As a seasoned analyst with over two decades of experience in the ever-evolving world of cryptocurrencies, I must admit that the recent turn of events at Friend.tech leaves me feeling a tad concerned. The series of controversial decisions and missteps by the team has undeniably shaken investor confidence, as evidenced by the plunge in FRIEND’s token price and the significant losses sustained by prominent investors such as the Taiwanese personality Machi Big Brother.

Friend.tech’s crypto social media platform experienced criticism following a contentious move made by their team. The value of their native token, FRIEND, fell dramatically by approximately 42%, reaching its lowest ever price point (all-time low) during this period of controversy. This decline caused an Ethereum (ETH) investor, known as a “whale,” to lose more than 95% of its investment in the token.

Friend.tech Loses Investors’ Trust

During the past weekend, cryptocurrency platform Friend.tech made public their choice to relinquish authority over their smart contracts to prevent any future modifications. Friend.tech is a Social Finance (SocialFi) platform introduced in 2023 that merges the concepts of social media and Decentralized Finance (DeFi). In simpler terms, they’ve opted to give up control over their smart contracts to ensure no changes can be made in the future. This platform was launched in 2023, bringing together the ideas from both social media and decentralized finance.

The project is a blockchain-based social platform built on Ethereum’s Layer-2 Base, offering users the potential to profit from content creation. The crypto platform allows creators to monetize their content by using tradeable tokenized shares, known as “Keys,” to access their exclusive publications and private chats.

On September 7th, Friend.tech’s team disclosed that they had transferred control of their smart contract systems to Ethereum’s zero address. This action was taken to ensure that no modifications could be made to the fees or features associated with these contracts in the future.

As stated in the article, the modification does not impact the independent “friend.tech web client,” which will carry on functioning as usual. Furthermore, it’s important to note that fees derived from the smart contracts or the platform are not being directed towards the developer team’s multi-signature wallet.

After hearing about the latest developments, members of the project’s community vocalized their dissatisfaction, voicing their incredulity over the decision. One community member labeled the team’s recent actions as “the most egregious example of POOR LEADERSHIP ever seen within the realm of cryptocurrency.

While some were wondering if the decision was more like sealing the deal or adding a bow to a gift, investors had started to express doubts back in May, as the project’s airdrop encountered various problems.

Initially, mistrust developed when the platform disclosed plans for constructing “Friendchain” in June. Subsequently, the announcement sparked criticism, leading Friend.tech to announce they had scrapped the project in a post that has since been removed. This move resulted in a significant drop of more than 35% in the value of its token in July.

Crypto Whale Investment Drops 94%

After the announcement, the value of FRIEND fell by 42%. Over the weekend, the cryptocurrency dropped significantly from $0.102 to $0.0593. By Monday morning, the crash had pushed the token’s price down to an all-time low (ATL) of $0.0574, which is a staggering 98% decrease from its highest ever value (ATH) of $3.26.

