As a seasoned cryptocurrency analyst with over a decade of experience in the industry, I have witnessed firsthand the challenges that Bitcoin (BTC) miners face during and after significant events like halvings. The April 2021 halving was no exception, as it led to a steep decline in miner revenues and profitability.

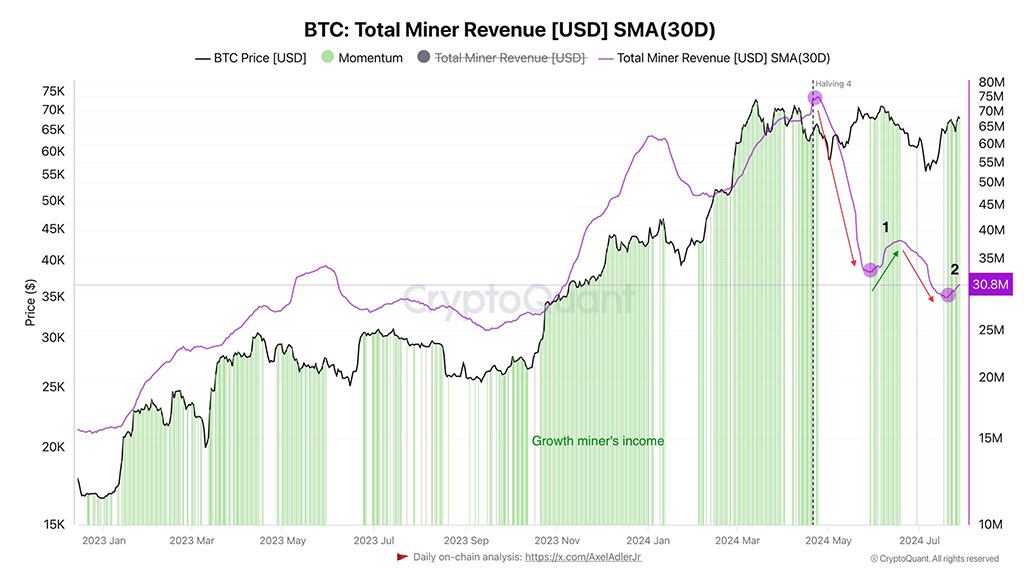

Bitcoin miners experienced a modest improvement in their profits in July, following a significant drop after the May halving event. According to CrypQuant analyst Axel Adler’s assessment, the daily revenue for Bitcoin mining surpassed $30 million in July, up from its highest point of $74 million recorded in May.

Photo: CryptoQuant

From a different viewpoint, miners currently receive 3.125 Bitcoins as reward for each new block they mine, in contrast to the 6.25 Bitcoins they used to get prior to the April halving event. This comparison excludes any transaction fees they might earn.

Although BTC miners experienced a notable increase in their average daily revenue, surpassing the $30 million mark, a significant number of them were still operating at a loss based on current market conditions.

BTC Miners Could Be Profitable Soon

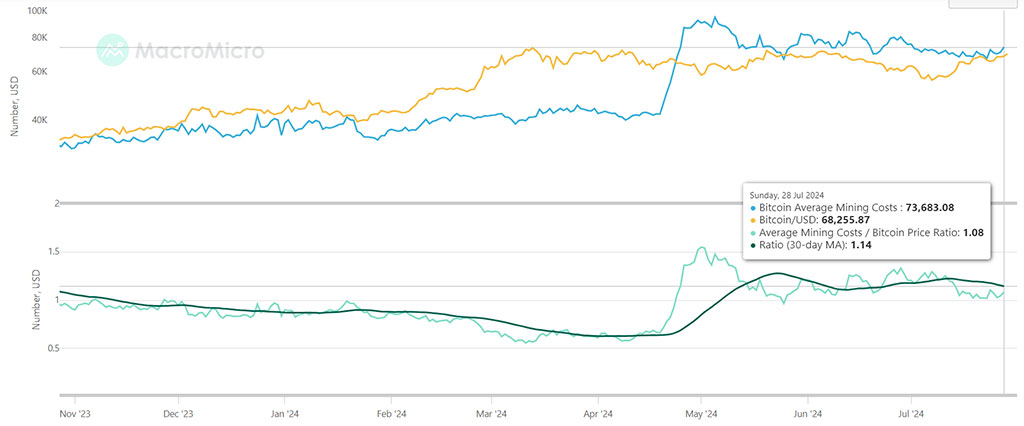

It’s worth noting that since the Bitcoin halving in April, profits for miners have become a challenge due to increased expenses. According to MacroMicro’s data, the typical mining costs have surpassed the Bitcoin price in the ensuing months.

