As an analyst with over two decades of experience in the financial markets, I’ve seen trends come and go, bulls and bears rise and fall, and whales swim in and out of the pool. The recent drop in Whale Transaction Count for Bitcoin, XRP, Ethereum, Cardano, and Toncoin is a trend that has piqued my interest.

Recently, there’s been a noticeable decrease in trading activity by large investors (whales) in Bitcoin, Ripple (XRP), and other leading cryptocurrencies, as compared to the levels seen earlier this year.

Bitcoin, XRP Among Assets Observing A Decline In Whale Transactions

In their recent update on platform X, Santiment, an on-chain analysis company, delved into the current patterns observed in Whale Transactions across different leading cryptocurrencies within the market.

In this context, “Whale Transaction Count” signifies a measure derived from on-chain activities, which tallies up the overall number of transactions taking place on a specific cryptocurrency platform that equal or exceed $100,000 in value.

Transactions as vast as these are typically attributed to the ‘whales’, so the Whale Transaction Count signifies the level of activity these giant players are engaged in.

When the indicator’s value is significant, it signifies that whales are currently engaged in numerous transactions. This frequent activity suggests that major traders are actively involved in dealing with the asset at present.

In contrast, a low level of this measurement suggests that the whales might not be closely watching the cryptocurrency because they’re not executing many transactions on the blockchain.

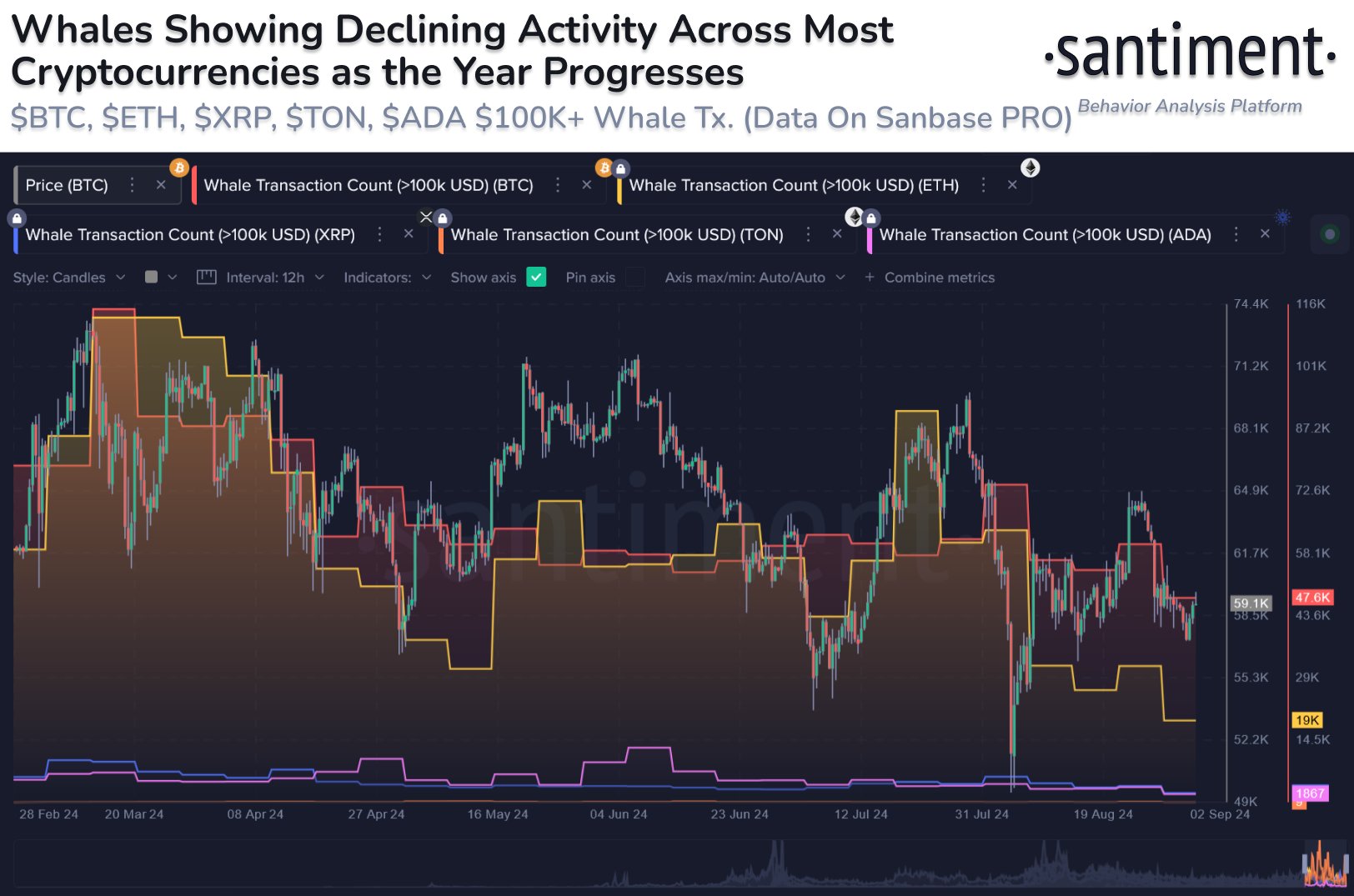

Let me share this graph illustrating the transaction frequency changes for the leading cryptocurrencies – Bitcoin (BTC), Ripple (XRP), Ethereum (ETH), Cardano (ADA), and Toncoin (TON) – during the recent period.

Based on the graph presented earlier, it’s evident that the number of Whale Transactions was notably high for both Bitcoin (BTC) and Ethereum (ETH) during March. To be more precise, from the 13th to the 19th of the month, approximately 115,000 whale transactions were recorded for each cryptocurrency.

After Bitcoin reached its peak price, a surge in whale activity followed, hinting that these significant investors might have taken advantage of the bull run by cashing out their profits.

Since that time, there’s been a substantial decrease in this metric. Lately, Bitcoin has witnessed around 60,000 transactions involving large investors (whales), whereas Ethereum’s decline has been even more pronounced as the indicator shows only about 32,000 transactions.

In March, neither XRP nor Cardano exhibited the same level of intense whale trading activity as the leading cryptocurrencies did, but even so, the whale activity observed during that period was significantly greater compared to the current situation. This observation implies that large-scale traders (whales) across the market have temporarily halted their trading activities.

In simpler terms, if whales (large investors) are not active in the market, it can result in a less dynamic or sluggish market environment. This is because their significant trading volumes contribute to market volatility. Consequently, cryptocurrencies like Bitcoin may continue to consolidate, meaning they could see limited price fluctuations, as long as these large investors remain inactive.

BTC Price

Yesterday, Bitcoin dropped near the $57,000 mark, but it’s experiencing a recovery today, currently hovering around $59,000.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-09-04 02:00