As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, and the current cryptocurrency landscape is no exception. The recent surge in Ethereum (ETH) is indeed intriguing, given its recovery from sub $2,000 levels earlier this week.

In addition to Bitcoin, Ethereum (ETH), the world’s second-largest cryptocurrency, has seen significant growth, rising over 8% in the past 24 hours and exceeding the $2,650 mark. This asset class has bounced back by more than 30% from its earlier this week lows during the Black Monday crash that was at below $2,000.

During a 90-day span, the correlation between BTC and ETH is 0.82, indicating they tend to move together significantly. This implies these two investment types are closely aligned in their market movements. As per blockchain analytics platform Santiment’s findings, over the broader market recovery, Bitcoin and Ethereum have been favored by investors as top picks.

It’s not surprising that Bitcoin and Ethereum are getting most of the attention. However, as cryptocurrency prices recover, it’s the less conventional investments that are seeing a surge in value, often overlooked by the general public.

Trading 101: Buy the dip in times and sectors where the crowd isn’t. 👍

— Santiment (@santimentfeed) August 5, 2024

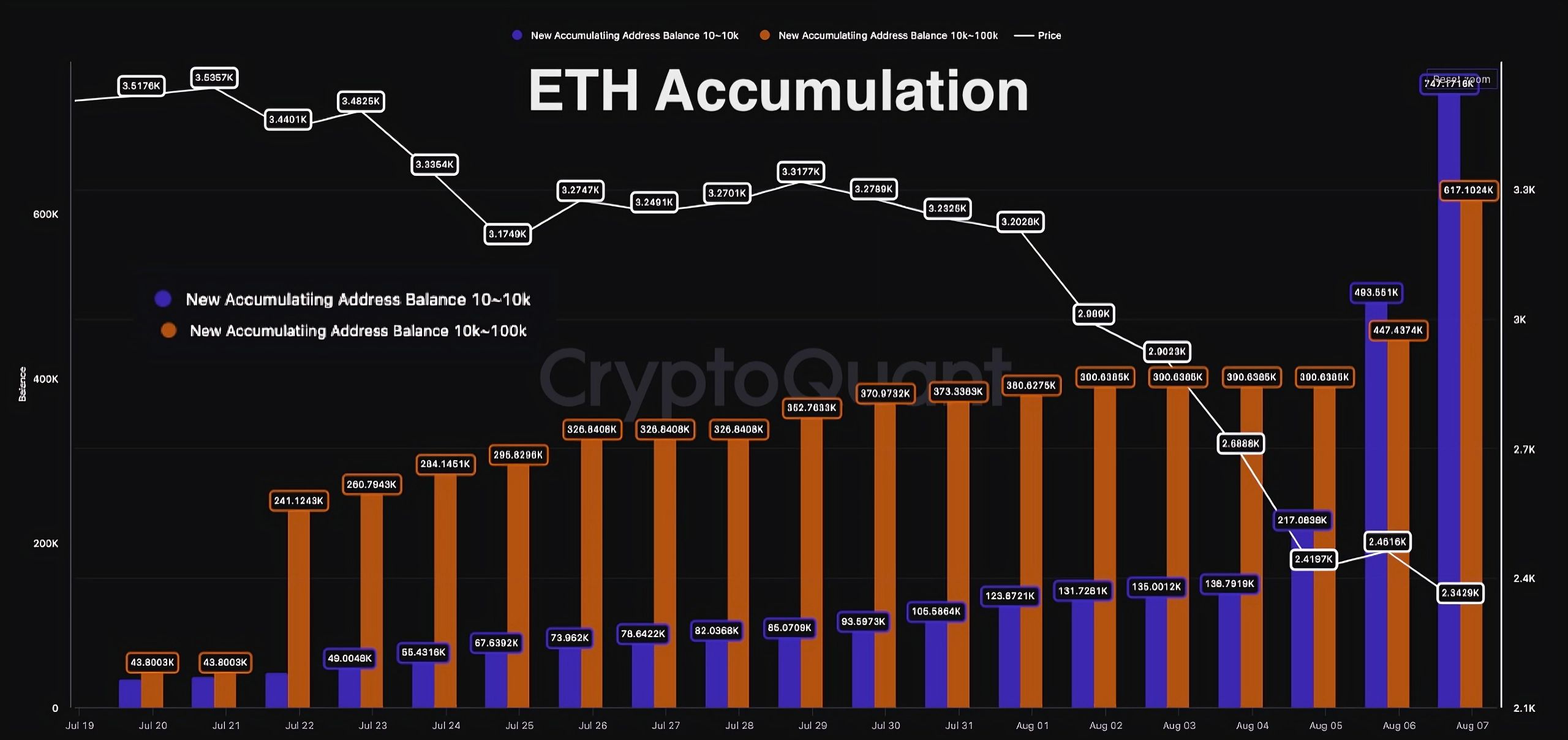

Additionally, it was observed that a significant number of 757,000 Ether were added to Ethereum addresses during the recent price drop, indicating a robust trend of accumulation as the market corrected. Data from a chain aggregator suggests that Ethereum holders, specifically those with balances between 10 and 10,000 ETH, and 10,000 to 100,000 ETH, have been consistently increasing their holdings since July.

According to the graph provided, it’s evident that larger Ethereum addresses significantly increased their holdings following the low points on Monday, specifically accumulating approximately 530,000 ETH with balances between 10 and 10,000 units. In contrast, addresses containing 10,000 to 100,000 Ethereum added around 227,000 ETH starting from the 5th of August.

Photo: CryptoQuant

Ethereum (ETH) Options Expiry and Price Trajectory Ahead

Today, August 9th, approximately 206,000 Ethereum (ETH) options are due to expire. The put call ratio stands at 0.96, indicating a tight struggle between buyers (bulls) and sellers (bears). These options have a significant market value of around $560 million, with the “max pain point” being set at $2,950. This suggests a large market interest and potential influence on Ethereum’s price trends.

Continuing my previous thoughts, it seems unlikely that ETH will break through the resistance zone during its initial attempt. Therefore, I’m inclined to believe we might witness a similar pattern instead.

Contingent on $BTC rejecting somewhere between here and 69k.

— CrediBULL Crypto (@CredibleCrypto) August 8, 2024

With the Ethereum price surging significantly, analysts foresee a period of sideways movement over the coming weeks. Notably, CrediBULL Crypto, a renowned crypto trader, anticipates that Ethereum might encounter “another slight dip in its lowest point”, possibly testing the support level at $2,111. He emphasized Ethereum’s current vulnerability relative to Bitcoin as a significant factor. This implies that even a small pullback in Bitcoin could result in a more substantial drop for Ethereum.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-08-09 16:48