As a seasoned crypto investor with battle scars from the 2018 bear market etched into my portfolio, I find myself once again standing at the precipice of uncertainty. The recent surge in miner reserves to a two-year high has me feeling a familiar sense of deja vu. Historically, such a development has been a harbinger of stormy weather for the crypto market. However, I am not one to be swayed by historical precedents alone.

Bitcoin miners are holding record amounts of Bitcoin for the past two years, causing some investors to worry that this could lead to a drop in the Bitcoin market value. As per the latest findings from CryptoQuant, these miner reserves have surged up to approximately 368,000 Bitcoins, which equates to around $22.36 billion in current exchange rates.

Miner Reserves Hit Critical Levels

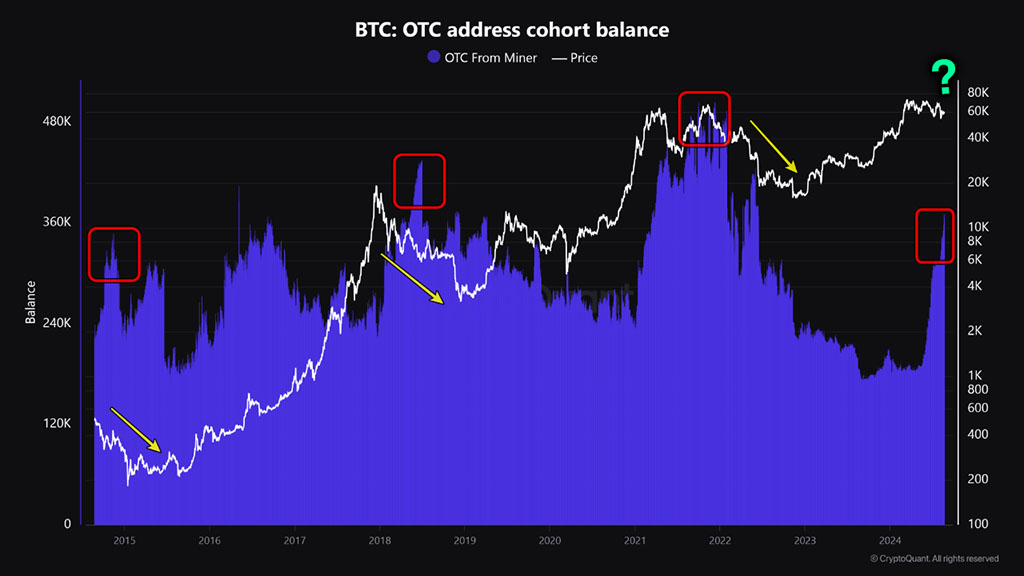

As a crypto investor, I’ve learned from past experiences that when miner reserves reach substantial levels, it often foretells an impending downturn in the cryptocurrency market. Recently, according to the CryptoQuant report, Bitcoin reserves held on over-the-counter (OTC) desks have skyrocketed by over 70% during the last three months. This rapid increase from 215,000 BTC in June to 368,000 BTC in August suggests that miners might be gearing up to sell a significant amount of Bitcoin. Such a massive offloading could potentially exert downward pressure on the market.

Analysts find similarities between current situations and past events where a rise in miner reserves led to sudden drops in Bitcoin prices. For instance, in May 2018, the total miner reserves surpassed 400,000 BTC as its value hovered around $8,475. In seven months, the price of Bitcoin dropped by 63%, reaching $3,183. A similar trend was observed in November 2021 when reserves were close to their all-time high of 500,000 BTC, and within two months, Bitcoin’s price fell from $64,000 to $35,058.

In today’s cryptocurrency market, the effects of miners selling off Bitcoin might be lessened by various other factors. For instance, there seems to be a significant reduction in the amount of Bitcoin circulating on exchanges, hinting that some investors could be holding onto their Bitcoins for a longer period. Furthermore, large investors, known as whales, have amassed approximately 94,700 BTC over the past six weeks, which indicates a strong belief in Bitcoin’s long-term worth even amidst short-term doubts.

Future Outlook Amid Uncertain Conditions

The future of Bitcoin appears unclear given the present market conditions. An increase in miner holdings is causing difficulties for these miners. High operational expenses, along with decreased rewards due to Bitcoin’s halving in April, have narrowed profit margins significantly. Currently, it costs approximately $72,224 to mine a single Bitcoin, while the cryptocurrency trades around $60,797 – leaving many miners in a loss position. This financial stress may lead more miners to offload their reserves, possibly causing additional price drops.

From a different perspective, analysts have pointed out that economic factors on a larger scale, like hints from the Federal Reserve about possible interest rate decreases in September, might impact Bitcoin’s value. When interest rates decrease, borrowing becomes cheaper and returns on savings less appealing. As a result, investors might be enticed to explore riskier assets with higher potential returns, such as cryptocurrencies. This increased demand could counterbalance some of the selling pressure from miners. Historically, Bitcoin has experienced substantial price increases during periods of low interest rates when investors sought alternatives to conventional investments.

In this specific scenario, it’s important for market players to keep a close eye on mining activities. A large scale selling off could potentially cause a decrease in price, but other market factors might lessen the impact, resulting in a more intricate and multifaceted perspective regarding Bitcoin’s short-term future.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-08-23 11:54