As a seasoned analyst with over two decades of experience navigating various financial markets, I’ve seen my fair share of market fluctuations and cycles. Having witnessed the dot-com bubble burst, the global financial crisis, and the rise of cryptocurrencies, I’ve learned to approach every market shift with a blend of cautious optimism and pragmatism.

Based on current market signals, it appears that Bitcoin (BTC) could soon experience a brief recovery after undergoing heavy selling in the recent past.

A look at different market indicators suggests that the trend might be changing, but it’s important to stay cautious.

Weakening Downward Momentum

Based on the analysis of an on-chain expert named XBTManager at CryptoQuant, certain crucial signs and pointers indicate that Bitcoin might be approaching a low point following a decline of approximately 30% from its highest value at $70,000.

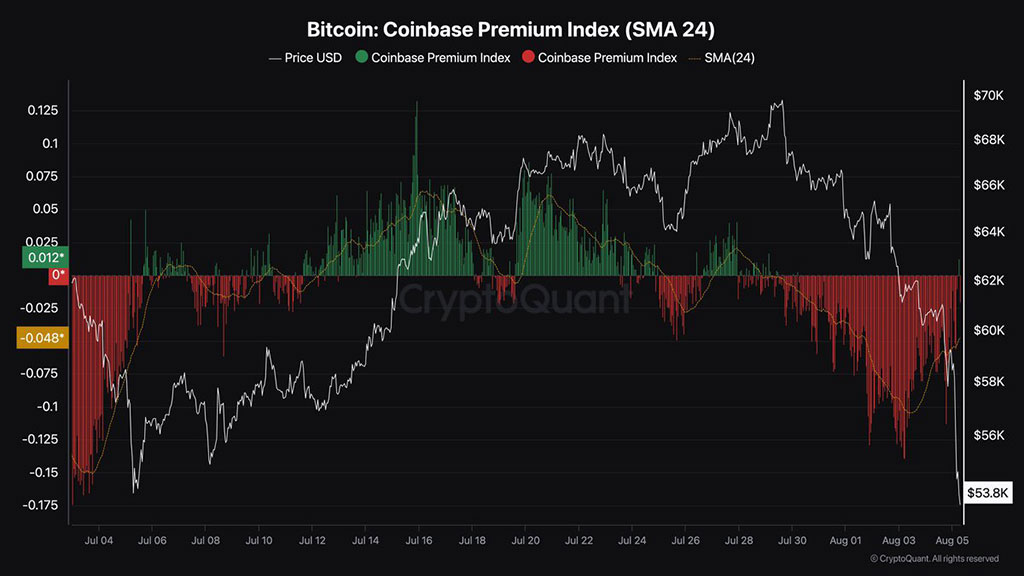

The gap between Bitcoin prices on Coinbase compared to other exchanges, as measured by the Coinbase premium index, seems to be slowing down in its descent. This change might indicate an uptick in demand, possibly hinting at an upcoming shift. However, it’s important to note that while the bottom could be near, there may still be a slight dip before a solid recovery starts.

Photo: CryptoQuant

Current Market Conditions

In simpler terms, the analysis of CVD (Cumulative Volume Delta) data indicates sustained selling pressure across various platforms like Binance and Bitfinex, suggesting oversold conditions on Binance and a slight shift towards buying on Bitfinex. However, overall, the trend leans heavily towards selling. Meanwhile, the Coinbase index points to mild selling but also hints at an uptrend, implying conflicting signals in the market.

The continuous demand for selling in the market is strong, indicating that the current downtrend might continue unless there’s a substantial market recovery. Yet, it’s worth noting that the number of open positions has reduced, implying that if buying activity picks up again, we could witness a potential shift in trend direction.

At the moment, the genuine retail-to-long Bitcoin ratio stands at 72, consistently pushing Bitcoin prices lower. This statistic suggests that individual investors are taking on more long positions than the larger “whale” investors. The difference between the two groups, known as the whale versus retail delta, is currently -5, indicating a stronger investment stance from retail investors. If whales were to increase their long positions, this imbalance could signal a change in market dynamics.

In terms of analyzing the heatmap, it’s essential to focus on the Bitcoin price movement between $50,000 and $48,000 in the upcoming stages. The heatmap suggests that once these levels are breached, a possible decline could start. Therefore, traders should adjust their positions and monitor these areas for potential signs of a recovery. Keep a close watch on these liquidity zones to gauge the possibility of a bounce back.

Broader Market Context

In simple terms, the overall financial situation can influence the fluctuations of Bitcoin’s value. The recent chaos in international stock exchanges, such as record-breaking drops in the Nikkei and substantial decreases in Nvidia stocks, suggest that we are currently experiencing increased market turbulence.

Warren Buffett’s latest move to lessen Berkshire Hathaway’s investment in Apple might intensify tension within stock markets, subtly shaping investor opinions across various asset groups, such as cryptocurrencies. In the United States, the Federal Reserve’s recent maneuvers and the speculation of an emergency interest rate reduction could potentially influence market equilibrium.

In summary, though Bitcoin’s present indicators hint at a possible brief recovery, the market continues to be unstable, showing conflicting signs. Therefore, investors are advised to exercise caution, closely watching crucial thresholds and wider market trends while dealing with this time of ambiguity.

Read More

Sorry. No data so far.

2024-08-05 15:31