As a seasoned crypto investor with a knack for navigating market turbulence, I find myself standing at the precipice of uncertainty, gazing upon Solana’s current predicament. With my portfolio battered by the relentless waves of volatility, I can’t help but feel a sense of déjà vu – it seems like just yesterday we were here, teetering on the edge, waiting for the market to make its next move.

Currently, Solana is hovering near an important support point following a 15% drop from its peak of $162.36. Although Solana appears relatively robust against other cryptocurrencies, the current market fluctuations could increase uncertainty and potential dangers for investors.

As an analyst, I find myself grappling with a palpable sense of apprehension and ambiguity in the cryptocurrency market right now. Key data from Coinglass indicate a bearish inclination among traders, which aligns with the broader market’s concerns as Solana edges towards a critical support level.

Over the next few days, it’s crucial to see if Solana can find its balance or face more potential decreases. Interestingly, major investors are keeping an eye out for a dip around $130, which is only about 7% lower than current prices, as a possible opportunity to invest.

In the present financial climate, people are keeping a close eye on how Solana behaves right now. If Solana manages to maintain its position, it might show strength and hint at the possibility of a rebound. But if Solana can’t sustain this level, it could signal more drops ahead.

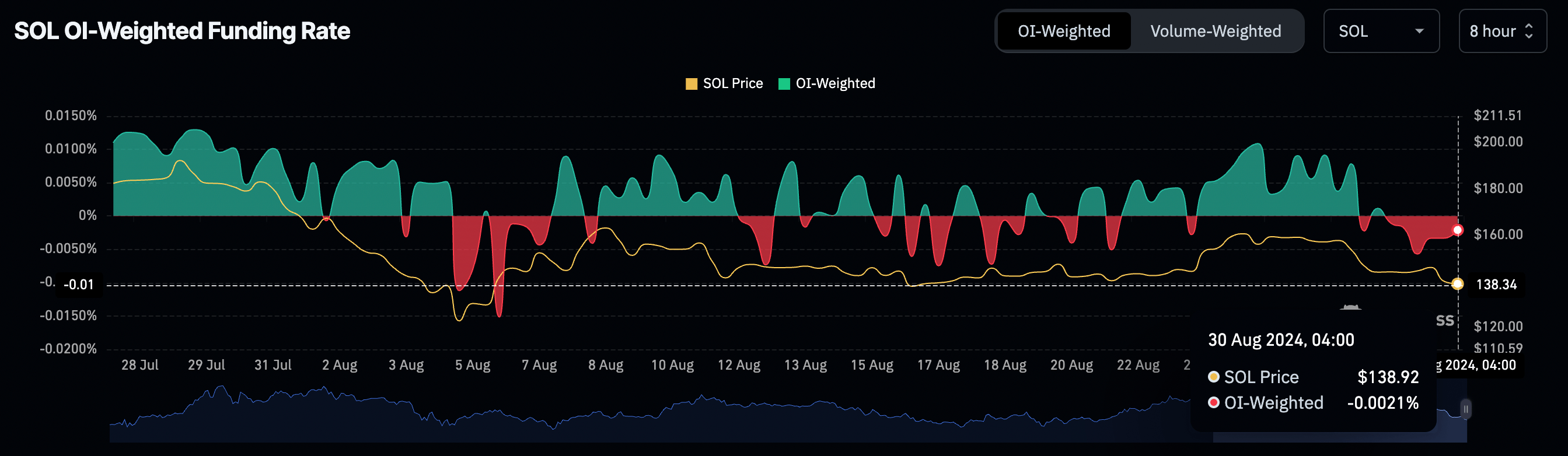

Solana’s Funding Rate Turns Negative

In recent times, Solana’s drop in value has led traders to adopt a pessimistic stance, particularly within the immediate future. Notably, key statistics from Coinglass indicate that the financing fee for SOL has shifted to a negative figure for the first time since August 23.

As a crypto investor, I notice when the funding rate turns negative; this signals that more traders are currently holding short positions than long positions on Solana (SOL). Essentially, they’re paying to keep their bets against SOL rising. This trend in trading behavior seems to indicate growing expectations among traders that the price of Solana may continue falling.

As a researcher, I’m contributing to the growing pessimism by predicting potential price drops. Following the analysis of well-respected trader AlienOvich on X, it appears that Solana could see further declines, with key support levels anticipated around $135-$128.

Should Solana not sustain its present position, a bearish outlook could become a reality, potentially moving Solana towards AlienOvich’s forecasted range. This downward trend wouldn’t just reinforce the current pessimistic market feelings but also test Solana’s resilience in preserving its recent advancements.

Over the coming days, Solana’s fate hangs in the balance as it undergoes critical tests at these lower price points. Investors will keep a close eye on Solana’s performance to ascertain whether it can regain support or if pessimistic feelings might drive the cost even lower. As the market responds to this stress, Solana’s capacity to rebound and possibly rebound could significantly influence its short-term course.

