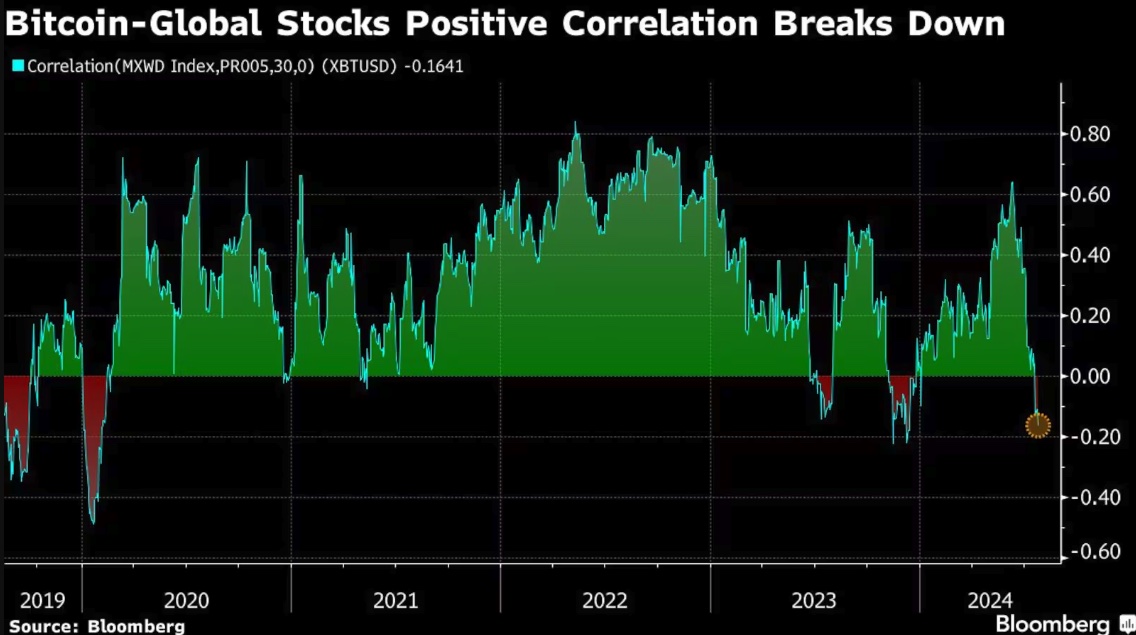

As a seasoned crypto investor with a decade of experience in the market, I’ve seen my fair share of price swings and regulatory developments that have impacted the value of my digital assets. The recent divergence between Bitcoin and global equities, as highlighted by the falling co-efficient between the two, has piqued my interest.

The way Donald Trump is promoting his electoral campaign and increasingly supporting Bitcoin and cryptocurrencies is contrasting with the trend in global stock markets.

According to Bloomberg’s data, the correlation coefficient between Bitcoin and the MSCI index for global equities over the past 30 days is approaching -0.20. This is an unusual development as this measure has generally been positive since the beginning of 2020. A correlation coefficient of 1 indicates that Bitcoin and global equities move in perfect alignment, while a reading of -1 implies they move in opposite directions.

Photo: Bloomberg

The second-quarter earnings reports have begun with inconsistent results, causing uneasiness in the global stock market. Market participants are eagerly looking for signs that the current bull run, driven primarily by advances in artificial intelligence and tech industries, will persist.

In his presidential campaign, Donald Trump has strongly endorsed Bitcoin and the cryptocurrency market. He has even pledged to advocate for the Bitcoin mining sector if he is re-elected. To further demonstrate his commitment to the crypto industry, President Trump will attend the Bitcoin Conference 2024, which takes place later this week.

The odds of the Republican Party’s nominee winning the upcoming November election are high according to betting markets. Consequently, investors are buying Bitcoin in anticipation of a potentially friendlier US regulatory landscape under a Republican administration. As reported by Sean McNulty, director of trading at Arbelos Markets.

“Bitcoin currently serves as a stand-in for the anticipation of a Trump victory. Conversely, when it comes to stocks, there aren’t any definitive winners or losers in relation to a ‘Trump trade’.”

Alternatively, Vice President Kamala Harris is making efforts to bridge the divide between her role and the crypto sector. It’s been reported that she will attend the Bitcoin conference; nevertheless, her office has not yet verified this information.

Bitcoin Price Action Going Ahead

Amidst the significant distribution of Bitcoins to Mt. Gox creditors, the Bitcoin price has experienced some selling pressure, causing it to dip below $66,500 as reported at press time. However, according to CryptoQuant CEO Ki Young Ju, there hasn’t been a noticeable increase in hourly spot trading volume or Bitcoin outflows on Kraken since then. While keeping a close eye on the Asian trading session is essential, the current indicators show promising signs.

Correction occurred due to Mt.Gox issue, reaching the defense line of 1-3 month holders

Due to this development, the Bitcoin price has dropped momentarily and now hovers near the $66,700 mark. Notably, this price level is quite close to the typical buying price of $66,500 for individuals holding Bitcoins for one to three months.

If that…

— CryptoQuant.com (@cryptoquant_com) July 23, 2024

According to CryptoQuant’s analysis, the $66,500 level is a significant support for Bitcoin (BTC). On average, this price point has been where BTC buyers have entered the market over the past three months. If the Bitcoin price does not regain this level, there is a risk that it could drop down to $63,600 instead.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-07-24 14:03