As a seasoned financial analyst with over three decades of experience in the industry, I find the concept of a strategic Bitcoin reserve by the US government intriguing and potentially beneficial, albeit requiring cautious consideration. My career has been marked by witnessing numerous economic crises, including the dot-com bubble, the 2008 financial crisis, and the ongoing global debt crisis.

With the 2024 presidential election on the horizon, there’s growing support for the U.S. government creating a Bitcoin reserve as part of its strategy. This idea, backed by ex-President Donald Trump and Senator Cynthia Lummis, who are crypto advocates, could offer an innovative method to reduce the nation’s staggering $35 trillion debt burden.

A Bitcoin-centric financial organization named River has delved deeply into this idea in a comprehensive video study. They posited that amassing Bitcoin as a strategic reserve might offer significant benefits to the U.S. administration, such as…

Bitcoin Reserve As Antidote To US Debt Crisis?

Using the U.S. as an illustration, the company underscores the country’s significant national debt, stressing the urgent importance of taking steps to bolster America’s financial stability.

As an analyst, I propose a strategy to fortify our stance: investing in assets that grow in worth over the years could offer us a significant advantage. Should these assets increase in value more rapidly than our country’s money supply expansion, we may have the ability to counterbalance a considerable portion of our future debt.

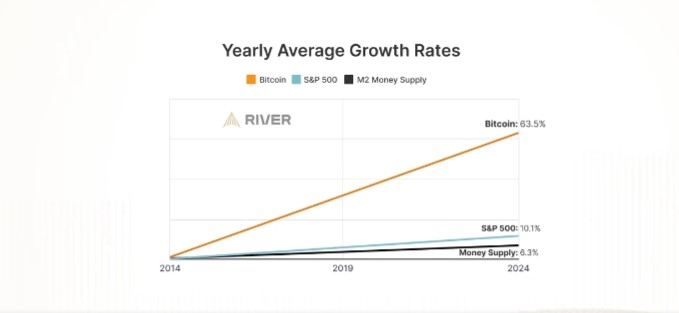

Highlighting Bitcoin’s impressive yearly average increase over the last ten years, River presents the following graph, illustrating Bitcoin’s rise by more than 60%. This growth is accentuated by its restricted supply of only 21 million coins, making it less common than conventional assets like gold and paper currencies.

The video also references El Salvador’s Bitcoin reserve strategy, highlighting the nation’s acquisition of approximately 5,800 BTC valued at around $340 million, with a notable profit margin of 38%, equating to approximately $50 million.

Globally speaking, the United States ranks among the top Bitcoin holders, with approximately 213,246 Bitcoins in its possession. The majority of these coins were acquired through the seizure following the Silk Road marketplace and funds pilfered from the Bitfinex exchange.

As a researcher studying economic strategies, I propose that by acquiring approximately 5% of the entire Bitcoin (BTC) supply, the United States could potentially ease a substantial chunk of its existing national debt.

From my perspective as an analyst, I believe it’s plausible that some nations might consider building Strategic Bitcoin Reserves. This action could enhance Bitcoin’s value proposition significantly, potentially sparking a chain reaction. In this scenario, countries might feel compelled to follow suit in order to stay competitive and relevant in the rapidly changing financial landscape.

In their final remarks, the company suggested that establishing a National Bitcoin Reserve could be advantageous for both the country and its people. This move would potentially accelerate Bitcoin’s acceptance in everyday life and make it more user-friendly over the long term, ultimately facilitating a smoother transition into routine transactions.

Trump And Lummis Push For US BTC Reserve

River’s insights stem from recent remarks made by Donald Trump and Senator Cynthia Lummis a month ago, emphasizing their proposed strategies for utilizing Bitcoin as a means to tackle the enormous U.S. national debt.

Trump’s remarks suggest a possible approach to distribute cryptocurrency as a means of easing financial burdens. Meanwhile, Senator Lummis has proposed an extensive strategy to purchase one million Bitcoins over a five-year period, aiming to own 5% of the total Bitcoin supply, which could help decrease the nation’s escalating debt.

At the Bitcoin 2024 conference, Lummis highlighted that creating a Strategic Bitcoin Reserve could protect the U.S. dollar‘s role as the world’s primary reserve currency and bolster America’s dominance in financial advancement. This move would set the stage for ongoing economic success in the 21st century.

Bitcoin’s current price stands at approximately $59,000, marking a 1% decrease within the last day as it struggled to maintain its position above the crucial $60,000 threshold.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-08-15 08:17