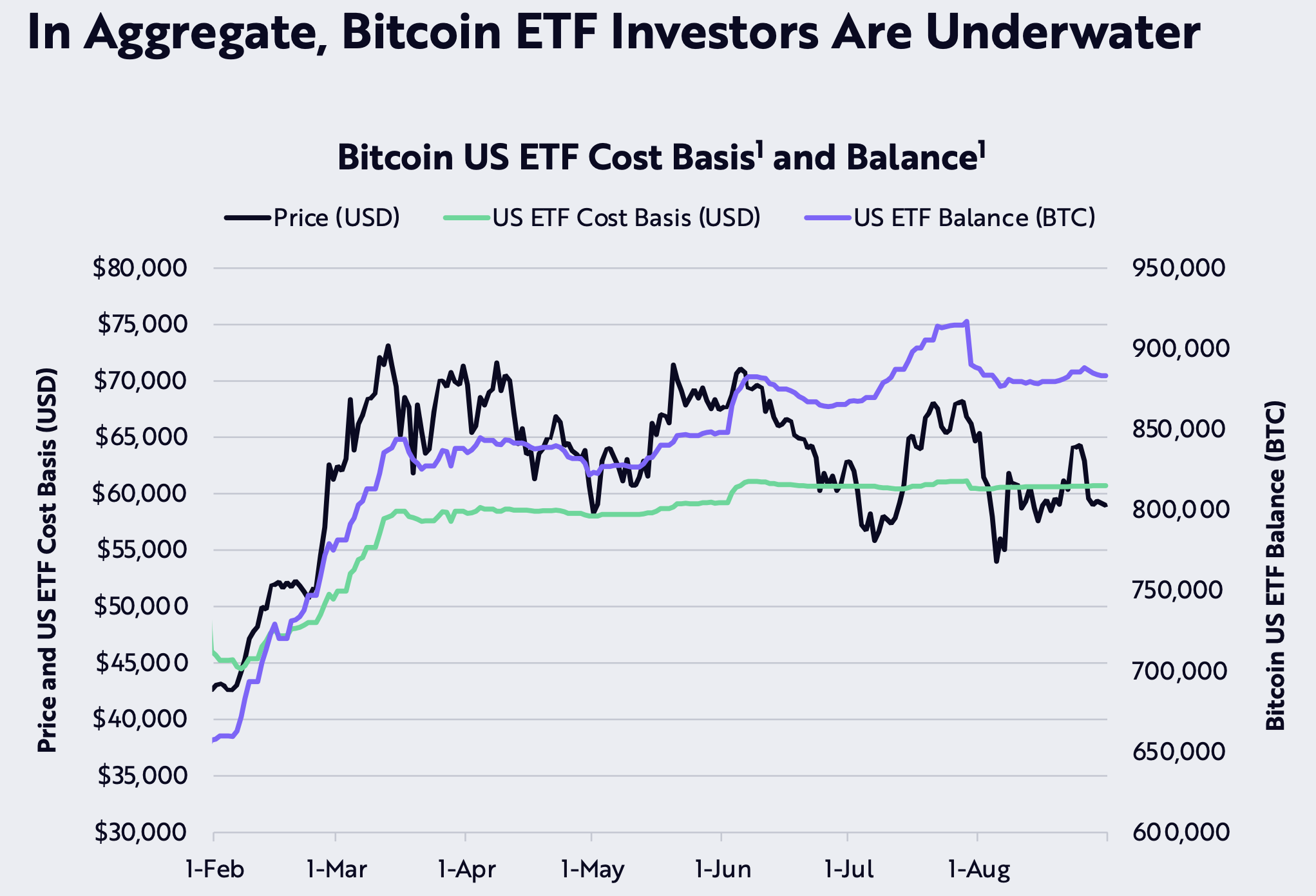

Bitcoin ETF Investors Underwater At Large

As a crypto investor looking ahead to August 2024, a recent report suggests that the average cost I’ve paid for US spot exchange-traded funds (ETFs) is higher than the projected Bitcoin price at that time. This could mean that on average, ETF investors might be facing a loss. You can verify this by checking out the chart below.

Earlier this year, the United States Securities and Exchange Commission (SEC) gave its approval for a Bitcoin Spot ETF, providing institutional and individual investors an easier avenue to invest in Bitcoin via a legally-compliant financial instrument.

Institutional investors, including giants like Goldman Sachs and Morgan Stanley, are showing extraordinary enthusiasm for Bitcoin Exchange-Traded Funds (ETFs), investing huge sums of money into them. In contrast, Ethereum ETFs haven’t yet attracted similar levels of institutional interest.

Currently, one Bitcoin is valued at approximately $57,836, marking a slight increase of 0.2% over the past day. The total market value of all Bitcoins in circulation amounts to around $1.14 trillion.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-09-14 02:46