As a seasoned crypto investor with a few battle scars and a heart full of resilience, I find myself analyzing the recent pullback of Bitcoin to the $58,000 level with a mix of intrigue and caution. The massive Tether (USDT) outflows from exchanges, as reported by IntoTheBlock, have raised some eyebrows in the community. Historically, such events have been associated with bullish sentiments for volatile assets like Bitcoin. However, given that we’re dealing with a stablecoin here, the implications are a bit more nuanced.

Over the past day, Bitcoin has seen a dip to approximately $58,000. Potential reasons for this drop, based on on-chain analysis, are as follows:

Exchanges Have Seen A Large Amount Of Tether Withdrawals Recently

Based on information from IntoTheBlock’s market intelligence platform, there has been a surge of over $1 billion in withdrawals of Tether (USDT) from centralized exchanges lately.

Typically, investors store their cryptocurrencies on exchanges if they plan to trade them soon. However, choosing to withdraw their digital assets might suggest that these investors are planning to hold onto them for the long term.

As a crypto investor, I’ve noticed that when volatile assets like Bitcoin show increased exchange outflows, it often indicates a bullish trend for me. However, in our current discussion, the asset being withdrawn is a stablecoin. This shift in context suggests a slightly altered interpretation: rather than a potential surge in value, these outflows might signal a strategic move by investors or institutions, possibly preparing for market fluctuations or taking advantage of opportunities in other sectors.

As a researcher, I’ve observed that many investors prefer to hold fiat-backed tokens such as Tether during periods when they wish to avoid the volatility typically associated with cryptocurrencies like Bitcoin. These investors often have plans to re-enter the market at a later stage and may utilize exchanges for executing their trades.

When people purchase Bitcoin or other similar assets using their stablecoins, it tends to increase the price of those assets because there are more buyers. Consequently, an increase in stablecoin inflows to exchanges might indicate a positive outlook for the cryptocurrency market.

As an analyst, I’ve observed that transferring USDT and other assets into personal wallets (self-custody) might indicate a bearish trend in the market. This is because it suggests that investors are less likely to enter the volatile market in the short term, as they seem to be taking their funds out for safekeeping instead.

It’s possible that recent Tether withdrawals are the reason for the decline in Bitcoin’s price. These withdrawn Tethers might have been turned into Bitcoin sell orders, as some investors prefer to manage their own digital assets after exchanging them.

In my analysis, I’ve observed that the recent substantial Tether (USDT) exchange outflows have tended to influence Bitcoin negatively. Specifically, the last two significant outflows have been followed by a bearish trend in Bitcoin.

Speaking as a fellow crypto enthusiast, I’ve noticed a significant wave of liquidations across the broader cryptocurrency derivatives market today, likely due to the high volatility we’ve seen in Bitcoin and other digital currencies over the past 24 hours.

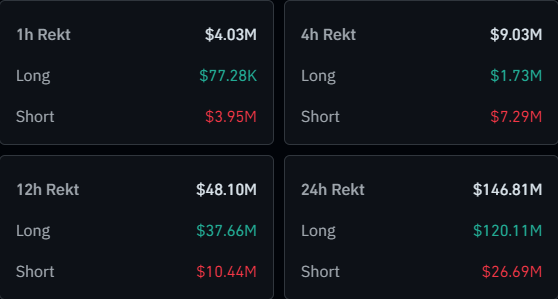

As someone who has navigated through numerous market volatilities over the years, I find it essential to keep a close eye on liquidations during such periods. The table below from CoinGlass provides a comprehensive summary of the latest liquidations that have taken place in this recent volatile phase, offering valuable insights into the current state of the market. This data can help me make informed decisions and adjust my investment strategies accordingly.

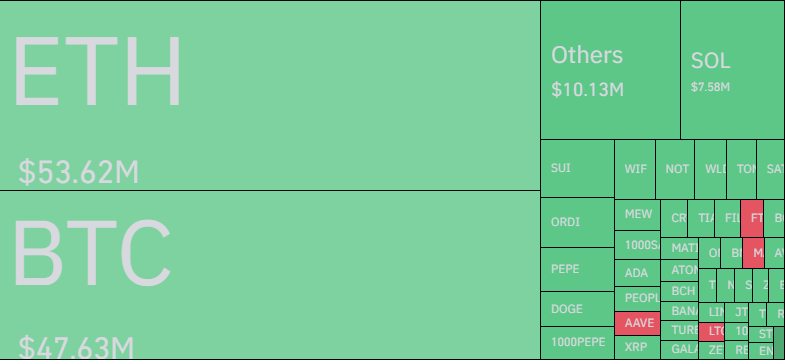

Over the past day, approximately $146 million worth of cryptocurrencies have been liquidated, and around 80% of that amount, which equals about $120 million, was due to long contracts being closed.

It’s worth noting that while Bitcoin (BTC) is often associated with significant movements in derivatives markets, it’s actually Ethereum (ETH) that has led this recent flush. However, the difference in liquidations between ETH and BTC is relatively small, with ETH having just $6 million more in liquidations than BTC.

BTC Price

At the time of writing, Bitcoin is trading around $58,800, down 4% over the last 24 hours.

Read More

2024-08-16 01:36