As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of volatility and market swings – but the current state of the cryptocurrency derivatives market is nothing short of breathtaking.

Yesterday’s data indicates that the cryptocurrency derivative market experienced over a billion dollars in liquidations, due to a drop in Bitcoin‘s value to around $52,000.

Bitcoin Has Plunged By More Than 15% During The Last 24 Hours

On Monday’s opening, Bitcoin investors experienced quite a jolt as the digital currency plummeted by over 15%, causing its value to dip down to approximately $51,500.

The below chart shows how the recent trajectory has looked like for the asset:

Based on the chart, it appears that the recent steep drop in Bitcoin’s price is simply a speed-up of the downward trend the asset has been experiencing since the final days of July.

By the 29th, the cryptocurrency hovered near $70,000, representing a drop of over 26% within a week. This significant decrease brought Bitcoin back to its pre-February rally level. Remarkably, this point was later surpassed during the rally, reaching a new record high price all-time high (ATH).

Over the past day, Bitcoin (BTC) has struggled, but it’s been tougher for altcoins. Among the top contenders after BTC, excluding Tether (a stablecoin), Ethereum (ETH) has lost about 23%, Binance Coin (BNB) around 19%, and Solana (SOL) approximately 21%.

Given the widespread decrease in prices throughout the industry, it’s no wonder that long-term investors have suffered significant losses in the derivative market.

Crypto Liquidations Have Crossed $1 Billion, Majority Are Long Contracts

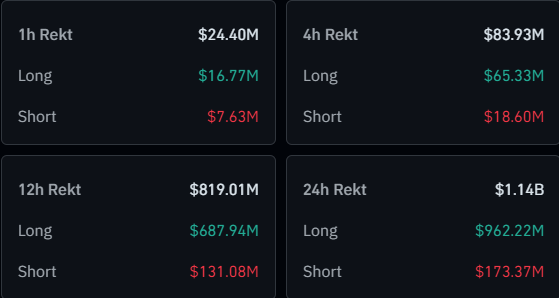

Over the last day, the unpredictability in different financial assets has led to turmoil within the derivatives market, as the data presented by CoinGlass indicates.

In this timeframe, an astounding $1.1 billion worth of cryptocurrency derivative contracts have been closed automatically due to substantial losses, with their respective platforms taking the necessary action to close them.

Approximately 85% of these liquidations were carried out by investors who held positions for a prolonged period. This is a typical outcome during a market-wide downturn.

It’s intriguing to note that even though the drop was significant, a sizable sum of $173 million in short positions were liquidated. This suggests that many investors placed their negative bets after the market crash had already occurred, indicating a substantial level of investment during the post-crash period.

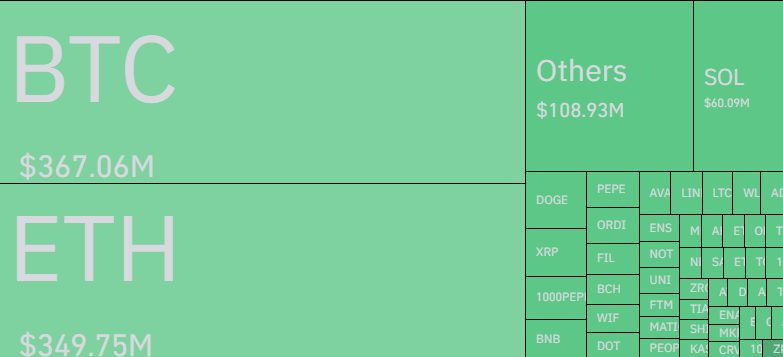

When it comes to their individual components, Bitcoin and Ethereum played almost identical roles in triggering a significant sell-off, recording liquidations worth approximately $367 million for Bitcoin and $350 million for Ethereum.

It appears that BTC maintains its lead, albeit narrowly, which is unusual. The surge in ETH‘s liquidations could potentially be due to the recent introduction of spot ETFs, causing increased focus on the second-largest cryptocurrency by market capitalization.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Best Japanese BL Dramas to Watch

- List of iOS 26 iPhones: Which iPhones Are Supported?

2024-08-06 04:34