As a seasoned crypto investor with over a decade of experience in this dynamic market, I find Dan Gambardello’s analysis on Cardano (ADA) particularly insightful and convincing. The shift towards on-chain governance through the Chang hard fork is indeed a monumental step that sets a new standard for blockchain governance. It not only solidifies trust within the community but also signals robust growth potential for ADA in the future.

In a recent video shared with his 368,000 YouTube followers, Dan Gambardello posits that ADA‘s overall outlook remains optimistic, even after a 17% decrease in price over the last ten days. Gambardello highlights significant advancements and technical configurations within the Cardano network, placing special emphasis on its recent shift to on-chain governance following the “Chang” hard fork upgrade.

Why Cardano Is ‘Fundamentally Bullish’

Gambardello’s analysis started by examining the Chang hard fork, a crucial move for Cardano, as it transferred decision-making authority straight to ADA token owners. This update empowers token holders to choose governance representatives and decide on development plans, signifying a substantial leap towards genuine decentralization.

“Gambardello excitedly announced that Cardano has moved into the top 10 cryptocurrencies, now primarily driven by its community. He pointed out the significant transition in decision-making authority, with network updates and hard forks no longer being controlled solely by the three founding organizations of Cardano – IOHK, the Cardano Foundation, and Emurgo.”

Gambardello passionately conveyed the broader implications of such decentralization, arguing that it not only solidifies trust and resilience within the Cardano community but also sets a new standard for blockchain governance. He referenced a critic of Cardano, Justin Bons (founder and CIO of Cyber Capital), who despite previous skepticism, recognized the significance of this milestone in blockchain technology, offering his congratulation.

Congratulations to the ADA community for implementing on-chain governance today!

A critical milestone that most have not achieved yet

As true decentralization at scale is impossible without governance

Others pretend to be decentralized but are still controlled at the center!

— Justin Bons (@Justin_Bons) September 1, 2024

Gambardello also proposes that these fundamental shifts correspond with wider financial trends, possibly indicating sustained expansion for Cardano in the upcoming period. In other words, if there’s no significant price breakout, this bullish trend could be seen as an extended version of 2019, suggesting a prolonged upward movement potentially lasting till 2026 or even beyond, which some might call a super cycle.

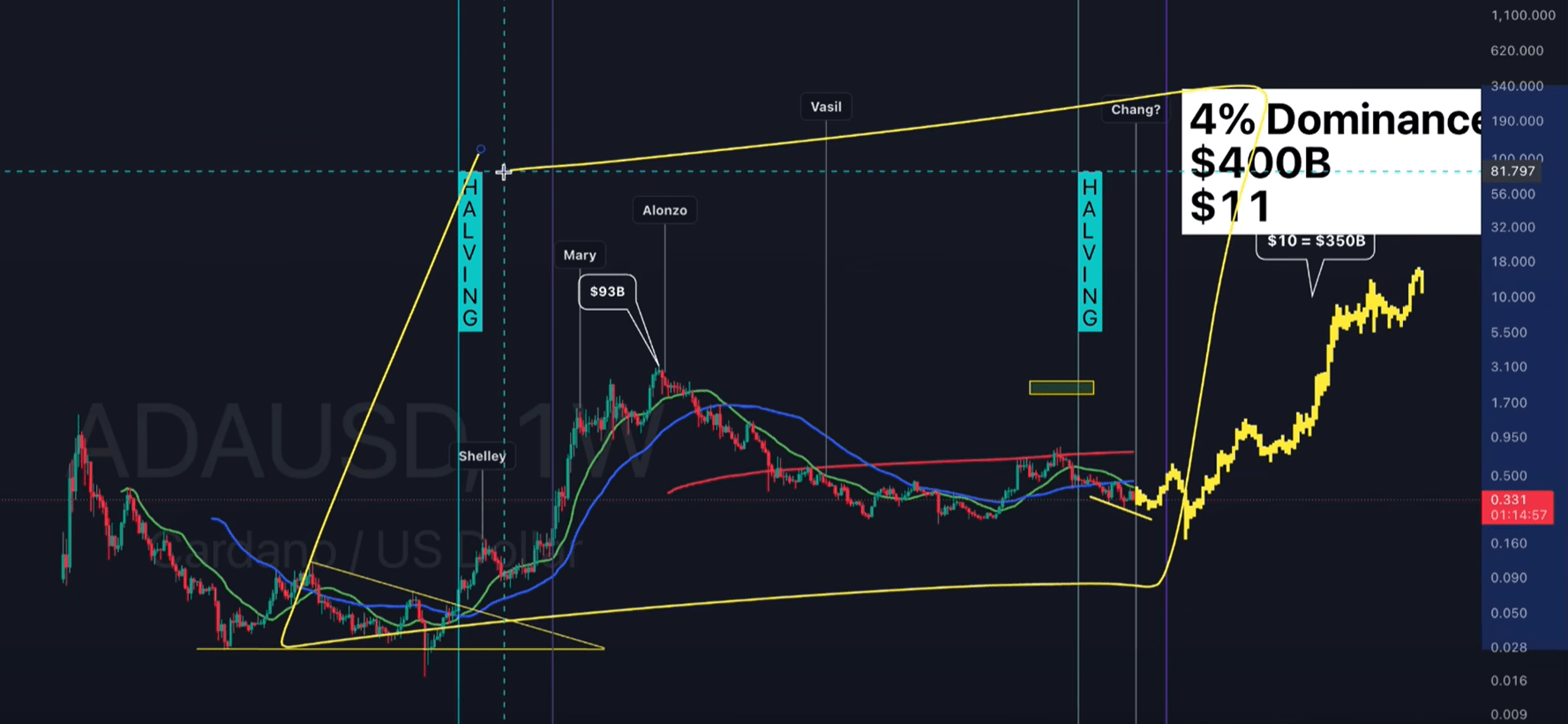

Additionally, Gambardello examined multiple pricing graphs, such as the weekly, daily, and 6-hour views, in order to predict the possible direction of ADA‘s price trend. He utilized a macro super cycle approach, which is a method for identifying extended financial cycles that encompass several smaller cycles over a longer term period.