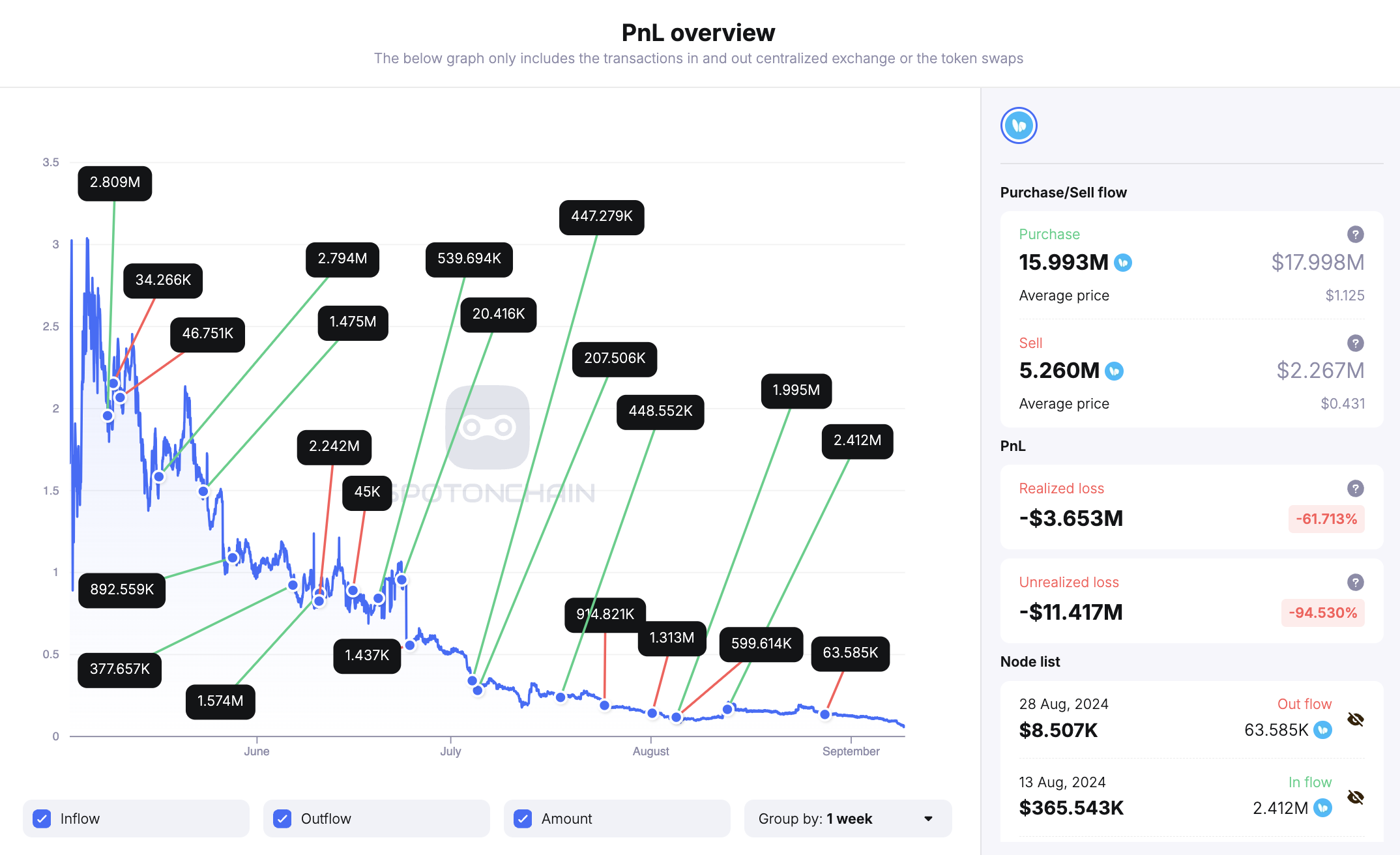

At the point when the value of the token reached its lowest, a cryptocurrency investor witnessed their investment plummet by more than 95%. According to blockchain research platform Spotonchain, a ‘whale’ incurred a loss of over $15 million on their FRIEND holdings.

According to the data, it appears that the Taiwanese figure known as Machi Big Brother had a particularly aggressive approach when dealing with the platform’s token. This influential investor, or ‘whale’, incurred approximately $16 million in both realized and unrealized losses after investing roughly $18 million in Ether (ETH) to purchase FRIEND tokens.

During the span from May 9 to August 13, Machi amassed a total of 15.99 million FRIEND tokens. On average, these tokens were acquired at a price of $1.125 each. Notably, this collection also includes FRIEND tokens earned by offering liquidity on BunnySwap during the same timeframe.

Over a period of several months, the value of the investment’s tokens decreased significantly. To mitigate this loss, the investor decided to get rid of approximately 5.26 million tokens. At that moment in time, these tokens were sold for a total of $2.27 million, with each token fetching an average price of $0.431. This sale resulted in a realized loss of 61.7%.

Originally, Machi held 11.1 million FRIEND tokens that had an unrealized loss of 94.5%, equivalent to $11.4 million. However, at the time of the report, the value of these tokens was approximately $689,000.

The cryptocurrency has recovered 32% from its ATL, briefly hitting the $0.09 mark earlier today, according to Coingecko data. As of this writing, FRIEND is trading at $0.0761, a 2.1% surge in the last 24 hours.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Etheria Restart Codes (May 2025)

- Green County map – DayZ

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-09-10 07:17