As a seasoned crypto investor with battle scars from previous bear markets etched into my portfolio, I’ve learned to navigate through these choppy waters with a mix of cautious optimism and pragmatic patience. The current state of XRP, trading at $0.55, is a familiar dance between hope and fear that we’ve seen before.

Currently, XRP is being traded at around $0.55, reflecting a period of anticipation and enthusiasm among investors who predicted a significant price surge. Nevertheless, apprehension and doubt seem to dominate the market as Bitcoin and many other altcoins are trading below their usual levels. This market slump has had a widespread effect on investor confidence.

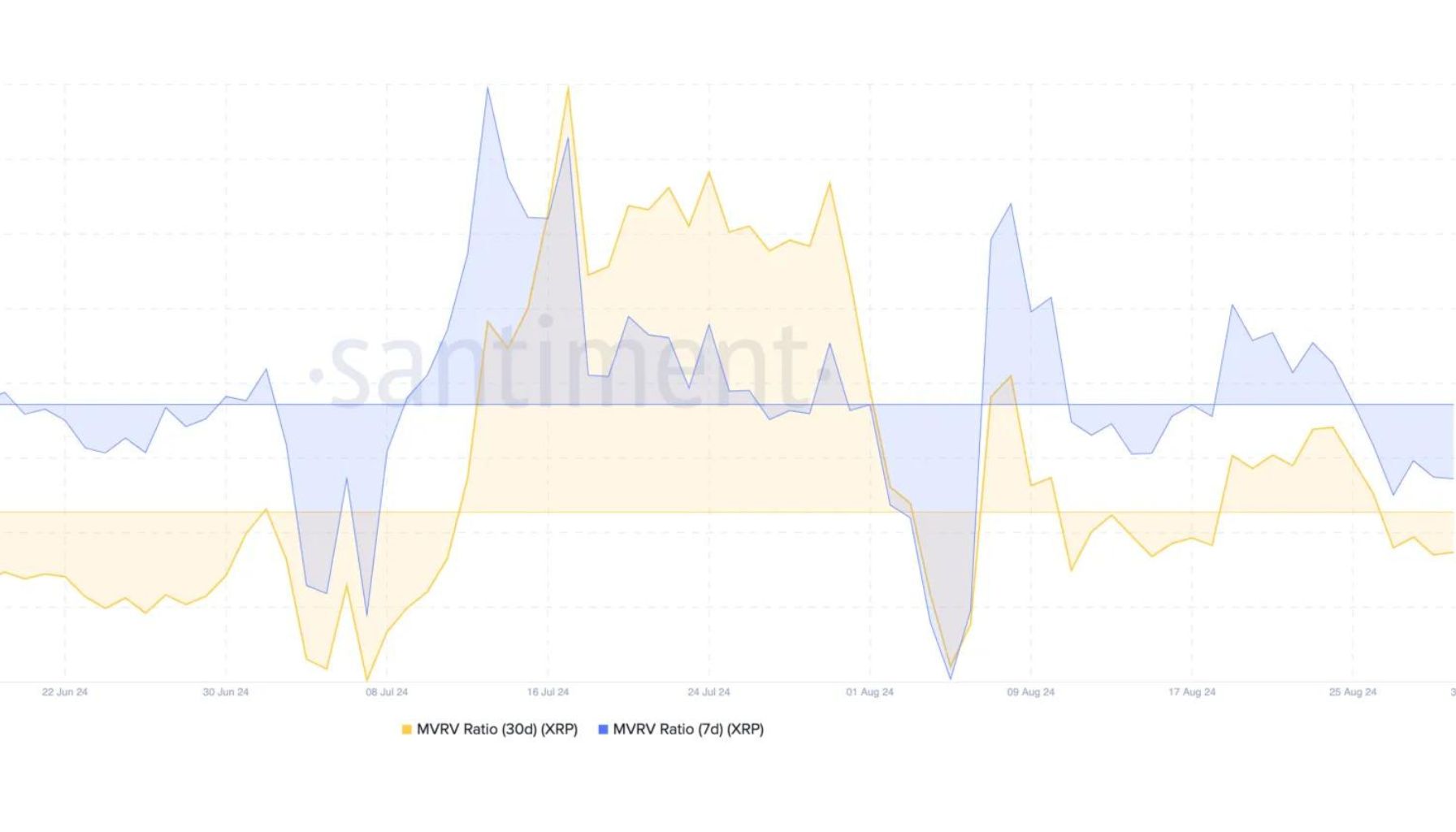

Important findings from Santiment indicate a significant change in the perspective of XRP investors. The initial enthusiasm that bolstered confidence is waning, as the majority are currently facing potential losses they haven’t yet realized. This transition in attitude highlights the mounting worries about XRP’s future, especially given the broader market difficulties. Under the current market strain, the outlook for XRP seems to be growing more unpredictable.

XRP Holders Facing Unrealized Losses

Over the past few days, XRP has shown resilience against other digital currencies, falling by approximately 13% from its peak of $0.631 on August 24th. This descent has generated concern among investors, reflecting the overall apprehension in the market as a whole.

Information provided by Santiment offers insight into the situation, demonstrating that both the 30-day and 7-day Market Value to Realized Value (MVRV) ratios for XRP have flipped negative. A negative MVRV ratio suggests that XRP is presently underpriced, implying that if all coins were sold at the current price, most traders would likely experience a loss on average.

This change in MVRM ratios is quite substantial, indicating that most XRP investors might experience losses on their investments now. The data mirrors a wider pattern of investors adopting a more cautious approach, especially given the current market instability. Although XRP has performed relatively well compared to other altcoins, the negative MVRM ratios underscore the mounting worries among investors.

