As a seasoned researcher with years of experience delving into the complex world of cryptocurrencies, I find myself constantly intrigued by the dynamic nature of Bitcoin’s price movements. The recent dip below $56,000 has piqued my interest, and upon examining the on-chain metrics suggested by CryptoQuant’s Head of Research, Julio Moreno, it appears that demand growth is indeed lacking.

The price of Bitcoin has fallen beneath $56,000, marking a continuation of its downward trend. Here’s a potential explanation for this direction, as suggested by the Head of Research at CryptoQuant.

Bitcoin On-Chain Metrics Are All Giving Bearish Signals Right Now

In a new thread on X, CryptoQuant Head of Research Julio Moreno has discussed why the original cryptocurrency has been struggling recently. “Bitcoin price is down simply because there is no demand growth,” notes the analyst.

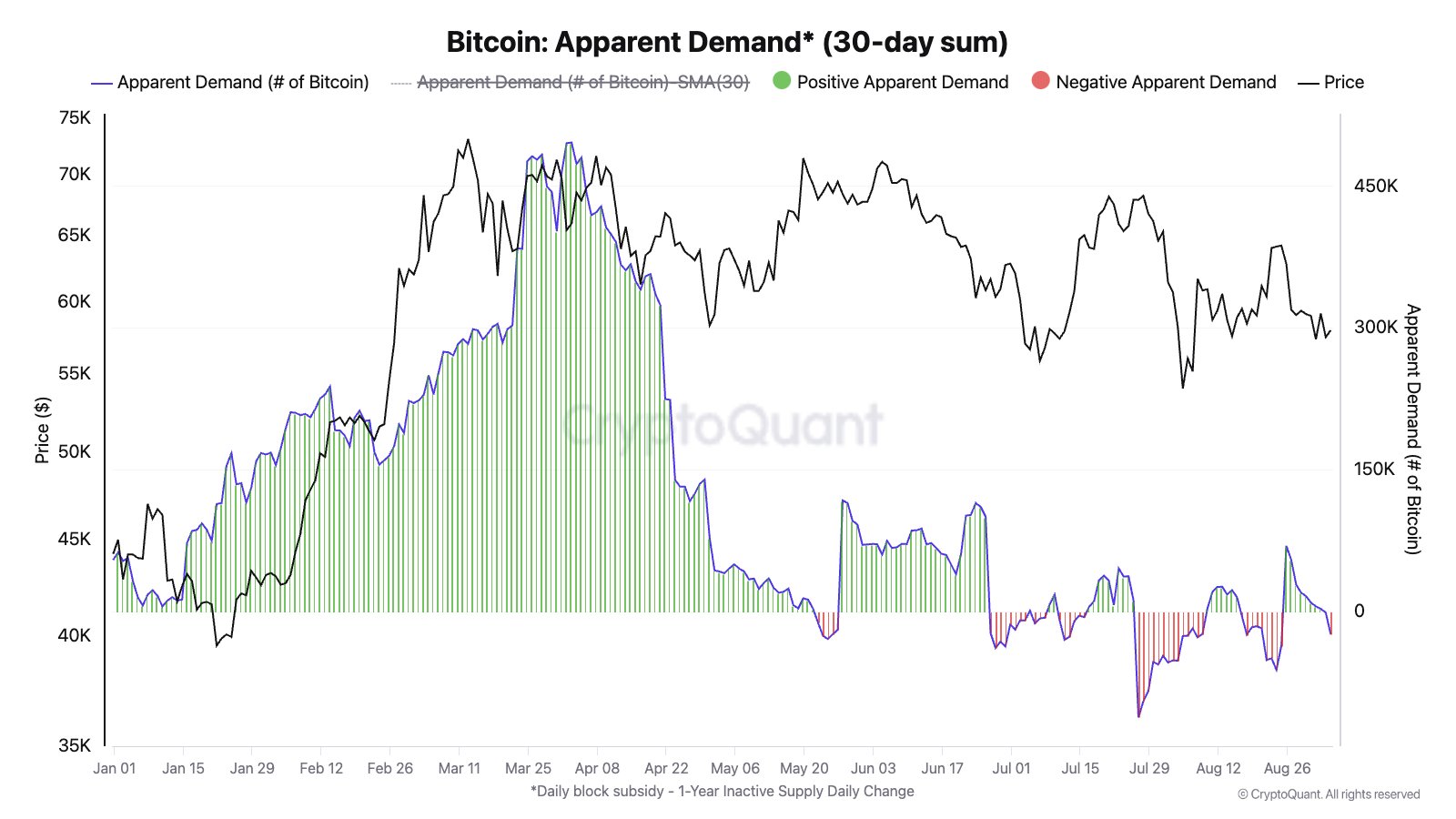

To illustrate the trend of interest in Bitcoin among investors over the past month, Moreno has provided a graph based on the “Apparent Demand” metric that utilizes on-chain data.

