As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset market, I find myself cautiously optimistic about the current state of Bitcoin and other major cryptocurrencies. While the past weekend saw relatively stable prices for BTC, the upcoming events, particularly the US economic data and the Trump-Harris debate, are likely to introduce a new wave of volatility into the market.

Bitcoin (BTC) has maintained a relatively steady level over the weekend, fluctuating between $55,000 and $58,000. Although the market remains calm, traders anticipate increased volatility this week due to significant events such as key US economic data, specifically the Consumer Price Index (CPI) that will be released soon. Additionally, the upcoming Trump-Harris debate is expected to impact market sentiment.

Due to the strong US jobs report released on Friday, there was a decrease in Bitcoin trading activity, leading to the cancellation of over $220 million worth of long positions. This massive sale has dampened the market’s momentum, causing unease among traders as they eagerly anticipate further economic indicators for guidance.

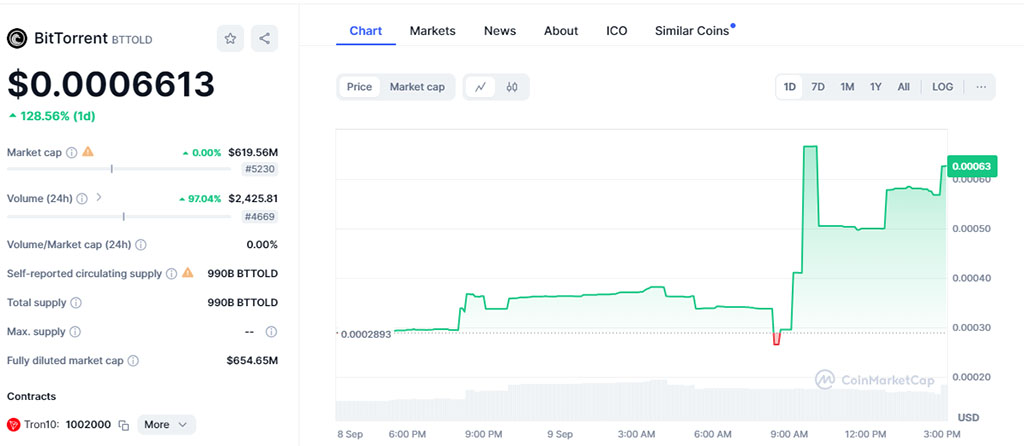

These significant cryptocurrencies – Ethereum (ETH), Solana (SOL), and Tron (TRX) – have displayed modest fluctuations of approximately 0.6% over the past 24 hours. Contrastingly, mid-cap tokens like BitTorrent (BTT) have experienced a substantial surge, climbing up by an impressive 128%.

Bitcoin’s Network Security Bolsters Bullish Sentiment

Although the market isn’t showing much growth right now, analysts from Presto Research believe that Bitcoin is significantly underpriced. Specifically, experts like Peter Chung and Min Jung argue that the current market is not giving enough credit to one of Bitcoin’s major advantages: its robust network security.

The amount of computational power used to maintain the Bitcoin network, known as hashrate, hit an unprecedented peak of 679 quintillion hash operations per second (EH/s) in September 2024. This significant increase indicates higher mining activity, pointing toward a robust basis for future expansion.

Chung and Jung contend that an increase in hashrate suggests a favorable perspective on Bitcoin’s future. With the introduction of spot ETFs, they believe Bitcoin is currently more robust than ever, leading them to perceive it as potentially underpriced.

As a researcher examining the cryptocurrency market, I’ve noticed an increase in mining activities that commenced in August. Historically, such upticks have frequently indicated market bottoms for Bitcoin. The expansion of these operations suggests a growing confidence among miners in the stability of prices. Many analysts posit that this surge could serve as a catalyst, potentially triggering a substantial price rise for Bitcoin.

CPI and Trump-Harris Debate Set to Shake Markets

In the near future, Bitcoin traders are keeping a close eye on two significant events this week: The release of August’s Consumer Price Index (CPI) data on Tuesday and the publication of Producer Price Index (PPI) figures on Wednesday. These reports provide critical information about U.S. inflation, which could impact Federal Reserve policies over the next few months.

Concurrently, the presidential debate between Donald Trump and Kamala Harris is causing unease in the financial markets. Given Trump’s ambition to transform the U.S. into a worldwide hub for cryptocurrency, his remarks during the debate could potentially stir up uncertainty in both the political and crypto spheres.

Harris’s position remains unclear, however, it’s been reported that her team is investigating potential policies to stimulate the growth of the cryptocurrency market. This ambiguity in her stance may influence investor perspectives and potentially cause greater market volatility.

As a crypto investor, I’ve noticed that recent weaker U.S. payroll data seems to have sparked a wave of asset selling since last Friday. Market expert Lucy Hu from Metalpha has indicated that this trend might persist as we approach the next Federal Reserve meeting, suggesting potential instability in the crypto market.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Gold Rate Forecast

2024-09-09 17:15