As a seasoned researcher who has closely followed the cryptocurrency market for years, I must say that the recent data on Ethereum (ETH) is quite intriguing. The MVRV metric suggesting a bottom at $1,687 and the reduction of ETH supply on exchanges below 10% are strong indicators that we might be looking at a new all-time high for ETH.

As a researcher examining Ethereum (ETH), it appears that the toughest times may have passed, given certain indicators pointing towards the bottom being already reached for the second-largest cryptocurrency by market cap. This positive outlook suggests that ETH could be on its way to setting a new personal best, potentially surpassing its existing all-time high of $4,800.

Ethereum MVRV Shows Bottom Is In

Data from the onchain analytics platform Glassnode shows that Ethereum’s market value to realized value (MVRV) lowest pricing level is at $1,687, which suggests that the bottom is already in for the crypto token. These MVRV pricing levels highlight how low or high a token will likely reach in a market cycle based on unrealized loss or unrealized profits.

In simpler terms, it’s unlikely Ethereum will fall below $1,687 in price, instead seeming to be moving towards its peak. It’s important to note that after the market crash on August 5, Ethereum dropped as low as $2,200. This price is near the $2,109 MVRV pricing band mentioned by Glassnode, suggesting that Ethereum may have already hit its bottom.

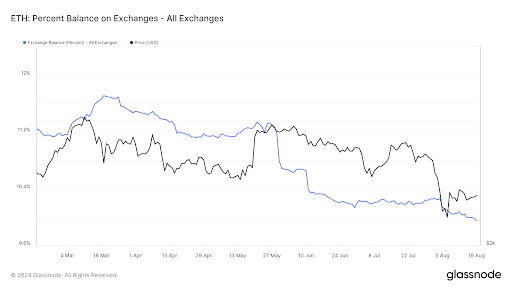

Currently, Ethereum investors seem to be switching their strategy from selling to holding onto their assets, suggesting they believe prices will rise in the future. According to Glassnode’s data, less than 10% of Ethereum’s supply is now stored on exchanges, which could mean less pressure for sell-offs and potentially set the stage for a significant price surge if investors maintain this trend.

According to Glassnode’s data, Ethereum might surpass $5,000 and peak at around $6,759, which is currently its highest MVRV pricing point. This price level could potentially signal a market top for Ethereum during this bull run. However, some crypto analysts like Tyler Durden anticipate that Ethereum may even reach $10,000.

Other Metrics That Support An Imminent Price Rally For ETH

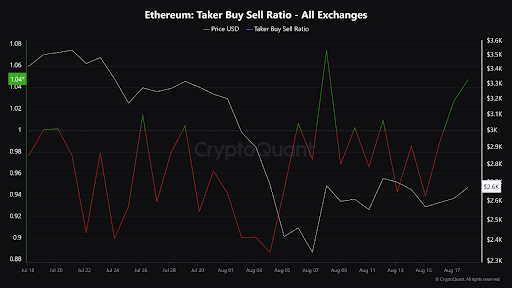

A fresh blog post on the digital analytics platform Cryptoquant recently emphasized two indicators suggesting Ethereum is preparing for another price surge. One of these indicators, the Taker Buy-Sell Ratio, determines the ratio of Ethereum buyers to sellers. Currently, this ratio is positive once more due to the resurgence of Ethereum bulls and their suppression of selling pressure from bears.

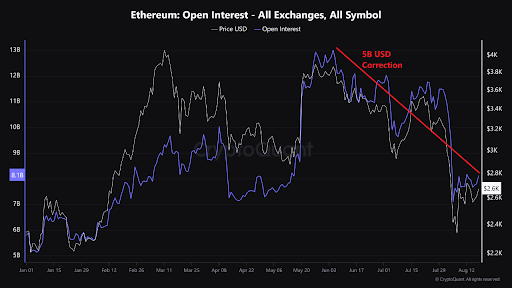

After falling to $7 billion due to the August 5 market crash, Ethereum’s open interest (OI) has increased again, now standing at approximately 10.81 billion. This suggests that traders using leverage are re-entering the market. It’s important to note that the activity in the derivatives market significantly influences the price of ETH.

As I write this, Ethereum’s current price hovers around $2,590, marking a decrease of approximately 3% over the past 24 hours, as per data from CoinMarketCap.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Japanese BL Dramas to Watch

2024-08-22 04:16