Based on the graph, there was a significant interest in Bitcoin at the start of the year, as suggested by the data. However, following its peak in April, the interest dropped dramatically, approaching zero.

After that point, the perceived demand has persisted at this balanced stage, possibly explaining why the cryptocurrency’s value has followed a predominantly downward trend.

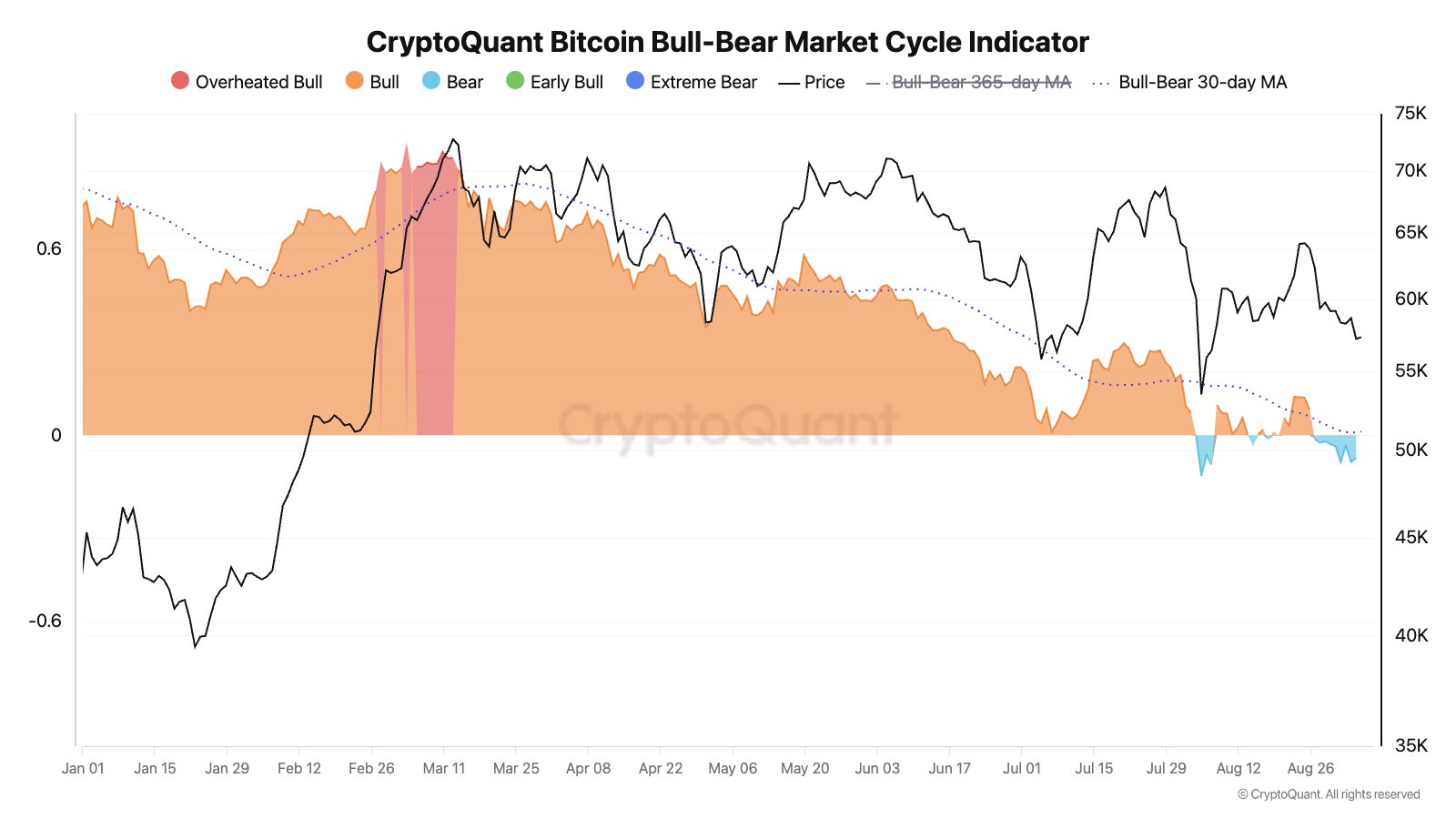

A different way of expressing this could be: The second piece of evidence mentioned by the CryptoQuant leader refers to the Bitcoin Bull-Bear Market Cycle Indicator. This tool takes several Bitcoin indicators linked to profit and loss, blends them together to create a single value that gives an overall picture of the market’s state.

According to CryptoQuant’s Bull-Bear Market Cycle Indicator, the asset was within the historically “Overheated Bull” phase at the time it reached its highest price point (All-Time High or ATH).

Following its cooling down from the peak, the indicator displayed a typical “Bull” signal, similar to what happened in January and February. This bullish trend persisted until the recent market downturn that occurred a few weeks ago.

