As a seasoned analyst with over a decade of experience in the volatile world of cryptocurrencies, I have learned to read between the lines of on-chain data and market trends. The latest surge in Litecoin (LTC) whale activity, as reported by Santiment, certainly piques my interest.

Recent data indicates a surge in market activity among large Litecoin (LTC) holders, often referred to as ‘whales.’ The intriguing part is whether this heightened activity could lead to a recovery in Litecoin’s price.

Litecoin Whale Activity Ignites

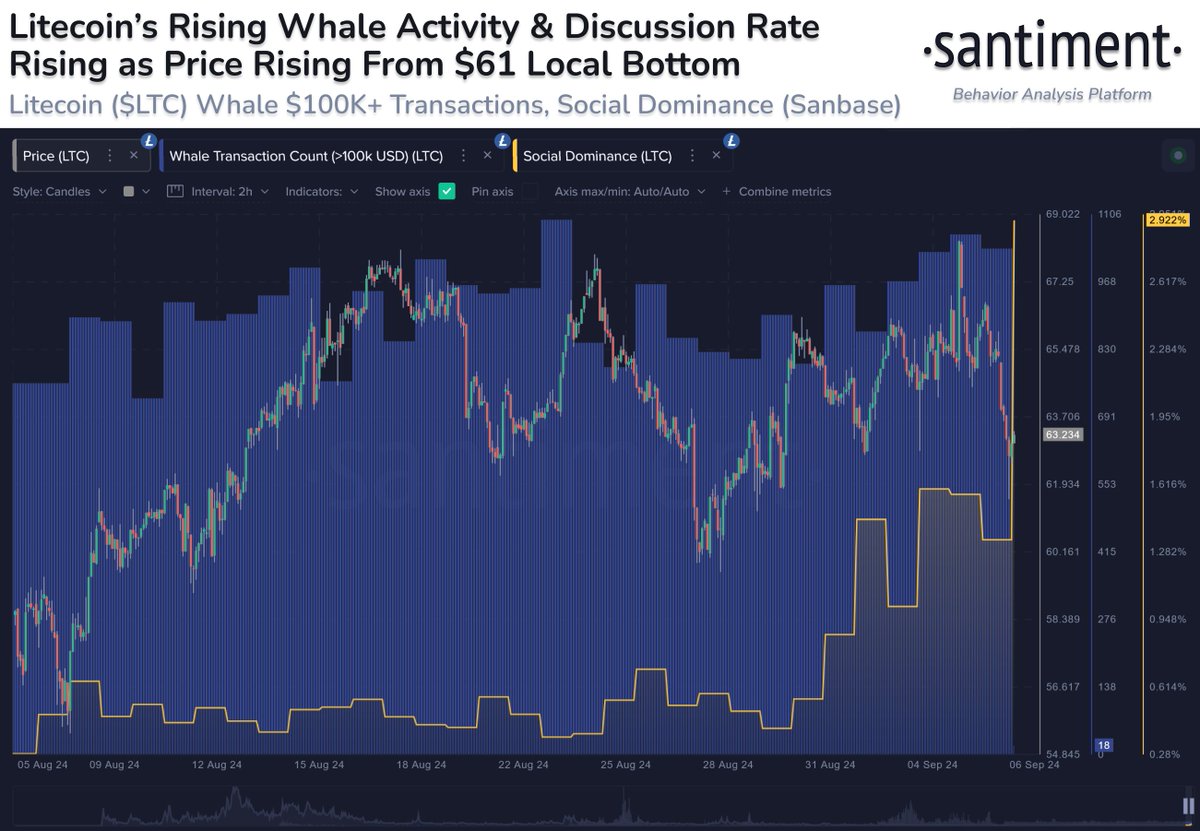

On the X platform’s latest update, Santiment’s on-chain analysis team reported a persistent rise in significant investor activity concerning Litecoin. The key statistic here is the number of large transactions, or whale transactions, which are defined as transfers exceeding $100,000, occurring daily on the blockchain network.

Entities with substantial amounts of a specific cryptocurrency, known as “whales,” possess considerable market power due to the size of their holdings. Their actions and trends are closely monitored and studied because they offer valuable insights into market behaviors and potential future price fluctuations.

As reported by Santiment, there’s been a noticeable uptick in high-value Litecoin transactions (over $100,000) since late August. Generally, this trend might indicate that larger investors, often referred to as ‘whales’, are becoming more active on the Litecoin network. Such heightened whale activity could potentially serve as a positive trigger for the price of LTC.

It’s important to point out that the rise in whale transactions for Litecoin might suggest either stockpiling or dispersal. If these big investors are buying more LTC, it could signal an upcoming price surge. Conversely, if they’re selling off their holdings, Litecoin’s price could be in danger.

Furthermore, the altcoin appears to be a popular topic among many cryptocurrency enthusiasts, with its influence within the crypto media landscape growing as well. This “social dominance” metric measures the proportion of discussions about a specific coin or token in the broader cryptocurrency discourse.

This metric relies on social volume, which measures the total number of social posts that contain a particular crypto subject. The social dominance for an asset compares its social volume to the combined social volume of the 100 largest assets by market capitalization.

The recent uptick in whale activity and social discussions could signal an imminent price breakout for Litecoin. “Whether or not you are a fan of LTC, this is worth keeping an eye on,” Santiment said in its post.

LTC Price At A Glance

Currently, the cost of Litecoin hovers at approximately $62, marking a 1.5% decrease over the past day. Looking at statistics from CoinGecko, it’s clear that Litecoin has dropped by almost 5% within the last week.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-09-08 19:16