As a seasoned crypto investor with scars to prove from previous market cycles, I find myself intrigued by the recent turn of events surrounding Avalanche (AVAX). The consolidation phase has been longer than anticipated, and the volatility in this market can make even the sturdiest of investors question their convictions.

In the turbulent world of cryptocurrencies, Avalanche (AVAX) has struggled to regain ground lost in the market. While it’s been a slow process compared to other Layer-1 blockchains, some are questioning whether AVAX’s consolidation could have happened more swiftly. This sluggishness sparks doubts about its potential future success.

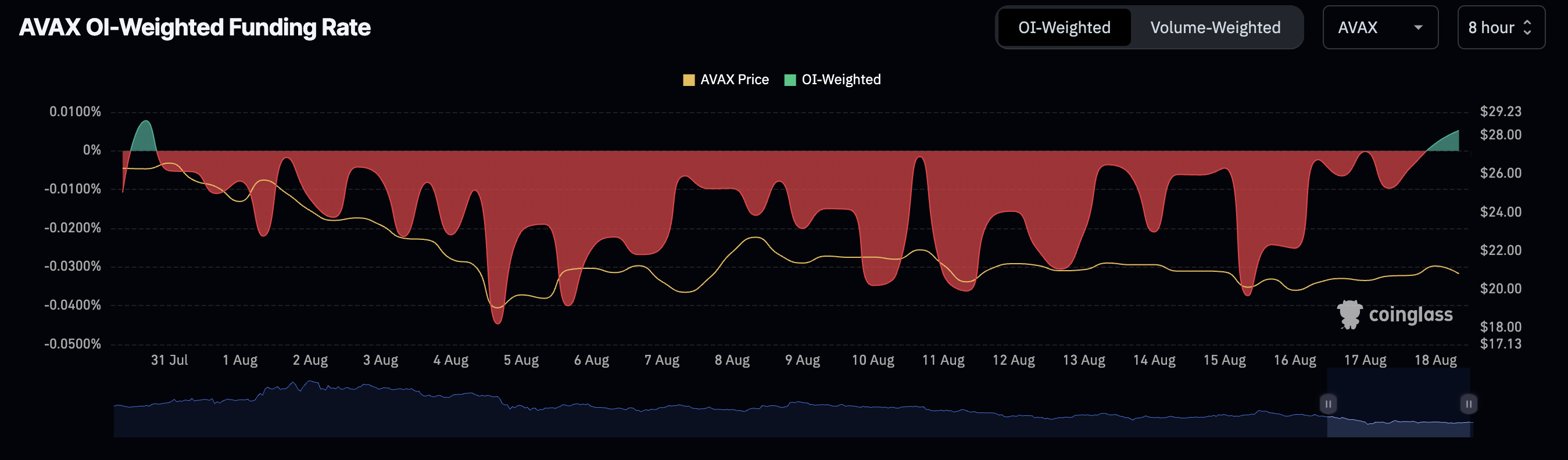

Despite this uncertainty, recent price action shows AVAX consolidation above the $19.80 support, trading at $22.11 when writing and creating a positive sentiment among bulls. The Avalanche funding rate has turned positive for the first time since late July, and some analysts are even anticipating a potential reversal in Avalanche’s fortunes.

AVAX Funding Rate Turns Positive

Based on information from Coinglass, the funding rate for AVAX (Avalanche) has turned positive, possibly indicating a shift in market trends.

In futures trading, when there’s a positive funding rate, it usually means greater interest in long positions, as traders are prepared to pay extra to keep these positions open. This suggests a surge of optimism among traders, who believe AVAX‘s price will increase rather than decrease, marking a significant change from the pessimistic outlook that has prevailed in the market lately.

At present, the growing optimism surrounding AVAX, as indicated by its favorable funding rate, suggests a potential build-up of bullish energy. If this momentum continues and the bulls manage to drive the price beyond the significant resistance at around $23, we might witness a breakout in the market.

October 2023 Vs. August 2024: Avalanche AT A Turning Point?

1) Investors anticipate that surpassing $22.79 could alter the weekly downward trend, and they see parallels with October 2023 in their analysis.

Analysts similar to Daghan are predicting a market flip and have drawn parallels between the current market scenario and that of October 2023, which preceded Avalanche’s price surge from $8 to its peak this year of $65 by March 18th.

In his analysis, Daghan highlights the speed at which Avalanche’s price surges following extended and significant downturns, demonstrating how swiftly it transitions from a bearish to a bullish state.

At present, Avalanche’s price stands at $22.11. In order to surge ahead and challenge the supply area around $22.79, thereby setting a new peak, it needs to surpass the significant resistance level. If buyers successfully regain control over the $23 mark, this might suggest a broader market recovery for AVAX. Conversely, if the market fails to maintain its position above the August 5 low of $19.53, there could be a possibility of a downward trend reemerging, potentially pushing the price back towards demand zones below $17.50, with the next potential bearish point at $15.

With the funding rate suggesting a potential change in investor attitudes, the upcoming period is crucial for deciding if Avalanche (AVAX) can escape its current holding pattern and continue its uptrend.

Cover image from Unsplash, chart from Tradingview

Read More

2024-08-21 03:40