As a seasoned crypto investor with a decade of experience under my belt, I’ve learned to navigate the rollercoaster ride that is the cryptocurrency market. The recent drop in Ethereum (ETH) revenues has been a cause for concern, but it’s important to maintain perspective and not panic.

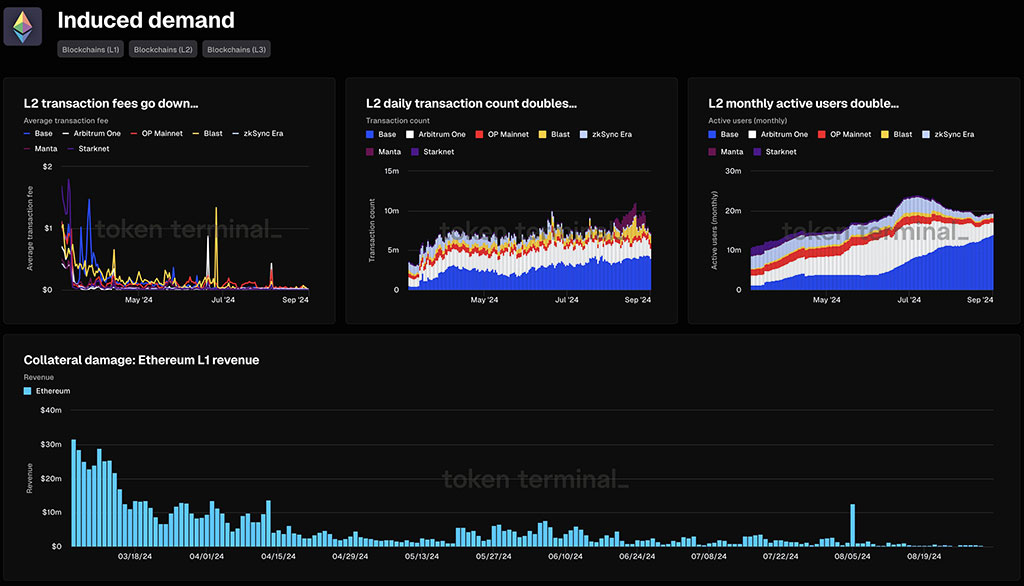

Ethereum (ETH) revenues have dropped significantly in 2024. After peaking at $36 million in daily revenue in March, it recently recorded a low of $199K. According to Token Terminal, the revenues have plunged by 99% in the past six months.

Photo: Token Terminal

Ethereum Blobs Impact Revenues

The accelerated revenue drop has been majorly linked to blobs. Blobs are a scaling and efficiency update implemented in March. It allowed L2s to process transactions cheaply without relying on the base layer’s relatively expensive DA (data availability) for storage.

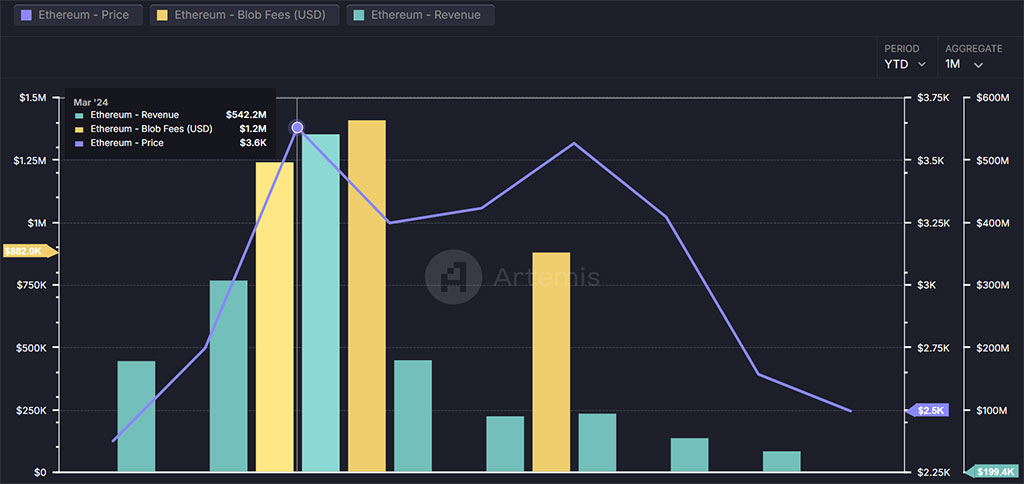

According to Artemis, Ethereum monthly revenues hit $542 million in March, while blob fees raked in $1.2 million in their first month of debut. In subsequent months, the revenues took a hit, dropping below $100 million in May and remaining below the level to date.

Photo: Artemis

Many experts point out that a large number of applications are moving from the primary layer to Layer 2 solutions due to cost advantages after the introduction of blobs. This shift has led to a decrease in revenue because fewer users are paying transaction fees with Ethereum gas on the base layer, which impacts revenues directly.

Besides, per the Ethereum fee structure, the higher gas usage also led to a high burnt rate for ETH tokens and kept the altcoin deflationary. After blobs, the burn rate declined, flipping ETH into inflationary and could potentially weigh on the altcoin’s price.

Despite the significant cost reduction for users, some market watchers and researchers have called for tweaking blob fees to help burn more ETH and make it deflationary. One of the Abstract Chain contributors suggested hiking blob fees to rebalance ETH’s relationship to L2s.

He noted that L2s enjoy the robust security provided by Ethereum, but they don’t contribute a significant amount of value in return to ETH.

However, Ethereum community member Ryan Berckmans viewed the proposal as a hasty idea. Instead, Berckmans called for more time amid potential growth in demand from L2. Regarding ETH’s declining revenue, he stated that the fees aren’t the goal for the chain.

“Ethereum doesn’t “aim” to collect fees. Fees are not a goal; they’re a byproduct,” he wrote.

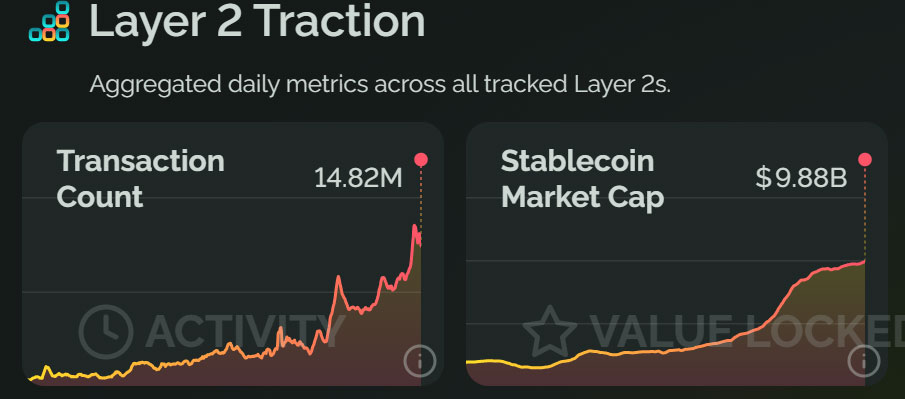

Despite the ‘worrying’ revenue, L2s have recorded massive growth, hitting a record high in transaction count and stablecoins, according to data from Growthepie.

Photo: Growthepie

This network growth could partly explain why others like Berckmans might be confident that a likely L2 demand surge could be a game changer for blob fees and ETH inflation status.

Yet it’s the Ethereum if the suggestion for Blob hefty costs savings on the future of the feasibility of the Ethereum community members’ choice of adopting the cost

Meanwhile, ETH’s value was back above $2.5k at press time after rallying 4% on Monday.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-09-03 14:41