As a seasoned analyst with over two decades of experience in traditional finance and a deep dive into the crypto realm since 2017, I find myself cautiously bearish on Ethereum (ETH) at this juncture. The current relief rally is a welcome sight, but it’s essential to consider the long-term outlook, as highlighted by analysts like Benjamin Cowen and Quinn Thompson.

Speaking of Ethereum (ETH), the second largest cryptocurrency in terms of market capitalization, it experienced an uptick earlier this week, gaining approximately 2%. Currently trading at around $2,300, this is a positive shift following last week’s 5% decline that took ETH down to $2,100. However, despite this minor recovery, crypto analyst Benjamin Cowen foresees a potential drop below $1,500, drawing a parallel with the market pattern of 2019.

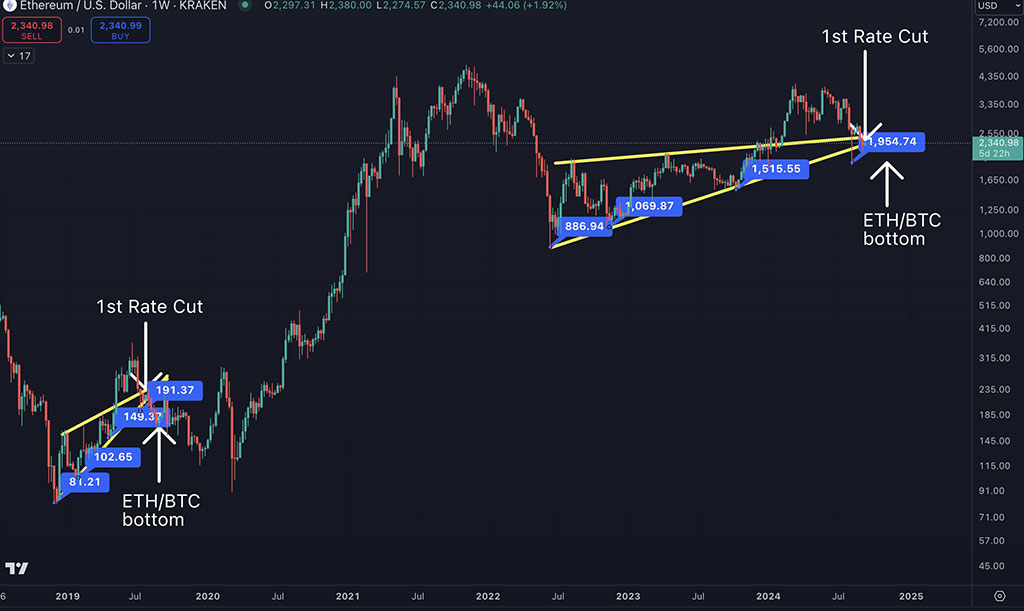

According to Cowen’s observation, ETH retraced into its pattern similar to 2024 just before the initial interest rate reduction in 2019. After the first rate cut in 2019, ETH dipped below its pattern, and subsequently, the ETH/BTC pair reached its lowest point.

Photo: Benjamin Cowen / X

Analysts predict that the Federal Reserve will lower interest rates at their upcoming meeting next week, which could influence the cryptocurrency market. In 2019, when the first rate cut occurred, Ether (ETH) dipped below a wedge pattern, leading to a significant drop in its value compared to Bitcoin (BTC). For clarity, the ETH/BTC ratio indicates the value of Ether relative to Bitcoin.

As a crypto investor, I’ve been closely following the predictions from Cowen, which suggest that if the 2019 pattern repeats itself, the ETH/BTC ratio might find its bottom when Ether (ETH) reaches around $1200 by December 2024. At present, the ETH/BTC chart has been struggling to maintain its position at the lower end of its two-year long channel.

Quinn Thompson from Lekker Capital, a crypto investment firm, has expressed a similar viewpoint. He believes that the Ethereum (ETH) to Bitcoin (BTC) ratio could decrease to approximately 0.033 by year-end, and then potentially rebound. This prediction is based on his belief that ETH is currently overpriced. If Bitcoin remains at its current value of around $56,000, this would suggest an Ethereum price of roughly $1800.

ETH Demand Woes

A significant portion of Ethereum’s underperformance compared to Bitcoin can be attributed to the disappointing performance of US spot ETFs related to Ethereum. Since their launch in July, these products have seen a total withdrawal of $574 million, according to Farside Investors data. In fact, there were no inflows or outflows on certain trading days over the past two weeks.

Contrary to some assumptions, U.S.-listed Bitcoin Exchange-Traded Funds (ETFs) have garnered a total inflow of approximately $16.9 billion since their introduction. Notably, they have outperformed expectations, particularly in the initial two months of operation.

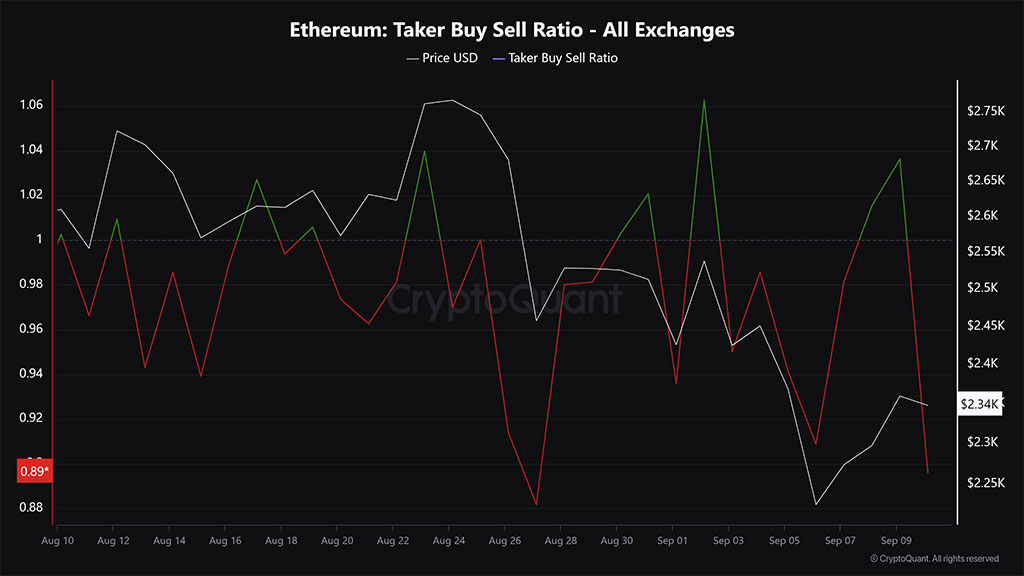

Photo: CryptoQuant

Despite this week’s ETH price increase, which might suggest otherwise, most Ethereum speculators maintained a pessimistic view. This can be seen in the Taker Buyer Sell Ratio metric, where sell volumes significantly exceeded buy volumes. This imbalance indicates that the derivatives market is largely bearish.

Photo: TradingView

In the near future, it’s crucial to keep an eye on significant support levels around $2.3K, $2.4K, and $2.5K, as these are the 50-day Exponential Moving Averages (EMA) that could impact the market trend.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-09-10 12:10