As a seasoned crypto investor with a knack for reading market trends and understanding their underlying factors, I find Arthur Hayes’ analysis intriguing. His focus on US liquidity and its impact on Bitcoin and altcoins resonates with my own observations over the years.

As a crypto investor since April, I’ve noticed Bitcoin (BTC) has been trading within a range of $60K to $70K, occasionally dipping below $60K. During this timeframe, many altcoins have experienced significant sell-offs, with some plunging more than 50%. Yet, BitMEX founder Arthur Hayes believes that the market trend might turn favorable starting from September. In his recent blog post, he expressed:

“I expect that crypto will exit its sideways-to-downward trajectory starting in September.”

Hayes anticipated an increase in the money supply injected into the U.S. economy as we approached the end of the year.

Hayes: How US Liquidity Could Change BTC Trajectory

To provide a historical perspective on how U.S. liquidity has influenced Bitcoin, Hayes studied crucial monetary indicators such as the issuance of U.S. Treasury bills (T-bills) and the Federal Reserve’s Reverse Repurchase Agreement (RRP).

To put it simply, Treasury bills (T-bills) are financial instruments sold by the government to cover their budget shortfalls (excessive spending over income). An increase in T-bill sales would provide more funds for government expenditure and enhance overall liquidity. Conversely, a decrease in T-bill issuance could lead to a reduction in liquidity.

Alternatively, the Federal Reserve (Fed) employs the Reverse Repurchase Agreement (RRP) as a means to regulate the amount of money circulating. This tool is given to banks, enabling them to lend money to the Fed. An expansion in RRP activity indicates less liquidity available.

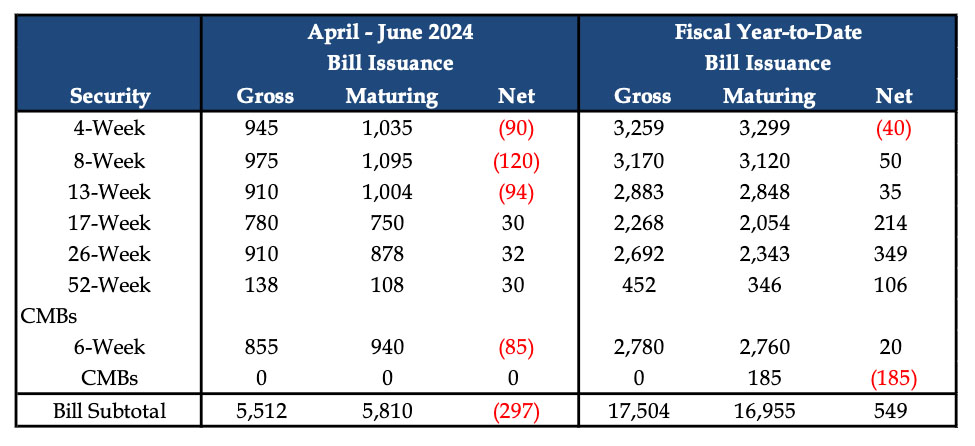

From April to June 2024, the U.S. actually decreased the amount of Treasury bills it issued. This decrease led to a lowering of the liquidity in the U.S. market.

Per Hayes, this led to BTC and the crypto market’s muted price action.

“Due to fewer Treasury bills being circulated, there was less liquidity available within the financial system,” he noted.

In addition, it was observed that the movements of Treasury bills (T-bills), Repurchase Agreement Rate (RRP), and Bitcoin (BTC) prices were closely related. Notably, during Q1, an increase in T-bill issuance occurred simultaneously with a decrease in RRP, which was followed by unprecedented highs in Bitcoin’s price in March, as observed by Hayes.

However, the opposite trend has played out since April.

Between April and July, as T-bills were more often removed from the market than added, the Repurchase Agreement (RRP) rate increased, and Bitcoin’s price moved in a relatively steady pattern, occasionally experiencing sharp declines, according to Hayes.

Based on my personal experience as a financial analyst, I believe that the US Treasury’s decision to net-issue $301 billion in T-bills between now and the end of the year could potentially have a significant impact on various financial markets, including Bitcoin (BTC).

How about Altcoins and the elusive Altcoin season?

When will Altcoin Season Begin?

If the liquidity increases, it could spur on altcoins and possibly ignite what’s known as an “altcoin boom.” But according to Hayes, this phenomenon, or the “altcoin season,” would only occur if Bitcoin surpassed $70,000 and Ethereum exceeded $4,000.

As a researcher delving into the realm of cryptocurrencies, I found an interesting point worth sharing. Furthermore, I observed that the potential for Solana (SOL) to surge beyond the $250 mark could be a significant boon. This upward movement might bring a much-needed respite to the broader altcoin market.

Considering the market’s liquidity situation, Hayes intended to seize reduced-price purchases during the summer downturns and subsequently unload them at the peak of the October surge. He aimed to complete these transactions before the U.S. election in November, which might disrupt the market’s momentum.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-08-13 13:13