As a seasoned crypto investor with a few battle scars from past market fluctuations, I find the recent dip in Bitcoin’s price to $59,000 quite intriguing. The surge in Exchange Inflow, particularly from the whales, is a red flag that I can’t ignore. It’s like hearing the ominous drumbeats before a storm hits.

During the last 24 hours, the price of Bitcoin dipped down to approximately $59,000. Here’s one theory as to why this might have happened, based on blockchain data.

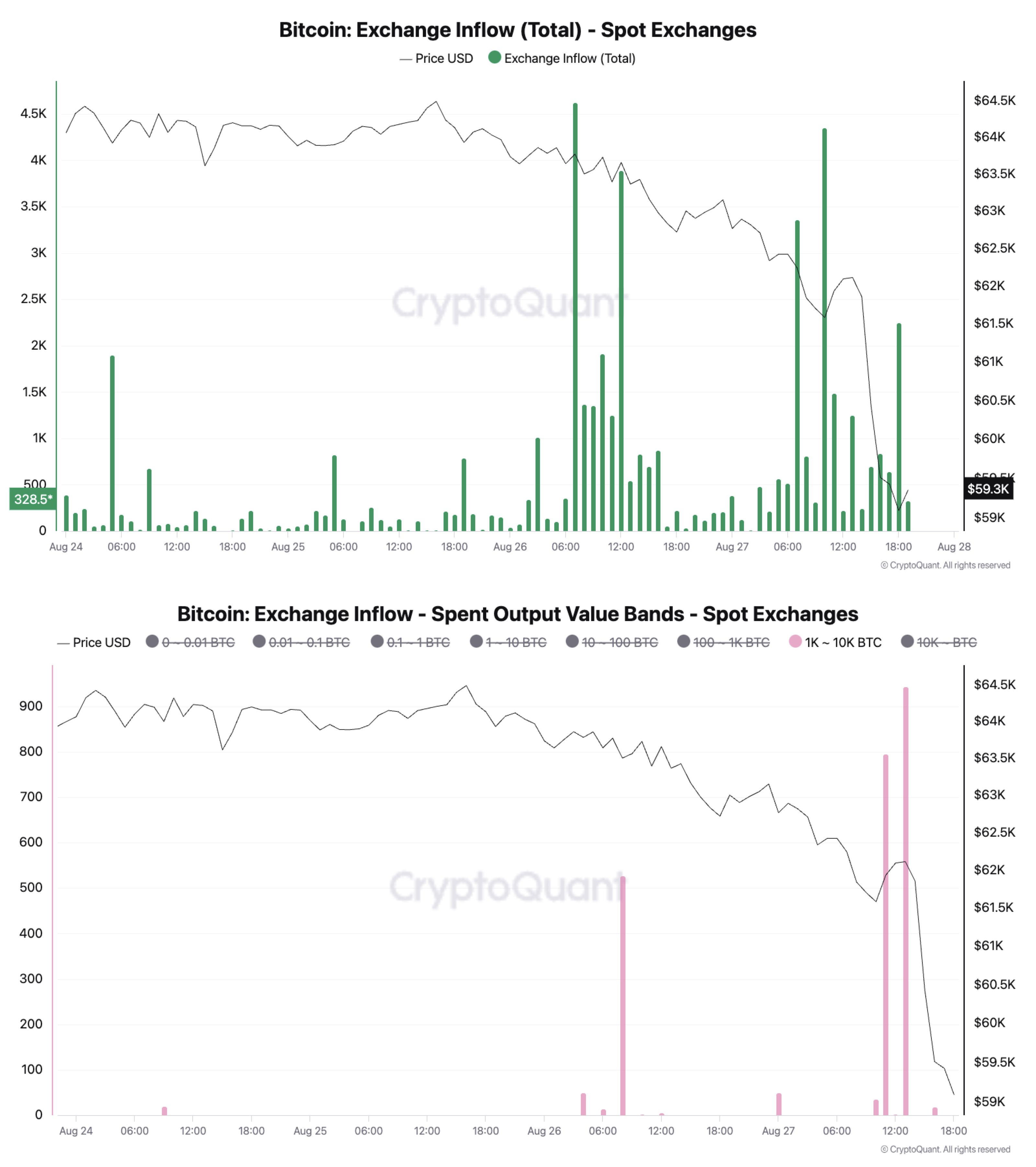

Bitcoin Exchange Inflow Spiked Just Before The Crash

In a new post on X, CryptoQuant Head of Research Julio Moreno discussed the latest trend in Bitcoin Exchange Inflow. Exchange Inflow is an on-chain metric that tracks the total amount of assets being transferred into the wallets of centralized exchanges.

When the value of this specific indicator is high, investors tend to place numerous cryptocurrencies on these platforms. A significant number of holders might move their assets to trading exchanges for selling purposes, which could lead to a downward pressure on Bitcoin’s value. This trend could potentially have bearish implications for Bitcoin.

Alternatively, a small value in this measure suggests that owners aren’t transferring their coins from personal storage to exchanges very often. If withdrawals aren’t happening simultaneously, this could indicate a positive trend for the cryptocurrency.

Currently, I’d like to present a graph provided by Moreno, which illustrates the recent pattern of Bitcoin Exchange Inflows:

According to the graph at the top, there were significant increases in Bitcoin Exchange Inflow before the recent price drop. Since this particular indicator on the chart applies only to spot trading platforms, it suggests that the investors who made these deposits were probably aiming to sell.

As a researcher, I’ve incorporated an additional dataset into my analysis: the Spent Output Value Bands variant of the Exchange Inflow, which can be found beneath the main Exchange Inflow chart in CryptoQuant. This new metric promises to enrich our understanding of the data and potentially reveal new insights.

As a crypto investor, I’m focusing on an indicator that categorizes Exchange Inflow based on the transaction size. This tool is particularly useful as it highlights trends within transactions ranging from 1,000 to 10,000 BTC. Moreno has drawn my attention to the band representing addresses holding between 1,000 and 10,000 tokens in their balance, which can provide valuable insights into market activity.

On a larger scale, investors like these are commonly referred to as “whales” and are recognized as significant players with substantial impact on market trends. As the graph demonstrates, the inflow to exchanges for these major Bitcoin holders also increased during the spikes in overall data, suggesting that these whales may have been involved in some of the deposits made at those times.

Based on when large investors deposited funds, it’s likely that some of the selling activity contributed to the downward trend in the cryptocurrency’s price over the past day.

From my perspective, it seems prudent to keep a close eye on this indicator, as further appearances of significant Bitcoin deposits might indicate that sellers are still active in the market.

BTC Price

At the time of writing, Bitcoin is floating around $59,900, down almost 4% over the last 24 hours.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-08-28 23:46