As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market volatility and cycles. The recent 20% drop in Bitcoin (BTC) is reminiscent of some past bearish episodes, but it doesn’t necessarily mean that we’re in for a prolonged downtrend.

Over the weekend, Bitcoin (BTC) experienced a 20% decrease, dipping below the $50,000 support point temporarily. This downward trend was mirrored throughout the crypto market, causing a 23% drop in the last three days. Despite some recent recovery, analysts remain concerned that the price declines may not have ended just yet.

Is The Bitcoin Bottom In?

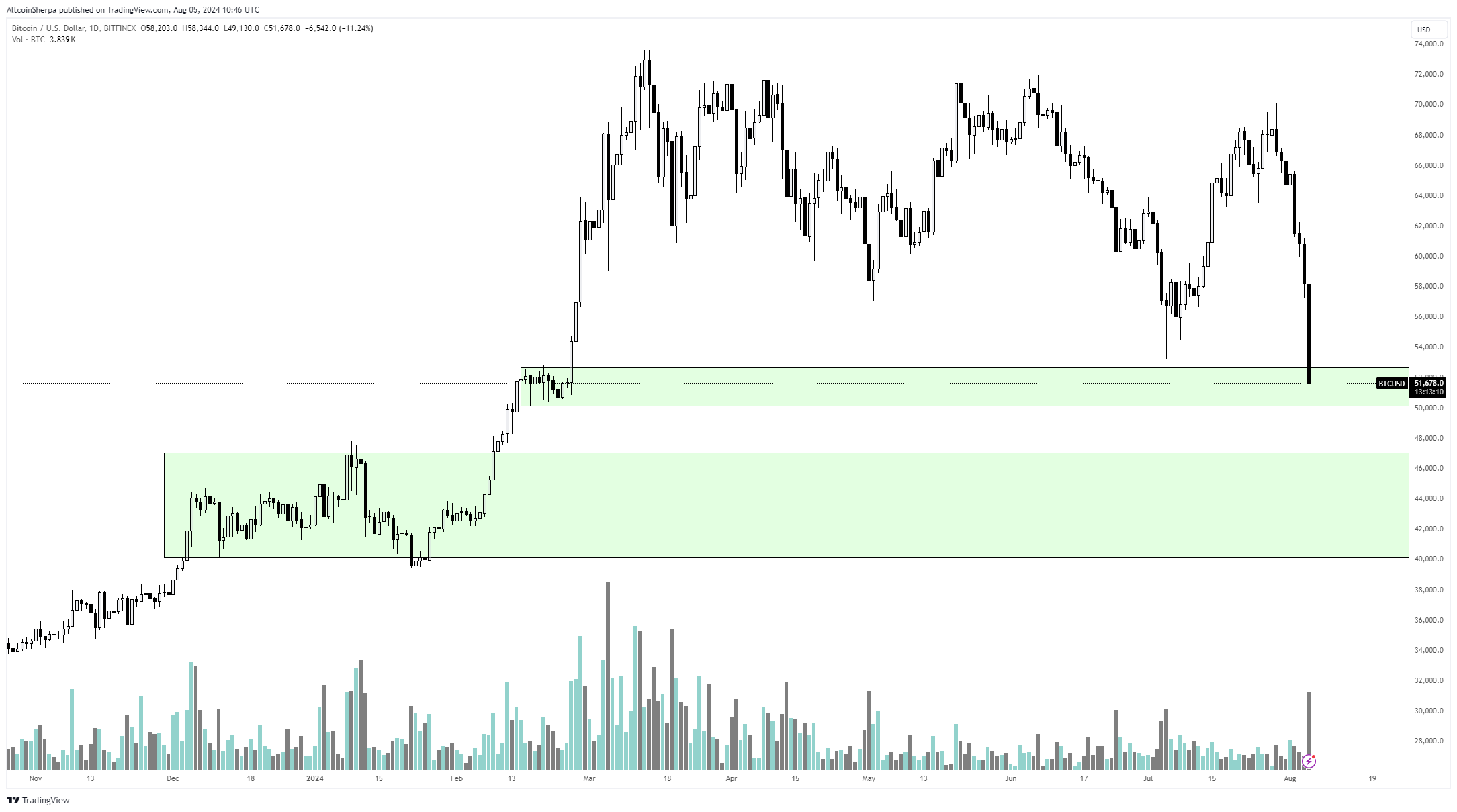

After Bitcoin fell below $50,000, crypto expert Altcoin Sherpa expressed his views about the digital currency’s performance. In his opinion, Bitcoin might have reached one of its potential lowest points during the early hours of Monday when it touched the $49,000 support level.

In light of recent developments: Bitcoin’s Relative Strength Index (RSI) Indicator Shows a Downward Trend for the First Time Since August 2023; Could this lead to a drop in value below the $40,000 mark?

According to Sherpa, the significant decrease in price to around $49,000-$50,000, which is a 17% drop within a day, might mark the lowest point. Yet, he anticipates that lower price levels could still be tested over the next few days.

As a crypto investor, I’m keeping a close eye on the market, and according to my analysis, I won’t feel fully at ease until Bitcoin’s price reaches the $40,000-$47,000 range. This area seems to have substantial support based on past trends, which is reminiscent of Bitcoin’s behavior during the 2021 rally. In other words, I believe these levels could provide a solid foundation for further price growth.

During the summer of 2021, I observed that the January consolidation area served as a significant focal point for a temporary recovery bottom. Following the dramatic sell-off during that period, reminiscent of our present situation, a bottom was gradually formed over several months.

According to Sherpa’s analysis, the January 2024 price range seems crucial to monitor. He stands firm by his earlier prediction that the market will regain momentum in Q4 2024 and carry on its growth through Q1 2025.