“He emphasized a key observation: If his theory holds up, take note of the patients who have been through the entire bear market and the extended period of sideways movement, waiting for an altcoin season that’s taking longer than before. Keep in mind that historically, altcoin seasons often begin around now. Given this, he speculates that the Cardano price might reach $10 to $11 during this cycle.”

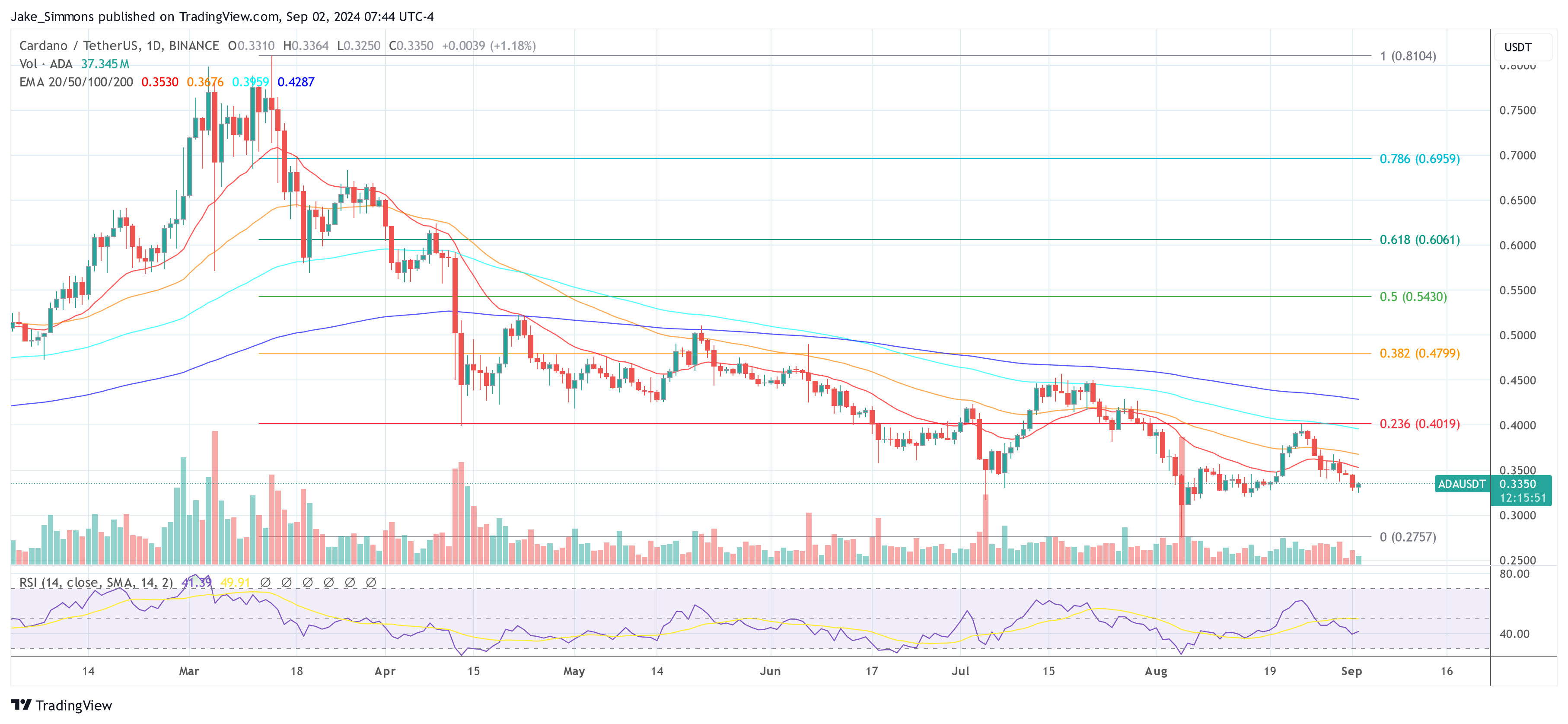

As a researcher examining the current state of ADA, I believe the recent downtrend can be linked to global economic changes, particularly interest rate cuts. However, upon analyzing the daily chart, Gambardello proposes that we might be approaching a potential bottom for ADA, offering a promising investment opportunity for long-term investors. To trigger a bullish reversal, as per the crypto analyst’s perspective, certain key events need to occur.

“You’re anticipating a significant price change or reversal, and you’re looking for the 20-day Exponential Moving Average (EMA) to surpass the 50-day EMA, followed by continued upward movement with increasing highs and highs above these averages. At the moment, I’m keeping an eye on this situation, specifically the position of the 20-day moving average around $0.35 and the 50-day moving average at $0.37.”

In addition, Gambardello is also known as the Relative Strength Index (RSI), and it’s moving closer to the oversold region. This suggests that even though it may linger in this area while ADA continues to drop, it’s reassuring to see that it’s approaching the oversold level. We might be nearing the bottom. It could be a tough week before we reach it, but we’re making progress. That was Gambardello’s summary.

At press time, ADA traded at $0.3350.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-09-02 20:10