In the recent dip, Bitcoin fell below $50,000, and the Bull-Bear Market Cycle Indicator marked the market as “Bear.” Ever since, the indicator has been oscillating near the changeover point, frequently switching between Bullish and Bearish signals.

Over the last few days, the metric has persistently stayed within what we call the “Bear” zone, and this could possibly explain the 6% drop in Bitcoin’s value during that timeframe.

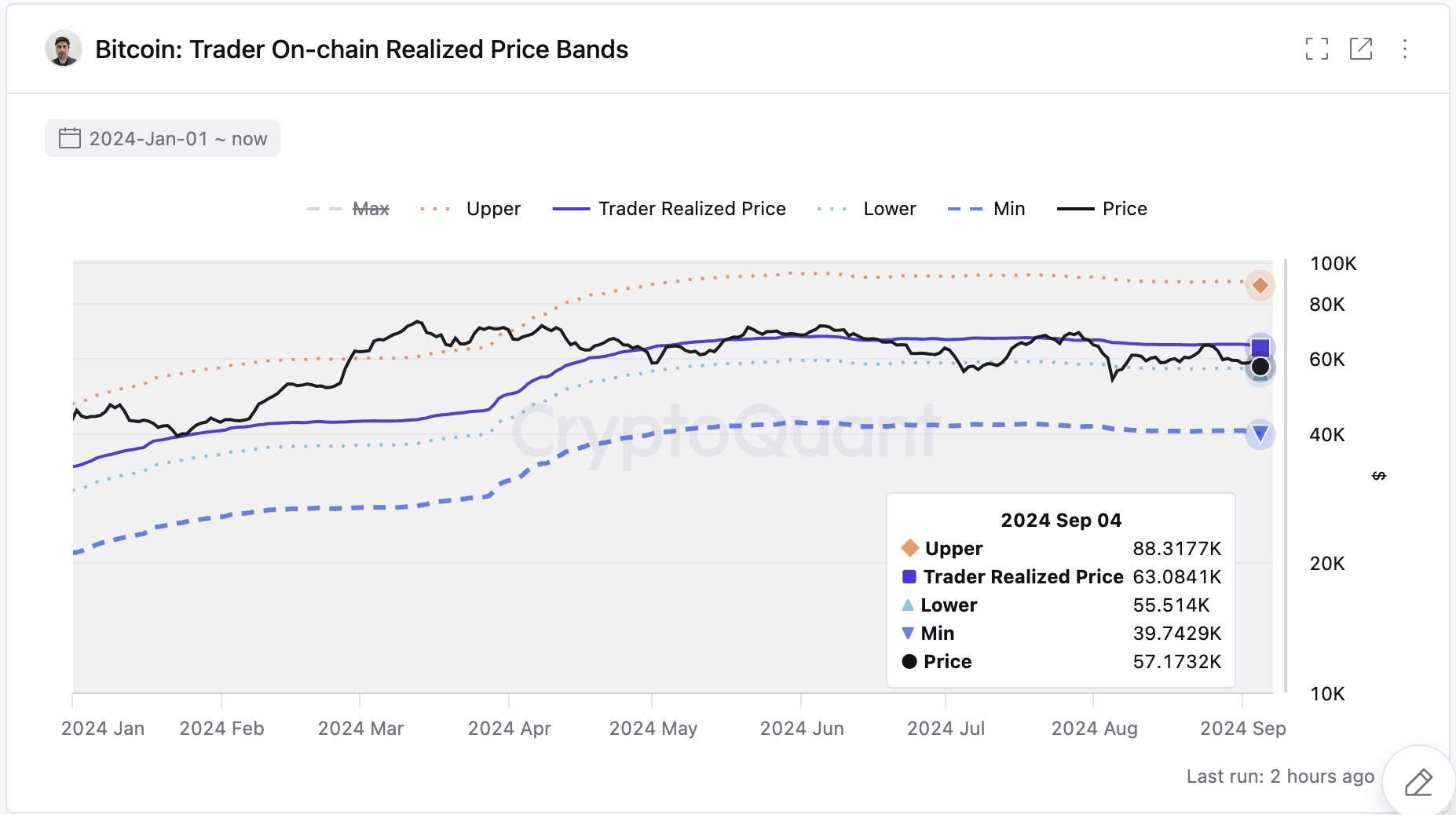

Additionally, Moreno notes a significant price point to keep an eye on, as Bitcoin is approaching it for possible retest. This critical level corresponds to the bottom boundary of the average trading cost for Bitcoin investors.

Currently, the price point hovers near about $55,500. Whether or not this level will hold up if the cryptocurrency persists in its downward trend as yet remains uncertain.

BTC Price

As an analyst, I find myself observing that at present, Bitcoin is hovering approximately around $55,900. This suggests that the cryptocurrency is getting quite near to challenging its seller above the initial investment price point once more.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-09-07 02:46