Photo: MacroMicro

It’s intriguing to note that the difference between Bitcoin mining costs and prices narrowed in May, only to widen again in June. However, by July, this difference had significantly shrunk, indicating that Bitcoin miners might once again be approaching profitability.

On July 29th, it cost an average of $73,600 to mine a Bitcoin, while the cryptocurrency’s market value was priced at $68,200. This signified a loss of approximately $5,400 per Bitcoin mined that day, taking into account expenses related to mining equipment usage and energy expenditure.

As a crypto investor, I can tell you that some miners are facing financial difficulties and might be compelled to sell their earlier Bitcoin (BTC) holdings in order to meet their operational costs. If an increasing number of miners were to follow this course of action, it could potentially lead to a surge in the supply of Bitcoin on the market, putting downward pressure on BTC prices.

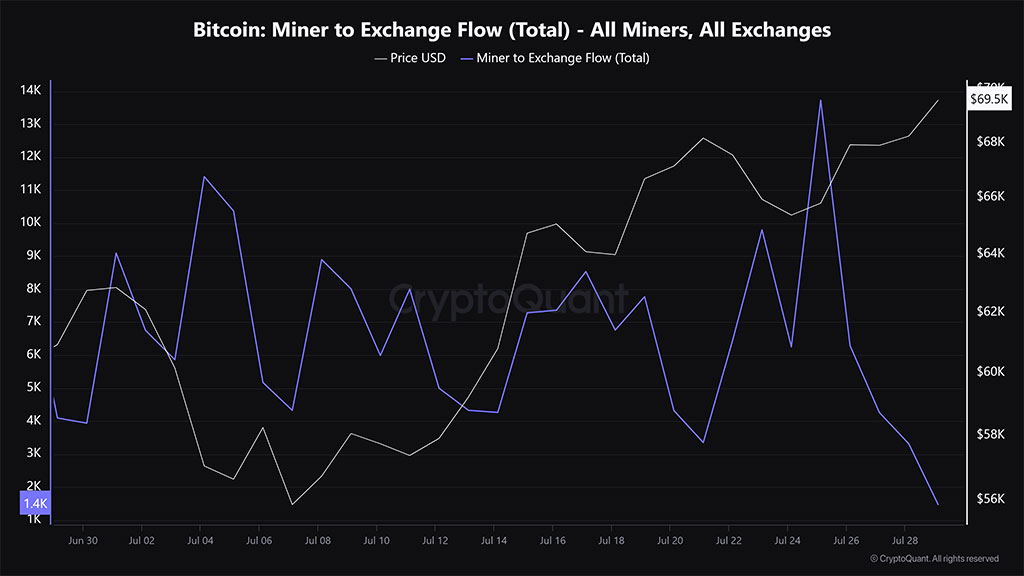

The miner-to-exchange transfer rate indicates that a larger amount of Bitcoin mined is being transferred to trading platforms by miners for potential sales. A surge in this measurement may signal impending Bitcoin sell-offs from miners, potentially leading to a decrease in its market price.

Photo: CryptoQuant

As a crypto investor, I would interpret a decrease in the number of Bitcoins held on exchanges by miners differently. Rather than viewing it as a cause for concern, I see it as a positive sign. This reduction suggests that miners are withdrawing their BTC from exchanges, which in turn indicates less sell pressure. Consequently, this situation can be considered bullish for Bitcoin as it reduces the amount of available Bitcoin supply on the market, potentially leading to increased demand and price appreciation.

The chart from CryptoQuant shows that the trend has repeated itself, as indicated by a gradual decrease in Miner to Exchange Flow from July 1st to July 20th. This decline coincided with a rally in Bitcoin’s price, which regained $60,000 and rose above $66,000, providing some relief.

From July 20 to 24, there was an increase in the metric, which led Bitcoin (BTC) to retreat briefly as miners sold a larger amount of their holdings on exchanges. However, the flow of miners’ Bitcoin to exchanges has significantly decreased since last Friday, indicating a bullish trend for BTC as it reached $69K. Currently, miners collectively possess about 1.81 million BTC, worth over $124 billion according to current market prices. This substantial reserve can significantly influence the price of Bitcoin.

New information indicates that Bitcoin miners may soon become profitable once again and are holding onto their cryptocurrency instead of selling. This development could potentially provide a boost for Bitcoin’s price as it tries to advance further.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-07-29 14:29