As a seasoned analyst with decades of experience in the cryptocurrency market, I’ve seen more than my fair share of ups and downs, bull runs, and bear markets. With Arbitrum Orbit Chains now supporting USDC for gas fees, it’s a move that could potentially attract more developers and users to the platform, particularly given the current volatility in ETH gas fees.

As a researcher exploring the dynamic world of blockchain technology, I am excited to share that users of Arbitrum orbit chains are now able to settle gas fees using USDC. This development is significant as it extends the flexibility and efficiency of layer-3 solutions built upon Arbitrum’s technological infrastructure.

Arbitrum Orbit Chains Support USDC For Paying Gas Fees

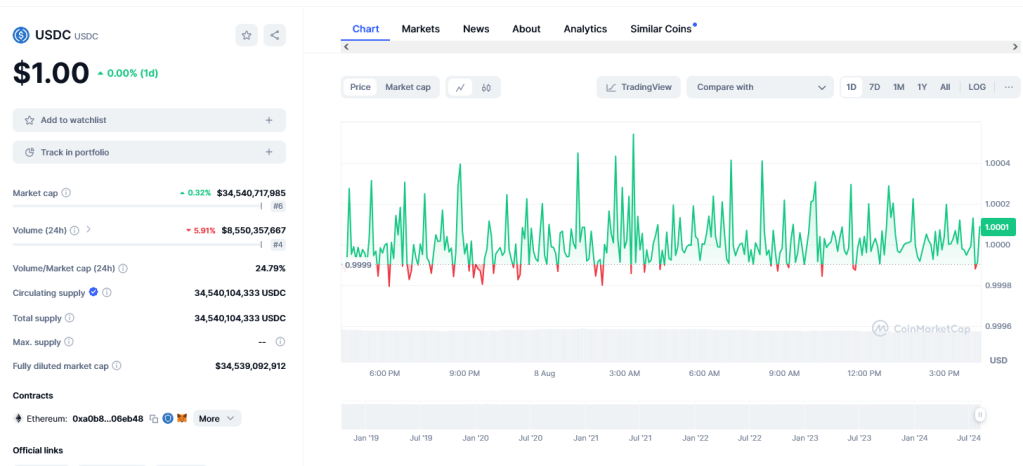

In a recent announcement, the move to incorporate USDC with reduced gas fees is intended to attract more developers and boost the platform. As of August 8th, USDC ranks among the leading stablecoins based on market capitalization. According to CoinMarketCap, Circle, the issuer of this stablecoin, has minted over $34.5 billion worth of USDC tokens, primarily on Ethereum and its layer-2 solutions.

It should be noted that USDC is also supported in other ecosystems, including Solana and the BNB Chain. Currently, over $1.6 billion USDC has been bridged to Arbitrum.

Through USDC payments for gas fees, Arbitrum offers users a way to avoid the discomfort caused by Ethereum’s common volatility. Since gas fees can vary based on demand and network congestion, they might spike significantly during peak times on the mainnet.

In my research, I’ve observed that fluctuations can have a substantial impact on user experience. Consequently, some users prefer to utilize other platforms such as Solana or Avalanche, where transaction fees (gas fees) tend to be lower compared to their original choice.

Because USDC maintains a fixed value relative to the U.S. dollar (or “greenback”), it offers stability. This consistency holds true regardless of the decentralized application employed on Arbitrum’s orbit chains. Consequently, users can anticipate gas fees more accurately, which facilitates budgeting and, crucially, financial management.

Pushing Adoption, ARB Down 80% In 8 Months

In a recent announcement, Arbitrum stated that by integrating with their platform, Orbit Chain users will no longer need to manage various tokens, thereby improving overall usability and convenience.

As an analyst, I’m excited to share that Circle has unveiled a grant initiative aimed at fostering development on Arbitrum. By offering support for projects, this move could potentially accelerate the utilization of USDC within the Orbit Chain ecosystem.

As a researcher studying the cryptocurrency market, I’ve observed that despite the integration, Arbitrum’s native token, ARB, continues to face significant selling pressure. Regrettably, as of August 8, this downward trend persists, with ARB plummeting almost 80% from its peak in January 2024.

Despite a recent period of price stabilization, as shown on the daily chart, bulls must aim for further increases beyond $0.60. Breaking cleanly above 40.80 (July highs) could stimulate increased interest. This renewed demand might sustain itself in the mid to long term.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-08-09 07:16