As a seasoned crypto investor with battle-tested nerves and a knapsack full of digital coins, I find myself standing at the precipice of yet another market downturn. The Bitcoin Fear & Greed Index, my trusty compass in these wild frontiers, now points me towards extreme fear territory once again, with a value of 25 on its scale.

As a crypto investor, I’ve noticed the market sentiment for Bitcoin has plunged into extreme fear once more, given its price drop to around $59,000. The data doesn’t lie; it seems we might be in for a challenging time ahead, but history has shown that such periods can present excellent opportunities for long-term growth.

Bitcoin Fear & Greed Index Suggests Market Now Extremely Fearful

The “Fear & Greed Index,” a tool devised by Alternative, offers insights into the prevailing emotions, primarily fear or greed, among Bitcoin and broader cryptocurrency market participants at any given moment.

The index uses the following five factors to determine the sentiment: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends. It then represents this estimation using a scale that runs from 0-100

As a researcher studying market sentiment, I’ve observed that readings above 53 on our indicator reflect investor greed, indicating they are more likely to take risks due to overconfidence. Conversely, values below 47 suggest prevailing fear in the market, with investors being cautious and risk-averse. The area between these two thresholds signifies a neutral mindset, where investors exhibit neither excessive optimism nor pessimism.

Apart from the three mentioned regions, we find two unique feelings known as intense fear and intense greed. The first one, or the feeling of intense fear, typically appears in individuals aged 25 and younger, whereas the second one, or the feeling of intense greed, is common among those aged 75 and older.

Now, here is what the latest value of the Bitcoin Fear & Greed Index looks like:

Currently, you can see that the indicator stands at 25, placing the market within the “extreme fear” zone. Compared to yesterday, this represents quite a notable shift in the metric’s value.

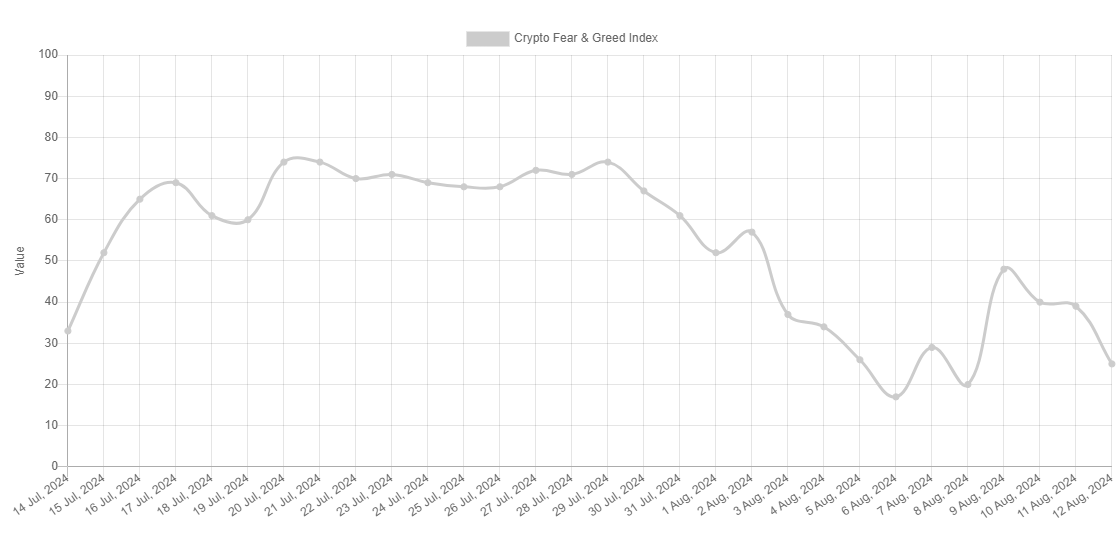

The below chart shows the trend in the Bitcoin Fear & Greed Index over the past month.

Looking at the chart, it’s clear that the Fear & Greed Index was quite high towards late July. However, as the downward trend in Bitcoin’s price ensued, so did a significant decrease in the Index’s value.

By the 29th, the index stood at 74, indicating it was teetering on the brink of excessive optimism. However, as of the 6th of this month, it dipped into the territory of intense worry, reaching a value of 17.

As an analyst, I observed that the asset’s recent recuperation noticeably enhanced overall sentiment, pushing the index back up to 48. However, upon closer inspection, it seems this upward trend was short-lived, as the sentiment has once more plunged into extreme fear due to a significant price decrease in BTC.

Although the general sentiment towards cryptocurrency seems to have deteriorated, this might not necessarily indicate a negative trend. In fact, history shows that Bitcoin often defies popular opinion, particularly when expectations reach an extreme level.

In summary, price levels at the high and low extremes often mark significant points where tops and bottoms occur in the market. Given that the Fear & Greed Index has moved back into extreme fear territory, it’s plausible we might witness a potential bottom soon. However, it remains uncertain whether this decline will be the end of the asset’s fall or if further drops are imminent.

BTC Price

It seems that Bitcoin is displaying indications of recovery, as its value has surged to around $59,700 after dipping below $58,000 earlier today.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2024-08-12 21:40