As a seasoned crypto investor with a knack for spotting trends and a penchant for meme coins, I must admit that the recent resurgence of DOGE has piqued my interest. Having been through numerous market cycles, I’ve learned to read between the lines of on-chain metrics and exchange data.

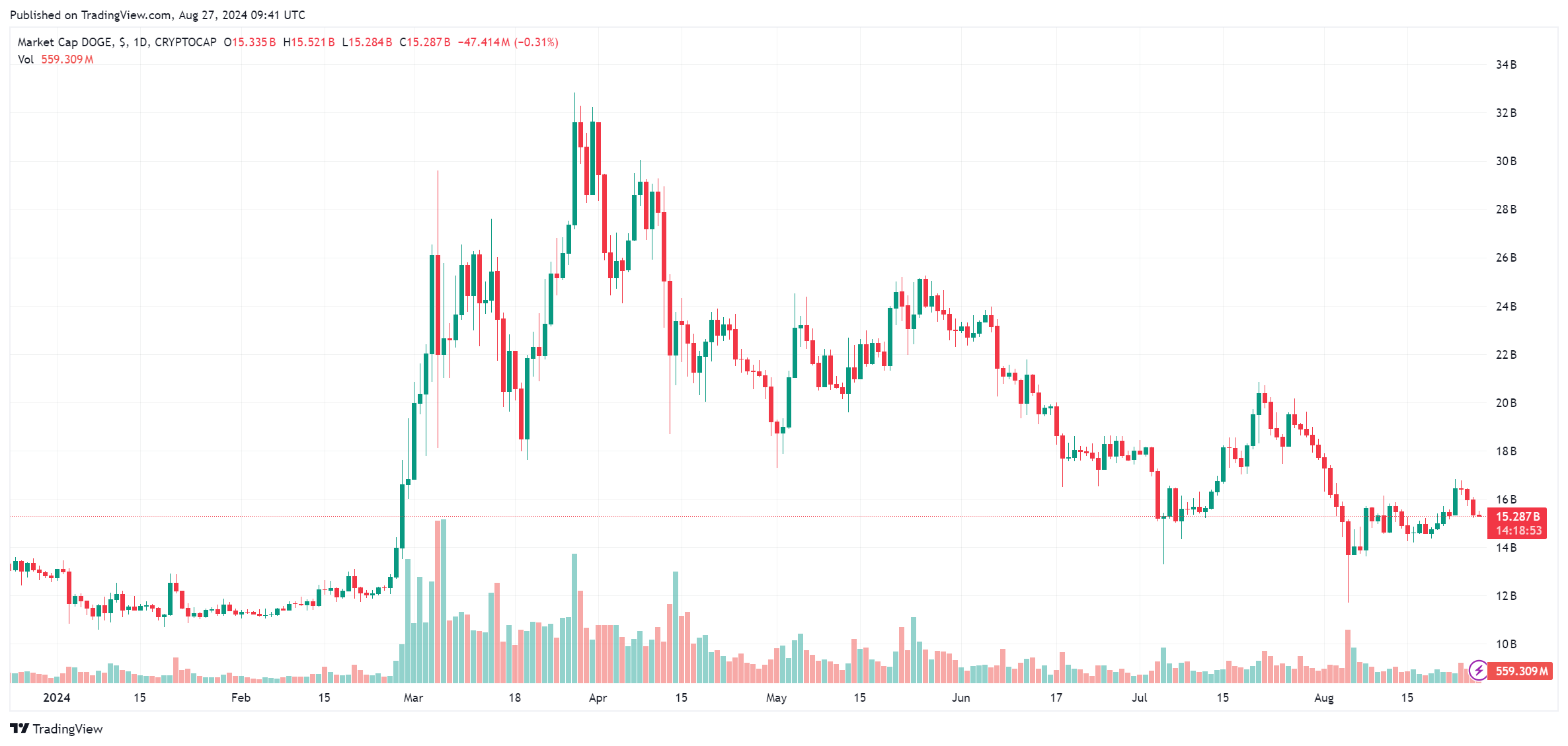

dogecoin, often referred to as the undisputed ruler of meme-based cryptocurrencies, seems to be showing indications of a possible comeback in its upward trend following a period of downward pressure lasting several weeks. In the past week alone, this digital currency has shown remarkable resilience, witnessing a notable increase of 16.3% and reaching a high of $0.115.

The surge indicates a significant change in speed for DOGE, as it had predominantly been trending downwards or remaining stable throughout much of the month.

As an analyst, I’ve noticed a refreshing surge in the price of DOGE, suggesting a revitalized bullish trend. This uptick coincides with a rebound in key on-chain indicators. These markers, encompassing heightened trading activity, increased withdrawals from exchanges, a spike in whale transactions, and a rise in buy orders, collectively point towards an increasingly positive outlook for DOGE.

Dogecoin Metrics Turn Green

As the new week begins, several key Dogecoin statistics suggest that the cryptocurrency may experience a bullish surge. Specifically, data from IntoTheBlock indicates a bullish trend, as two on-chain indicators and two exchange indicators have turned green.

Concerning the on-chain indicators, the “In The Money” value has risen by 2.52%, and the “Large Transaction” metric has gone up by 1.65%. These increases are positive signs for DOGE. The “In The Money” figure signifies a rise in optimistic sentiment among owners, implying more of them are now making a profit. Typically, this encourages them to keep holding as the price surge continues.

In terms of exchange signals for Dogecoin (DOGE), the “Bid-Ask Volume Imbalance” is used to express bullish attitudes. This particular metric just turned green and stands at 28.87%, meaning that buy orders are substantially more than sell orders on various cryptocurrency platforms. This imbalance indicates a high demand for DOGE, signaling strong investor interest.

In situations where buy orders are more prevalent, it frequently results in an increase in pricing because sellers have the advantage of setting higher prices thanks to the boosted demand for purchasing.

The bullish momentum can be further relayed through crypto exchange inflow/outflow data. Periods of negative sentiment are characterized by a high inflow rate into exchanges, which increases selling pressure. On the other hand, positive sentiment is characterized by notable outflows from exchanges.

According to this belief system, there’s been a massive 73.81% decrease in funds flowing into cryptocurrency exchanges during the last 24 hours. Furthermore, within the same period, there was a net loss of approximately 120.56 million Dogecoin tokens, indicating more coins being withdrawn from exchanges than deposited.

Dogecoin Eyes Bull Run

In simpler terms, as the indicators suggest positive trends and more funds are flowing into the broader crypto market, it seems like Dogecoin (DOGE), being the leader among meme coins, can only head higher. A favorable movement in DOGE’s price could also benefit other meme-based cryptocurrencies.

Currently, DOGE is being exchanged at approximately $0.1088. It has experienced a slight dip since reaching $0.1147, but it appears to have found a stable support level around $0.108. Any further uptrend from this level would likely boost the faith of numerous investors.

Cover image from Dall-E, Chart from Tradingview

Read More

- Odin Valhalla Rising Codes (April 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- POPCAT PREDICTION. POPCAT cryptocurrency

- Gold Rate Forecast

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- King God Castle Unit Tier List (November 2024)

- Incarnon weapon tier list – Warframe

- Is There a Tracker Season 2 Episode 21 Release Date & Time?

- Reddit (RDDT) Q1 2025 earnings results beat EPS and revenue expectations

- How To Play Sonic Dream Team On PC

2024-08-27 17:46