As a seasoned crypto investor with several years of experience under my belt, I’ve learned to pay close attention to on-chain data and whale activity when making investment decisions. The recent accumulation of Ethereum (ETH) by whales, as evidenced by the data from IntoTheBlock and Santiment, has piqued my interest.

Large-scale Ethereum investors, referred to as “whales,” have been actively purchasing large quantities of Ether tokens, according to on-chain analytics. This buying spree occurs during a downward trend in ETH‘s market price. Previous trends indicate that ETH could experience further price decreases in the near future.

Whales Accumulate More ETH

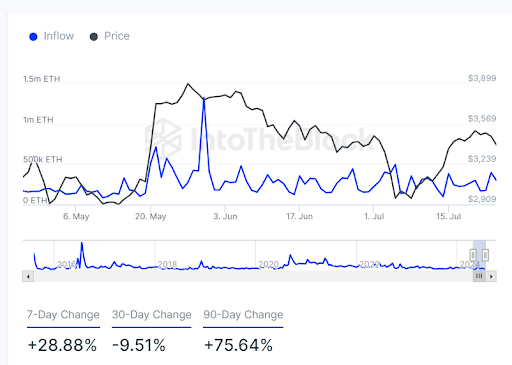

According to the market intelligence platform IntoTheBlock, Ethereum whales purchased approximately 297,670 ETH, equivalent to $1 billion, on July 24th. Notably, they had bought nearly 400,000 ETH the day prior. Moreover, there has been a significant rise of over 28% in the amount of Ether flowing into these whales’ wallets within the past week.

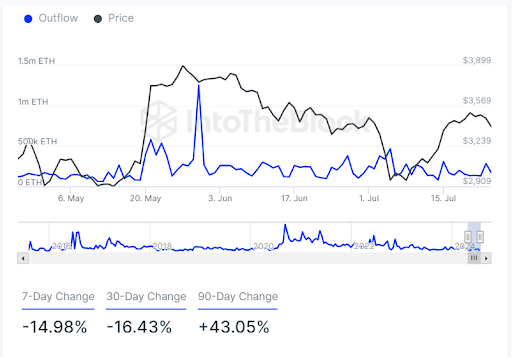

As a crypto investor, I’ve noticed that the decrease in withdrawals from Ethereum addresses is a clear indication of the unwavering optimism among investors towards this digital asset. Despite its recent underperformance, outflows have dropped by more than 14% over the last week and over 16% in the past month. This trend suggests that these investors remain confident in Ethereum’s long-term potential.

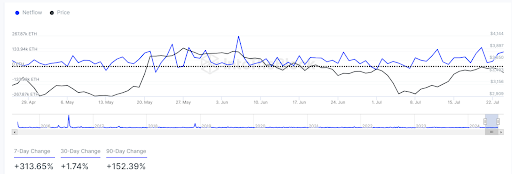

On IntoTheBlock, the substantial increase in netflow for Ethereum’s large-scale investors is indicated by the metric. Specifically, there has been a rise of over 313% in net flows. This signifies that these investors are actively buying up Ethereum rather than offloading their holdings.

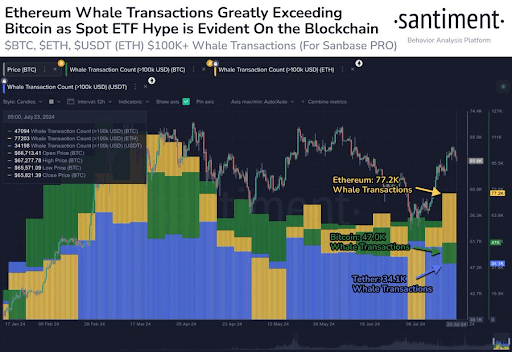

According to Santiment’s analysis, the surge in whale-sized ETH transactions can be attributed to the recent debut of Spot Ethereum ETFs on July 23. The analytics platform highlighted that since July 17, the value of ETH transfers has exceeded $100,000, marking a 64% increase compared to Bitcoin transfers and a staggering 126% surge relative to USDT transfers on the Ethereum network.

It’s no wonder that Ethereum whales have been hoarding Ethereum tokens in preparation for potential price increases, as analysts like RLinda had predicted a bullish outlook for ETH with the upcoming launch of Spot Ethereum ETFs. These funds were expected to boost Ethereum’s value and potentially push it up to $4,000.

The Spot Ethereum ETFs Launch Might Be A Headwind At First

The anticipated launch of Spot Ethereum ETFs could potentially trigger a significant surge in ETH‘s value. Yet, history indicates these funds might initially dampen Ethereum’s price growth, much like Bitcoin experienced following the arrival of Spot Bitcoin ETFs earlier this year.

Bitcoin underwent substantial price drops, primarily due to sizable withdrawals from Grayscale’s Bitcoin Trust (GBTC). A comparable scenario is emerging for Ethereum with Grayscale’s Ethereum Trust (ETHE). Notably, ETHE recorded a net withdrawal of $484.1 million on its first day of trading, which dwarfs the net withdrawals GBTC experienced during its initial day. Despite ETHE being smaller than GBTC in size.

Based on the information provided, it seems that Grayscale’s Ethereum Trust (ETHE) could lead to substantial selling pressure for Ethereum. According to Farside Investors data, there was a net withdrawal of approximately $326.9 million from the Spot Ethereum ETF on July 24. This outflow may be just the beginning of larger withdrawals from the fund that could negatively impact Ethereum’s price.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Green County map – DayZ

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

2024-07-25 20:10