As a seasoned researcher with over two decades of experience in the dynamic world of blockchain and cryptocurrencies, I have witnessed firsthand the incredible transformation Ethereum has undergone since its inception. The recent surge in circulating supply to over 120.72 million ETH is indeed noteworthy, and while it might raise eyebrows for some, I view it as a natural evolution of the network’s dynamics post-PoS transition.

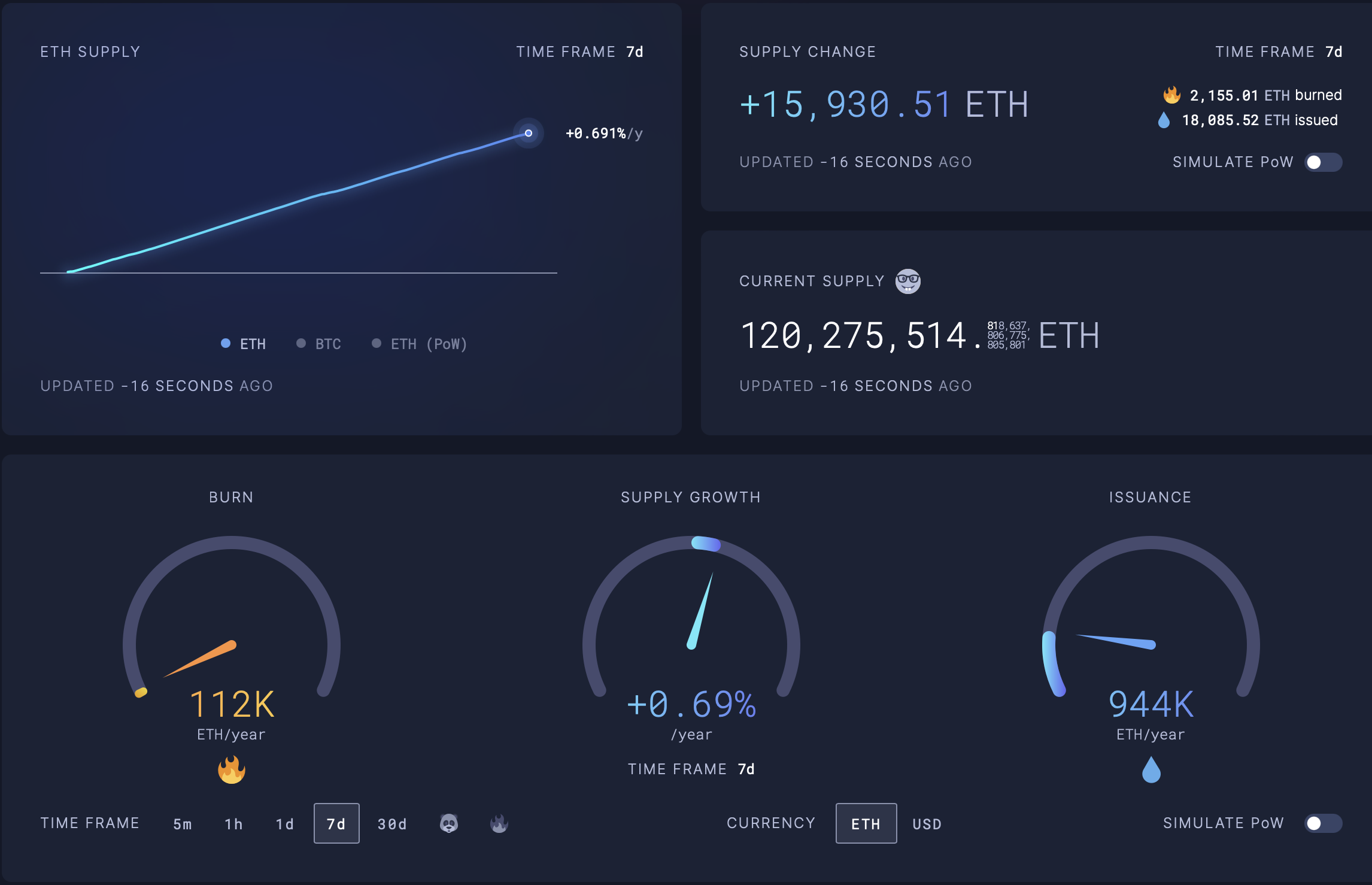

As a researcher, I’ve noticed an intriguing contrast in Ethereum‘s performance lately. While its price trajectory hasn’t been consistently bullish over the past few weeks, the circulating supply of Ethereum has taken a different path. According to data from Ultrasoundmoney, the circulating supply of ETH has soared, reaching over 120.72 million ETH as of today. This growth in circulation is quite noteworthy and deserves further investigation.

While an upsurge in ETH‘s supply may not initially appear detrimental, it does signify a significant change in the network’s behavior, mainly driven by the transition to the Proof-of-Stake (PoS) system.

Supply Increase, How And Why?

The significant increase in the total Ethereum supply (now at 120.72 million ETH) observed from recent data on Ultrasound.money indicates a surge of activity within the Ethereum network over the last month.

During this specific timeframe, Ethereum experienced the creation of approximately 77,102 new Ether coins, whereas around 19,402 Ether tokens were eliminated from the system via a burn process that was implemented with the latest London Upgrade in its network.

In simple terms, the additional supply of around 57,653 Ether in the last 7 days indicates a slight rise in the yearly increase percentage from 0.58% to 0.69%.

Significantly, Ethereum’s move from the Proof-of-Work (PoW) system to Proof-of-Stake (PoS) not only strengthened its security structure but also enhanced the incentives for active involvement.

