As a seasoned researcher and long-time observer of the cryptocurrency market, I find myself constantly intrigued by its volatility and unpredictability. The recent performance of Ethereum (ETH) has once again highlighted this aspect, with renowned analysts like Michael Van De Poppe and Javon Marks offering contrasting yet insightful opinions on the asset’s potential recovery.

In his recent post, well-known crypto expert Michael Van De Poppe pointed out Ethereum‘s present vulnerability and suggested possible moments of recovery amidst its ongoing price drop.

At present, Van De Poppe’s perspective emerges amidst Ethereum, the second-largest digital currency by market value, facing consistent bearish trends, similar to Bitcoin. Over the past 24 hours, Ethereum has experienced a dip of 3.7%, resulting in its current trading price at approximately $2,491.

Ethereum Outlook: When Will A Price Recovery Happen?

In his latest post, Van De Poppe mentioned that Ethereum encountered resistance at approximately 0.046 Bitcoins and is currently moving towards significant support zones based on larger time frames.

The analyst mentioned the possibility of a bullish divergence forming, which could lead to a rally later this week or next. However, this potential recovery is contingent on ETH finding support and reversing its current trajectory.

$ETH is super weak, it remains to be the case.

Initially declined at approximately 0.046 Bitcoins and is now trending towards potential support zones provided by the Hard to Fork (HTF) levels. A bullish divergence could potentially develop, suggesting a possible recovery starting from the latter part of this week and extending into the next week.

— Michaël van de Poppe (@CryptoMichNL) August 28, 2024

Crypto analyst Javon Marks recently expressed a positive forecast for Ethereum, likening its potential trajectory to Bitcoin’s recent surge past $67,000. In essence, he believes that the success of Bitcoin could pave the way for Ethereum’s future growth.

It’s possible that if Bitcoin keeps rising, it might clear the path for Ethereum to hit or even surpass its goal of $4,811 or more. Yet, this optimistic forecast hinges on Bitcoin’s capacity to sustain its uptrend and breach significant resistance barriers.

Marks noted:

If Ethereum’s price reaches $4811.6, Bitcoin could potentially surge beyond $67,559. This increase would provide a path for Bitcoin to push higher, opening up opportunities for gains above $116,000 and potentially driving the crypto market into even more bullish conditions.

Market Liquidations Surge As Traders Bet On Rising Prices

Currently, the recent decrease in the value of Ethereum and Bitcoin has taken many traders by surprise, causing a significant shift in their trading activities.

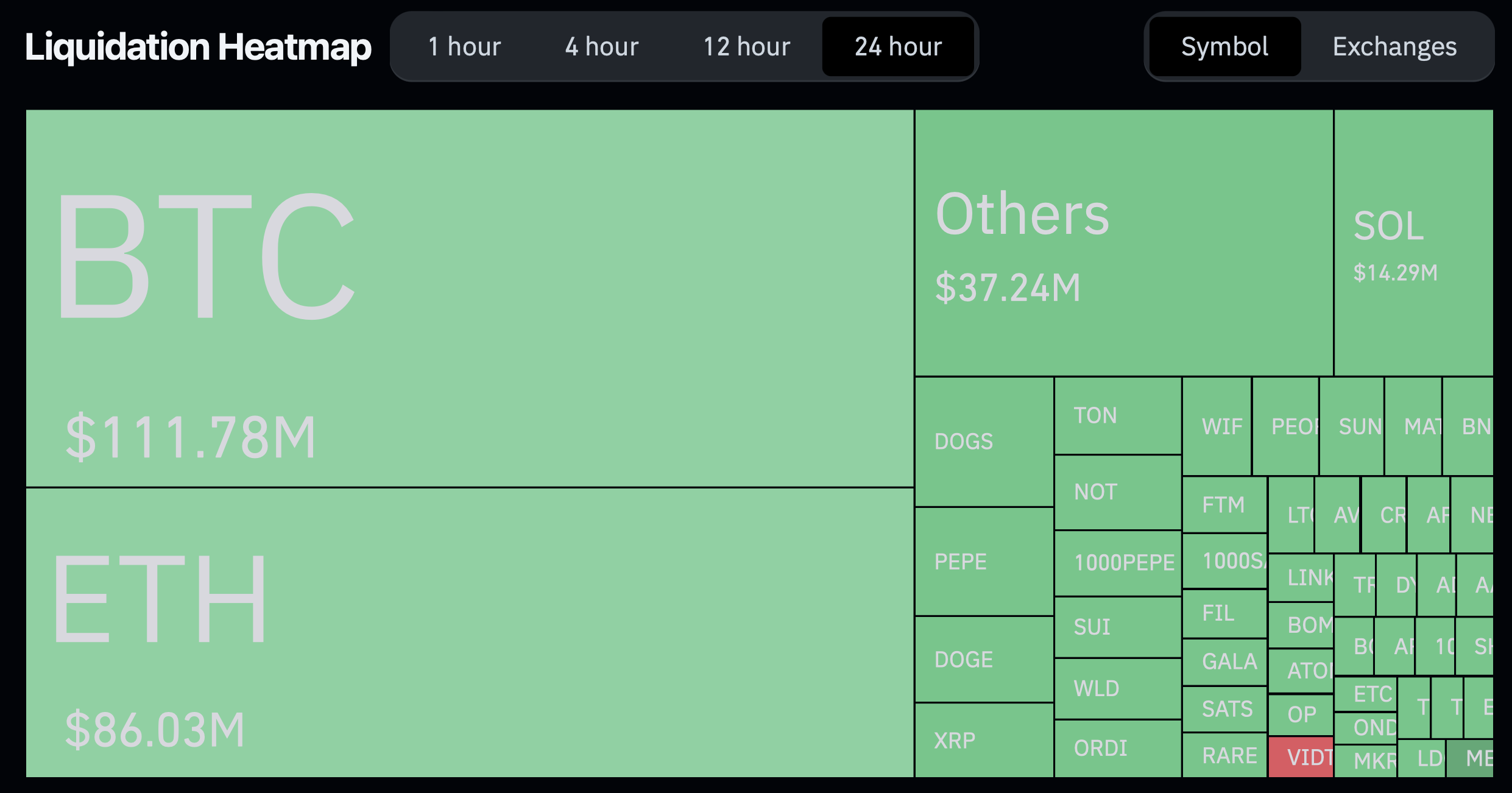

Based on information from Coinglass, approximately 92,000 traders have experienced being forced out of their positions in the last day, leading to a total liquidation amount of about $325.03 million. Ethereum was responsible for around $86 million of these liquidations, with nearly $67.90 million stemming from long positions.

As a researcher studying market trends, it appears that my analysis indicated a potential increase in the value of ETH, but the actual result was quite the opposite. Similarly, Bitcoin experienced significant forced sales, contributing about $111.78 million to the overall liquidations.

Much like with Ethereum, a large number of these liquidations stemmed from long positions, suggesting that the vast majority of traders failed to foresee the price drop.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- Paul McCartney Net Worth 2024: How Much Money Does He Make?

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

2024-08-29 08:46