As an experienced analyst with a keen eye for trends and a background in blockchain technology, I find the current surge in Ethereum restaking intriguing. The shift from traditional staking to restaking is reminiscent of the early days of Bitcoin mining, where miners sought innovative ways to maximize their returns amidst increasing competition.

The way Ethereum‘s staking environment is evolving is noteworthy. Although the drop in annual percentage yields (APYs) has sparked worries, a fresh approach called “re-staking” is growing in popularity. This strategy arises as investors seek to optimize their returns and maintain network security amid the decreasing gains from conventional staking.

In Ethereum’s Proof-of-Stake (PoS) system, an essential component is called staking, where you secure your cryptocurrency assets to authenticate transactions and receive compensation. Over time, staking has proven to be a financially rewarding endeavor, providing returns that significantly outshine traditional savings methods. However, with the increasing interest in staking, competition has also risen, leading to reduced individual profits.

In response, the concept of restaking is becoming increasingly popular. As decentralized finance (DeFi) continues to develop, restaking allows investors to leverage their currently staked tokens to earn extra returns. By unlocking the value of these previously inaccessible assets, restaking increases investors’ income while also boosting Ethereum’s security by encouraging sustained engagement.

Restaking Spurs ETH Growth

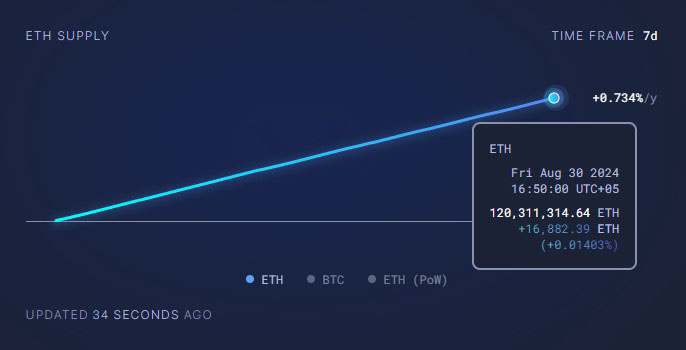

The surge in restaking activity can be attributed to several reasons. By August 15, 2024, Ethereum’s token circulation exceeded 120 million, with part of this growth being due to increased restaking as reported by Ultrasound.money. As investors realize the opportunity to restake and gain additional returns, interest in restaking increases, leading subsequently to a rise in ETH emission.

Source: Ultrasound.money

Beyond this, broader movements seem to fuel the increase in restaking. Artemiy Parshakov, the Head of Staking at P2P.org, points out that as network participation broadens, individual staking rewards decrease, which implies lower APRs for conventional staking. As a result, restaking emerges as a more attractive choice for investors seeking to maximize their returns.

Additionally, Parshakov highlights the importance of competition within the staking environment. He underlines how the rivalry between various staking services, custodians, and digital wallets, aiming to provide better yields and cutting-edge technology, has significantly boosted the acceptance and growth of restaking.

Reinvesting in opportunities goes beyond merely increasing returns for investors. As Parshakov points out, it enables protocols to enhance their security without incurring extra operational expenses or requiring unique, internal systems. This double-edged benefit extends to the advantage of investors as well as the overall network’s security.

Ethereum’s Recent Developments Drive Restaking Growth

1. The surge in restaking is being fueled by advancements happening within the Ethereum community, as highlighted by Alessandro Maci, a Senior Product Manager at P2P.org. He specifically mentions the recent introduction of EigenLayer, which grants users the ability to receive rewards on re-staked assets using the EIGEN token.

Furthermore, the arrival of flexible staking systems such as Symbiotic offers an attractive substitute for EigenLayer. Maci considers this protocol as a robust contender, thereby stimulating the expansion of the staking market even more.

Read More

- The First Berserker: Khazan Releases Soundtrack Excerpts

- POPCAT PREDICTION. POPCAT cryptocurrency

- Libre Capital’s Sui Blockchain Move: Money, Magic, and Mayhem! 🚀💰

- Who Is Alex Cooper’s Husband Matthew? Relationship, Age, Job, Kids Explained

- TLC’s The Baldwins Is More Than Just the Rust Controversy

- Who Is Cameron Mathison’s Ex-Wife? Vanessa’s Job & Relationship History

- Dead Rails [Alpha] Codes (February 2025) – Are There Any?

- Mazaka Trailer OUT: Sundeep Kishan, Rao Ramesh’s chemistry shines in upcoming action comedy entertainer

- Blue Lock Chapter 296 Spoilers: Bachira Scores, Barcha Takes the Lead, and a New Strategy Emerges

- Nicola Coughlan & Jake Dunn Dating Rumors All but Confirmed by Instagram Photo

2024-08-30 16:06