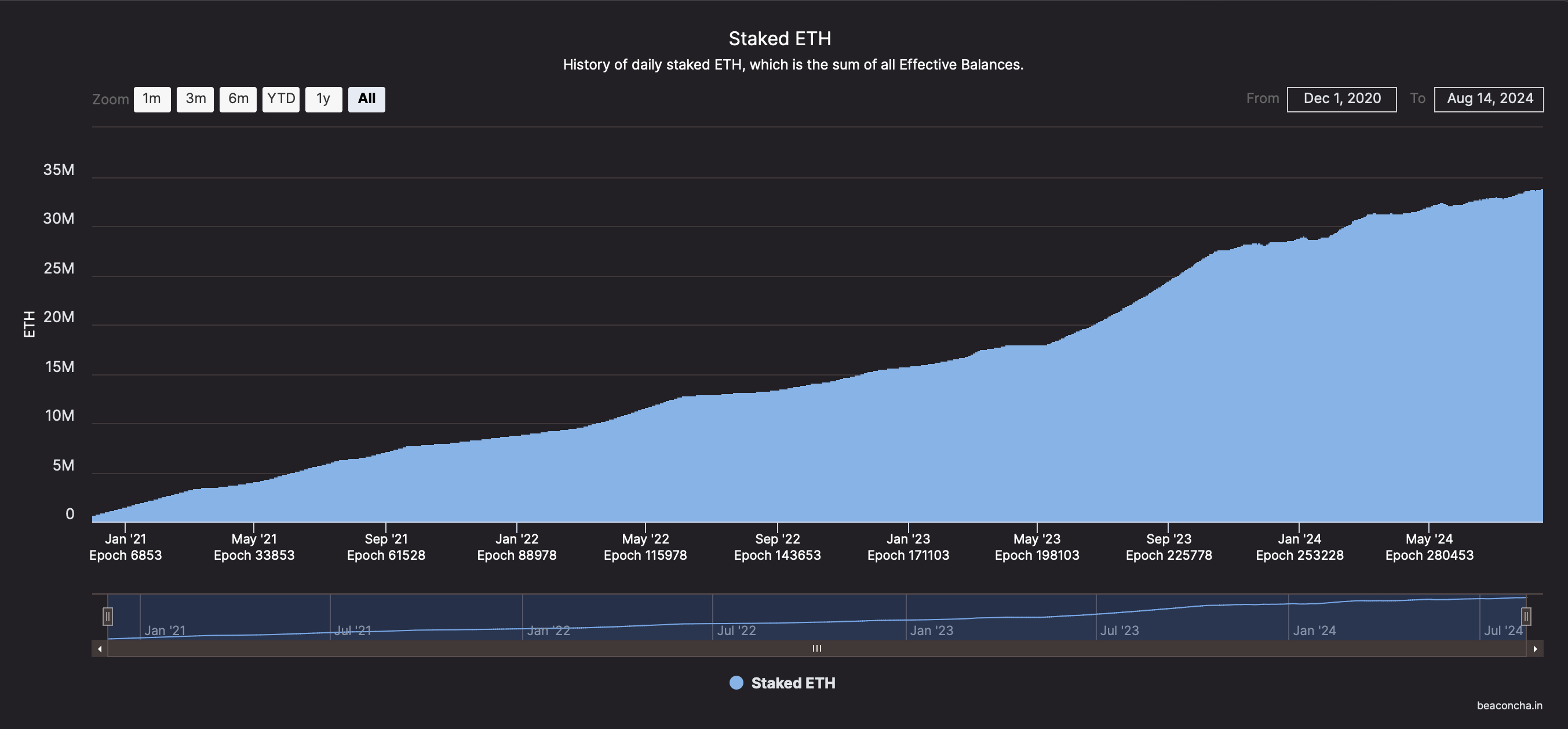

Speaking of factors contributing to the rise in supply, approximately 33.9 million Ether (ETH) are currently locked up within the network, earning significant returns through freshly minted ETH as rewards.

It seems that on a grand scale, staking is playing a substantial role in boosting Ethereum’s overall inventory. Moreover, the practice of staking has been intensified by the rising tendency of restaking, where stakeholders are re-investing their staking returns back into the system.

Each round in this reinvestment process amplifies the emission of fresh ETH, thereby increasing the total supply. As the Ethereum network transitions towards an “apparent” inflating path following its initial assumptions about a deflationary trend, instigated by the ETH destruction method.

Ethereum Market Performance

Over the past week, Ethereum’s price has been steadily rising. It was priced at around $2,500 last Thursday, but now it’s trading at approximately $2,652 as I write this, which represents a 9.3% increase in value.

Over the same timeframe, this increase in worth happened alongside Ethereum’s market capitalization value, which experienced a significant jump of almost $20 billion. However, contrastingly, Ethereum’s daily trade volume has decreased during this period.