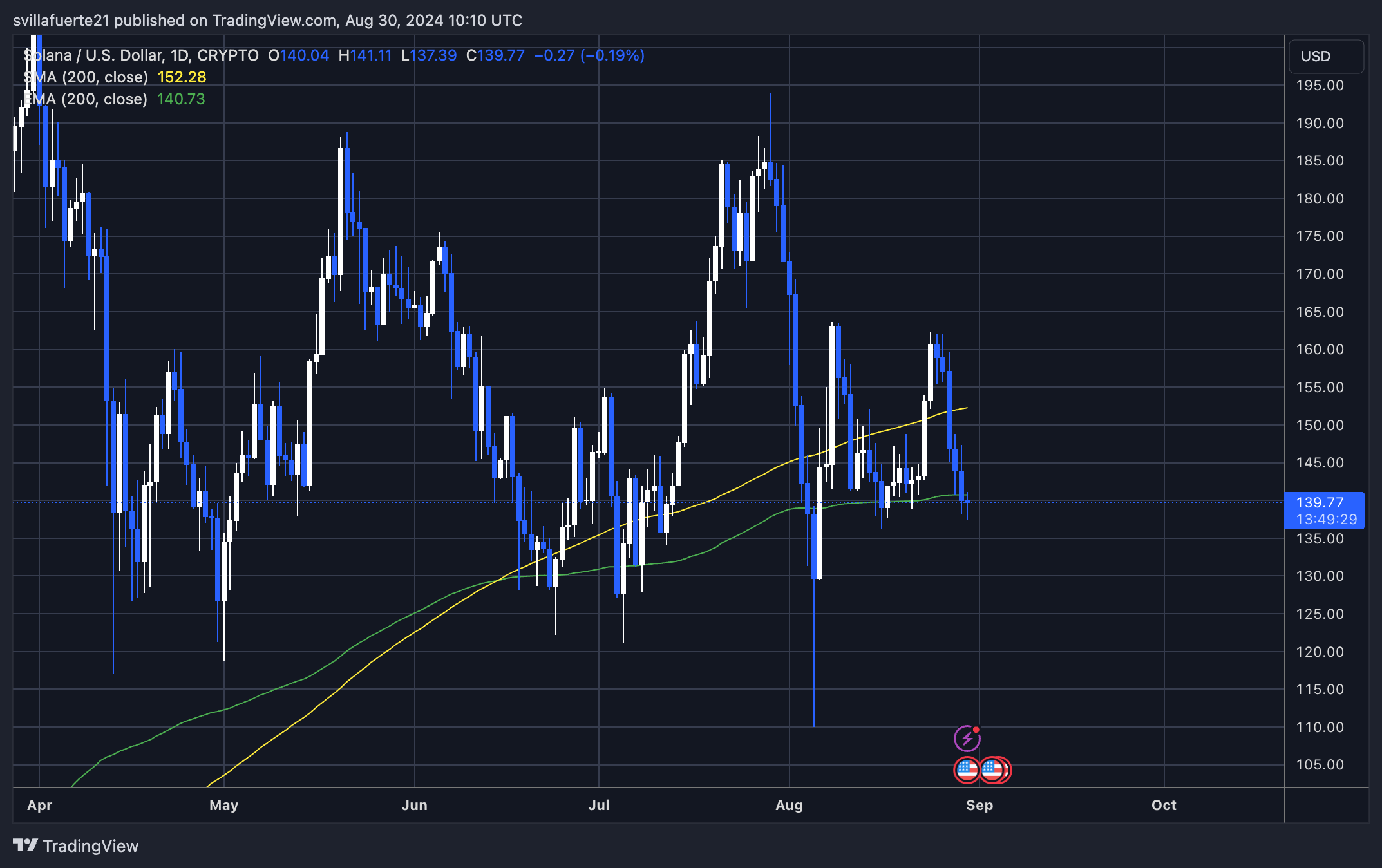

Solana Price Action

At present, Solana (SOL) is being traded at $139.87, which is noticeably lower than its daily 200 moving average (MA) of $152.28. Currently, it’s testing the daily 200 exponential moving average (EMA) after a brief dip below it. The main difference between these two indicators lies in their approach: whereas an EMA is a weighted average that prioritizes recent data points, an MA considers all data points equally.

If SOL doesn’t manage to surpass its Exponential Moving Average (EMA) and stabilize near the $140 region, it might continue dropping, potentially reaching the lows experienced on August 5.

At this cost point, it’s vital to decide if Solana (SOL) will sustain its present upward trajectory or encounter more downward force. This critical mark has traders on high alert because dropping below it could signal an approaching significant correction.

Cover image from Dall-E, Charts from Tradingview

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-08-30 17:10