As a seasoned researcher with years of experience analyzing blockchain data, I find myself intrigued by the recent surge in Polygon’s activity metrics. The spike in Daily Active Addresses and Age Consumed indicates a heightened interest in the network, which could potentially lead to increased volatility. However, interpreting these on-chain indicators can be like reading tea leaves – both selling and buying activity are flagged up, making it challenging to predict the future direction of the asset.

As an analyst, I’ve noticed a significant increase in on-chain activities associated with Polygon lately, suggesting potential bullish momentum for its asset price.

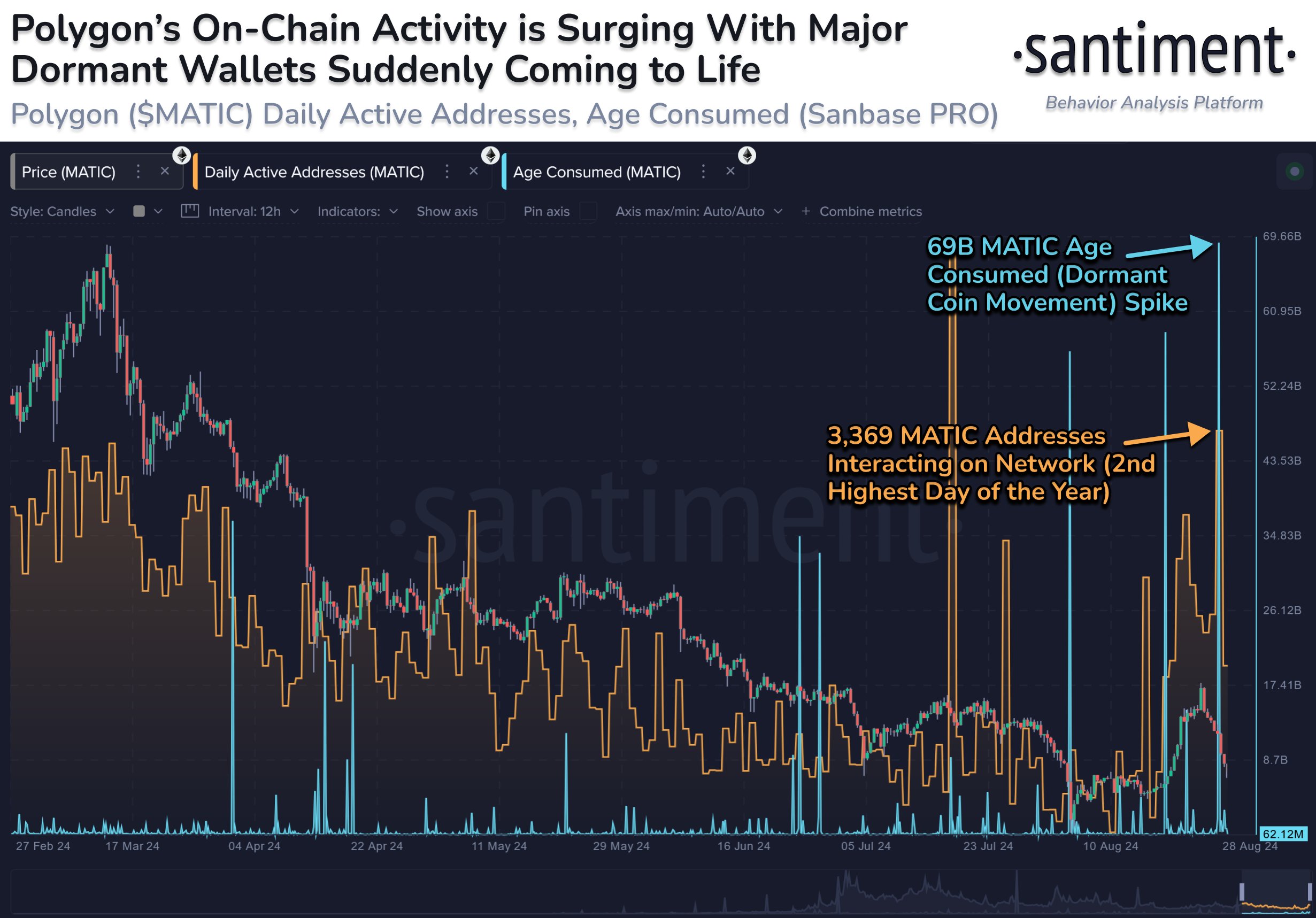

Polygon Active Addresses & Age Consumed Have Spiked Recently

As a researcher delving into the intricacies of X, I recently came across an insightful post by Santiment, an on-chain analytics firm, highlighting a recent trend in two key MATIC indicators. One of these is the “Daily Active Addresses,” a metric that records the total number of unique addresses engaging in some sort of transactional activity within the network each day.

In simpler terms, the count of distinctly active addresses on the blockchain network reflects the number of individuals actively engaging in its transactions. Consequently, the value of this measurement gives us an insight into the current level of activity or ‘traffic’ that the blockchain is experiencing at this moment.

As the indicator’s value increases, it suggests that more people are actively using the network. This pattern indicates that cryptocurrency is gaining interest among potential investors.

Alternatively, a decrease in the measured value indicates that investor enthusiasm for the asset might be decreasing, since there appear to be fewer individuals conducting transactions on the blockchain.

Presently, I’d like to share a graph illustrating the recent trend in Daily Active Addresses for the Polygon network over the last several months.

According to the given graph, there’s been a significant increase in the number of daily active addresses using the Polygon network lately. The most recent rise reached a peak where about 3,369 MATIC addresses were involved in transactions on the network, which is the second-highest figure for this year so far.

It seems that investors have been quite active on the network lately. However, it’s challenging to predict the impact of this activity on the asset, as increases (buying) and decreases (selling) are both captured by the indicator.

One thing that can generally be said is that high user activity may lead to cryptocurrency volatility. In the current case, though, there may be one other hint: the surrounding price action.

It’s worth noting that the peak in the indicator occurred immediately following MATIC‘s recent price drop, suggesting that investors might be eagerly buying the dip. If so, Polygon stands to gain if there’s an upturn in market activity.

In the chart, the term “Age Consumed” represents whether older coins within the system are being actively used. It appears from the data that a significant amount of older tokens were transferred during the recent spike in network activity.

As someone who has been investing in cryptocurrencies for several years now, I have learned to read between the lines when it comes to market signals. The recent movement of a particular asset has me a bit puzzled. It appears that the “diamond hands” associated with this asset might be selling off their holdings, but it’s not necessarily a bearish sign.

Based on the increases these blockchain metrics have experienced, it’s uncertain how the currency will progress moving forward.

MATIC Price

Polygon’s price has plunged almost 17% over the past week to $0.43.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-08-29 21:41