Specifically during the last seven days, this figure has dropped significantly from approximately $21 billion to its current level of $12.8 billion. Despite this decline, numerous cryptocurrency experts maintain a positive outlook towards Ethereum.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I have seen my fair share of trends and patterns. Today, I am excited to share my insights about Ethereum (ETH). Earlier today, a highly respected figure within our community, often referred to as the titan of crypto on X, set a $3,000 target for ETH.

As a crypto investor, I’m excited about Ethereum (ETH) right now. The current price action suggests that ETH might be gearing up for a significant move. There’s an intriguing gap in the CME futures market where the price has yet to fill. This could potentially lead to a surge towards my target of $3,000 if the market dynamics play out as expected. Let’s keep a close eye on this promising opportunity!

— Titan of Crypto (@Washigorira) August 15, 2024

Read More

- Odin Valhalla Rising Codes (April 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- POPCAT PREDICTION. POPCAT cryptocurrency

- Gold Rate Forecast

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- King God Castle Unit Tier List (November 2024)

- Incarnon weapon tier list – Warframe

- Reddit (RDDT) Q1 2025 earnings results beat EPS and revenue expectations

- Is There a Tracker Season 2 Episode 21 Release Date & Time?

- How To Play Sonic Dream Team On PC

2024-08-16 11:27