Following this event, predictions vary widely, but I believe we’ll be navigating through the following months and possibly into early 2025. After that challenging period, we might experience a strong recovery in Q4 of 2024 and Q1 of 2025. For now, let’s focus on making it through until then.

BTC Sees The Cycle’s Deepest Retrace Yet

As per Rekt Capital’s analysis, the most recent Bitcoin slump has marked the largest dip during this cycle. The price of BTC dipped by approximately 23% in May and around 25% in July. However, these declines have been outpaced by the latest 29% drop that occurred over the past two weeks.

In simpler terms, the crypto expert known as Crypto Bullet has shared his thoughts about Bitcoin’s recent behavior. He finds that Bitcoin’s graph resembles the market downturn due to COVID-19 in 2020, exhibiting a similar Descending Broadening Wedge trend.

According to the article, the top cryptocurrency, in terms of market value, experienced a comparable drop in March 2020 and subsequently underwent a price rebound and breakout from the pattern over the following months. In a similar fashion, BTC was tested at lower support levels within the pattern on Monday morning, potentially indicating an imminent price recovery.

Despite a seemingly challenging outlook, Crypto Jelle posits that Bitcoin’s weekly opening price is encountering significant levels. To him, Bitcoin (BTC) continues to maintain itself within the confines of a descending broadening wedge and in an area offering robust support. This performance leads him to believe that a higher close at the end of the day would be more favorable.

In summary, well-known analyst Ali Martinez posits that Bitcoin needs to regain its $54,000 support to avoid falling to $40,000. According to BTC‘s Market Value to Realized Price (MVRV) bands, the expert anticipates that if Bitcoin maintains its current price, it could challenge the $67,000 resistance level again in the near future.

As of this writing, BTC has recovered 8.8% from its fall, trading at $54,320.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- Fear of God Releases ESSENTIALS Summer 2025 Collection

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Gold Rate Forecast

- What’s the Latest on Drew Leaving General Hospital? Exit Rumors Explained

2024-08-06 09:04