As a seasoned researcher and crypto enthusiast with years of experience in this volatile market, I have seen my fair share of market fluctuations. The decline in open interest for PEPE from its peak by 72% is indeed a concerning sightly reminds meh, to levels noteworth

In terms of meme cryptocurrencies, PEPE has truly stood out as one of the top performers over the past year. Reaching a new peak following another peak in 2024, it surpassed a market capitalization of $5 billion. This remarkable increase in value was accompanied by a significant boost in the open interest for the meme coin at the time. However, as time passed, the open interest saw a significant drop, both in price and open interest. Yet, this potential decrease could be positive news for the PEPE meme coin.

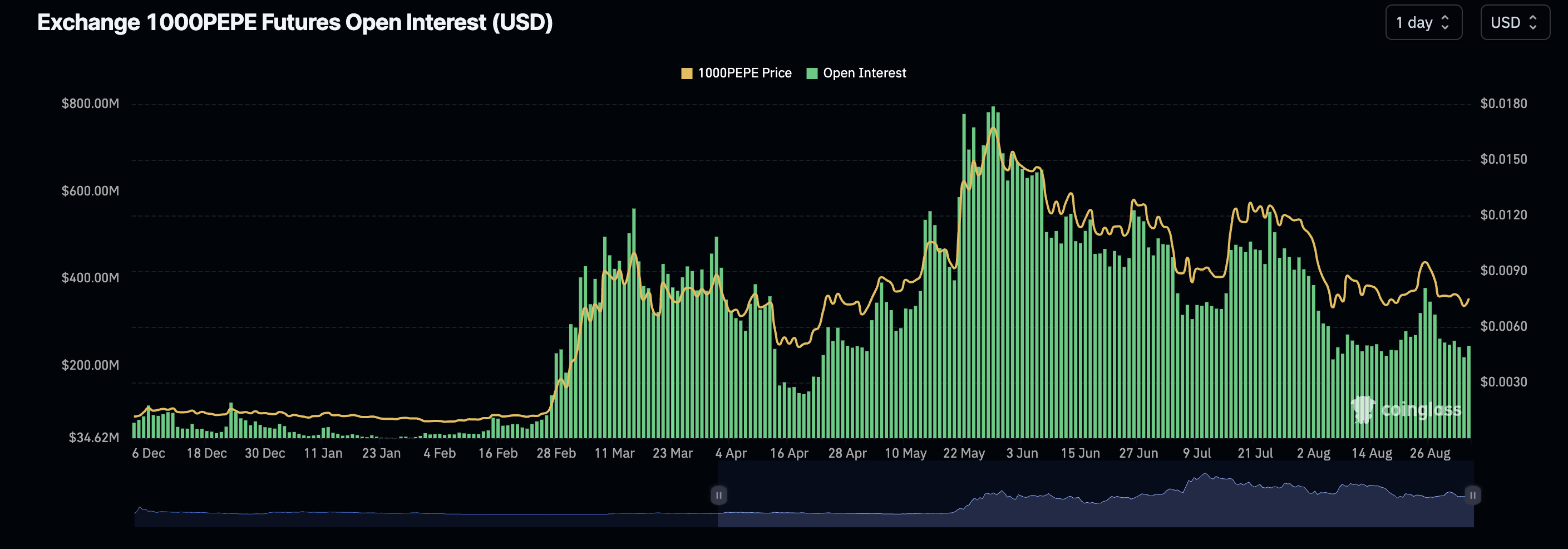

PEPE Open Interest Down 72%

By mid-2024, the value of PEPE skyrocketed due to a recovery in the cryptocurrency market. This rapid increase not only reached unprecedented peaks but also indicated a significant surge in popularity for the meme coin. Consequently, the open interest in PEPE also hit an all-time high.

Based on information from Coinglass, in May 2024, PEPE‘s price peaked at $0.000017, with a record-breaking open interest of $794.77 million. But the bullish trend faltered when bears stepped into the crypto market. Over the following months, both the PEPE price and its open interest saw a downturn.

By August, the PEPE open interest dipped down to levels last observed in April 2024, reaching a new 4-month minimum. Initially, the open interest plummeted from approximately $800 million to as low as $215 million. However, it has since shown some signs of improvement, yet the stability remains questionable.

The drop to August lows meant that the open interest had fallen as much as 72% from its peak. However, around this time, the PEPE price has fallen only around 55% from its peak, going from $0.000017 to as low as $0.000007.

Is This Good News?

A decrease in the number of open positions for the PEPE meme coin suggests that investors’ optimism is waning. This implies that investors are increasingly inclined to predict a fall in the coin’s price instead of its rise, which might lead to increased selling force on the token.

In periods like these, a cryptocurrency’s price may experience an uptrend. This is because when investors tend to be the most pessimists are negative, increasing, making a reversalsy, the likelihood of a turnaround increases, catching the short-term investor off guard. Since open interest has significantly decreased, it wouldn’t be surprising if we witnessed a short squeeze, forcing out the bearish investors from the market.

If this event transpires, it’s plausible that the PEPE price might rebound swiftly at this point. Notably, with the increase in open interest, we can expect the price to follow suit, as there appears to be a strong positive link between them up until now.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Green County map – DayZ

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

2024-09-03 14:11