As a seasoned crypto researcher with years of experience analyzing market trends and price patterns, I find the predictions made by Trader Tardigrade and Ali Martinez regarding Bitcoin’s future price movement intriguing. Based on my understanding of technical analysis and chart patterns, I agree that Bitcoin’s current Cup with Handle pattern could potentially lead to a significant rally to $263,000 if the resistance at $68,000 is breached.

An analyst specialized in cryptocurrencies has forecasted that Bitcoin, the leading digital currency, could potentially hit an unprecedented peak of $263,000. Nonetheless, he underscored that this bullish trend toward new record highs hinges on Bitcoin fulfilling certain market requirements.

Bitcoin Set For Massive Rally To $263,000

On July 23rd, in a post previously published on X (formerly Twitter), anonymously referred to crypto analyst named ‘Trader Tardigrade’ pointed out that Bitcoin’s price chart presented a significant technical figure called the “Cup and Handle formation.” This specific pattern is characterized by the price action of a cryptocurrency often mirroring the shape of a cup, followed by a minor correction or pullback resembling a handle. Historically, the emergence of this handle serves as a signal for potential investors to consider purchasing the asset at an opportune moment.

According to Trader Tardigrade, who presented a Bitcoin price chart displaying the Cup with Handle pattern, there’s a strong possibility that Bitcoin could experience a significant rally reaching $263,000 by the end of 2024. This bullish forecast hinges on Bitcoin surpassing the resistance level of $68,000 – the handle part in the Cup with Handle chart pattern.

In a recent X post, the crypto analyst indicated that Bitcoin’s price had touched the upper limit of its descending channel. This channel is formed by two trend lines that slope downward and enclose the price movements of a cryptocurrency. Normally, the upper trend line functions as a resistance level, while the lower one serves as a support.

The analyst pointed out that Bitcoin’s price had touched the upper limit of its downward trendline. Yet, he revealed that this barrier was less robust than the underlying support, increasing the likelihood that Bitcoin could surpass it.

As a crypto investor, I believe Bitcoin may experience a short-term pause in its price action, leading to a consolidation phase. However, I’m optimistic about the market’s current bullish trend and anticipate that Bitcoin will continue to rise significantly, reaching new heights by late 2025.

Key Support Level Identified For Bitcoin’s Next ATH

The price of Bitcoin is presently at $64,239 on the markets, representing a modest 3.11% drop over the past 24 hours, as indicated by CoinMarketCap. Despite Bitcoin’s recent challenges in setting new records, crypto analyst Ali Martinez continues to express optimism regarding its long-term prospects.

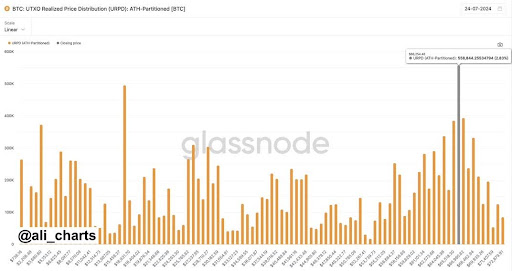

Martinez anticipates that Bitcoin, as depicted in the UTXO realized price distribution chart I’ve shared, is primed for reaching unprecedented peak prices imminently.

The analyst revealed that the $66,000 price point held significance for Bitcoin’s price stability. Should Bitcoin manage to maintain its value around this amount, it could pave the way for further gains and potentially higher prices.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-07-26 05:10