In simpler terms, the falling MVRV ratios signal a change in investor sentiment towards XRP, suggesting that optimism might be diminishing. As investors grow more cautious due to the possibility of further price drops, which could amplify losses, they need to be on alert. Despite XRP’s resilience, the unfavorable market conditions and negative MVRV ratios call for careful consideration. The upcoming days are crucial for XRP holders as they make decisions about whether to hang onto or sell their assets, considering both potential gains and losses in this challenging market scenario.

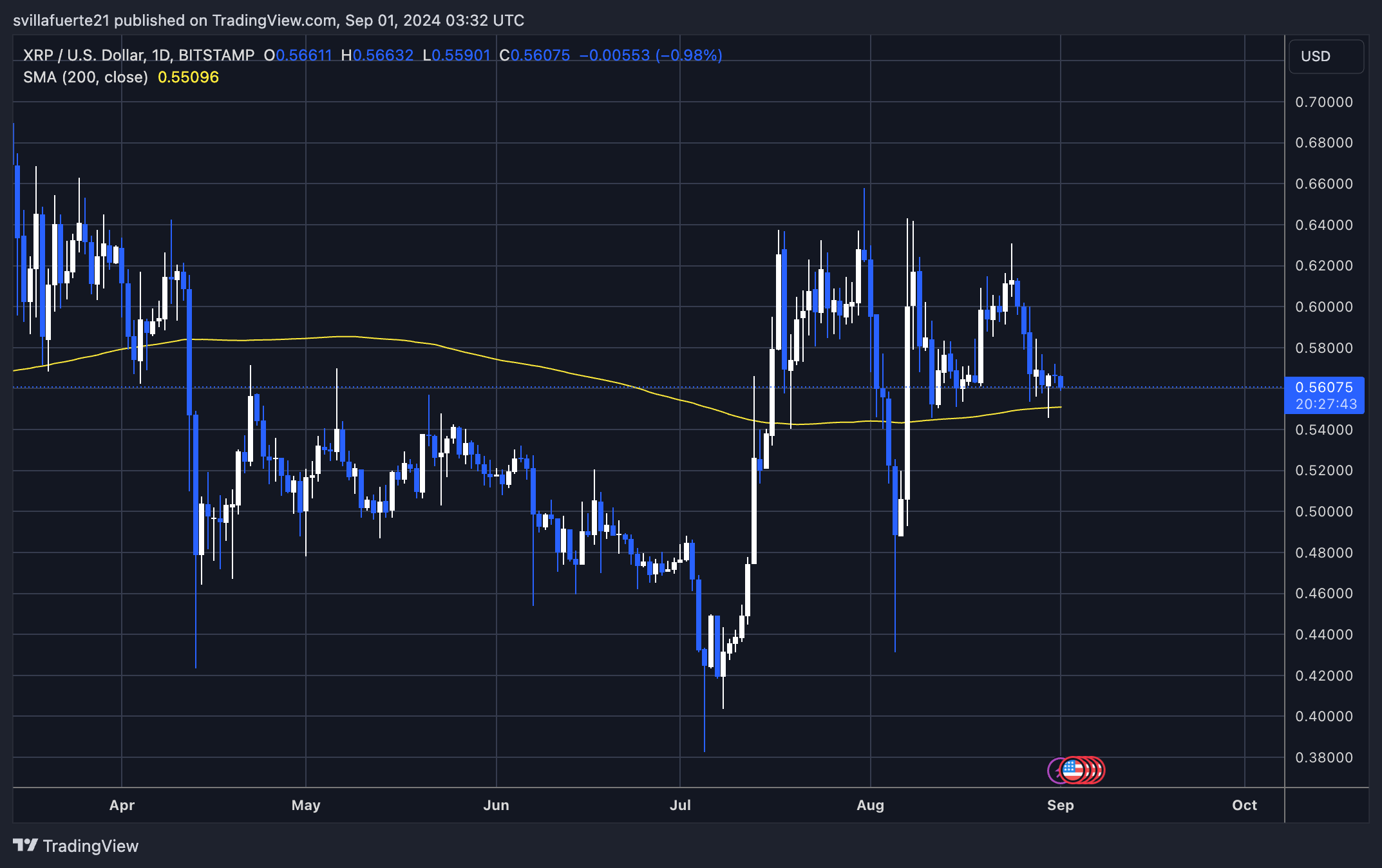

$0.55 Key Support Must Hold For Consolidation

At the moment, XRP is being exchanged for approximately $0.559. It’s hovering slightly above a significant support line, which is represented by the daily 200 moving average (MA), positioned at $0.5509. This particular level is vital in maintaining a bullish trend because it has consistently functioned as robust support for XRP prices, offering optimism to investors who anticipate a price rise.

Should the cost consistently stay above this Moving Average, it might suggest a possible prolongation of the upward trend, providing confidence to the optimistic investors. Conversely, if the price falls beneath this critical benchmark, it may initiate additional descent, steering the cost towards regions with lower demand.

In simpler terms, if you’re considering investing in XRP, a crucial level to keep an eye on is around $0.48. This level is important for bullish investors as they aim to protect it. Maintaining above the 200-day moving average (MA) is vital for a positive perspective, while dropping below could suggest increased selling activity. As XRP moves through this crucial stage, both traders and investors are closely observing these levels to predict where the market might head next.

Read More

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The Babadook Theatrical Rerelease Date Set in New Trailer

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Paul McCartney Net Worth 2024: How Much Money Does He Make?

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- Cardi B Sparks Dating Rumors With Stefon Diggs After Valentine’s Outing

2024-09-01 09:22