As a seasoned financial analyst with a deep understanding of the crypto market, I have closely followed the developments surrounding Ethereum Exchange-Traded Funds (ETFs) and their potential impact on both Ethereum (ETH) and Altcoins. Having witnessed the launch and subsequent performance of Bitcoin (BTC) ETFs, I am excited to observe how this new development unfolds.

After much anticipation, Ethereum‘s long-delayed Exchange-Traded Funds (ETFs) have officially launched, recording more than $100 million in trades within the initial 15 minutes. The financial community eagerly watches to see how this debut will influence the crypto market. Some industry analysts even speculate that the success of Ethereum ETFs could mark the beginning of a new altcoin boom.

Ethereum Spot ETFs Are Officially Live

On Monday, the SEC granted its final blessing for Ethereum spot ETFs, with a launch slated for Tuesday, July 23. However, after the announcement, concerns among investors emerged based on certain media reports.

According to Whale Alert, Grayscale shifted over a billion dollars worth of Ethereum from their holdings to Coinbase Institutional. This move raised concerns among investors, who worried that the transfer could result in increased selling activity for Ethereum and potentially impact its price behavior prior to its upcoming launch.

ETF specialist Eric Balchunas provided some reassurance to investors regarding Grayscale’s recent transfer of 292,262 Ethereum tokens. He explained that the tokens were moved from the Grayscale Ethereum Trust ($ETHE) to its equivalent product, the Grayscale Ethereum Fund ($ETH). Balchunas regarded this as a new factor in the ongoing competition that wasn’t present during the Bitcoin race.

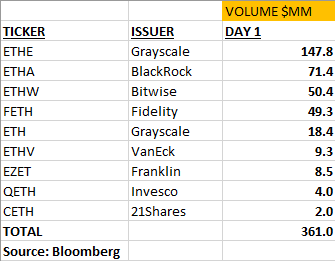

Now that the eagerly awaited items have gone live, the preliminary figures have been made public. According to Balchunas’ X post, Ethereum ETFs recorded a trading volume of $112 million in the initial 15 minutes. This amount grew to a total of $361 million after 90 minutes.

As a researcher examining the cryptocurrency market, I’d describe it this way: The Bloomberg analyst commended the substantial trading activity, referring to it as a “robust performance” despite only accounting for 20-25% of Bitcoin ETF transactions. Nevertheless, Ethereum (ETH) continues to fluctuate within the price bracket of $3,440 and $3,540.

Are ETH And Altcoins About To Take Off?

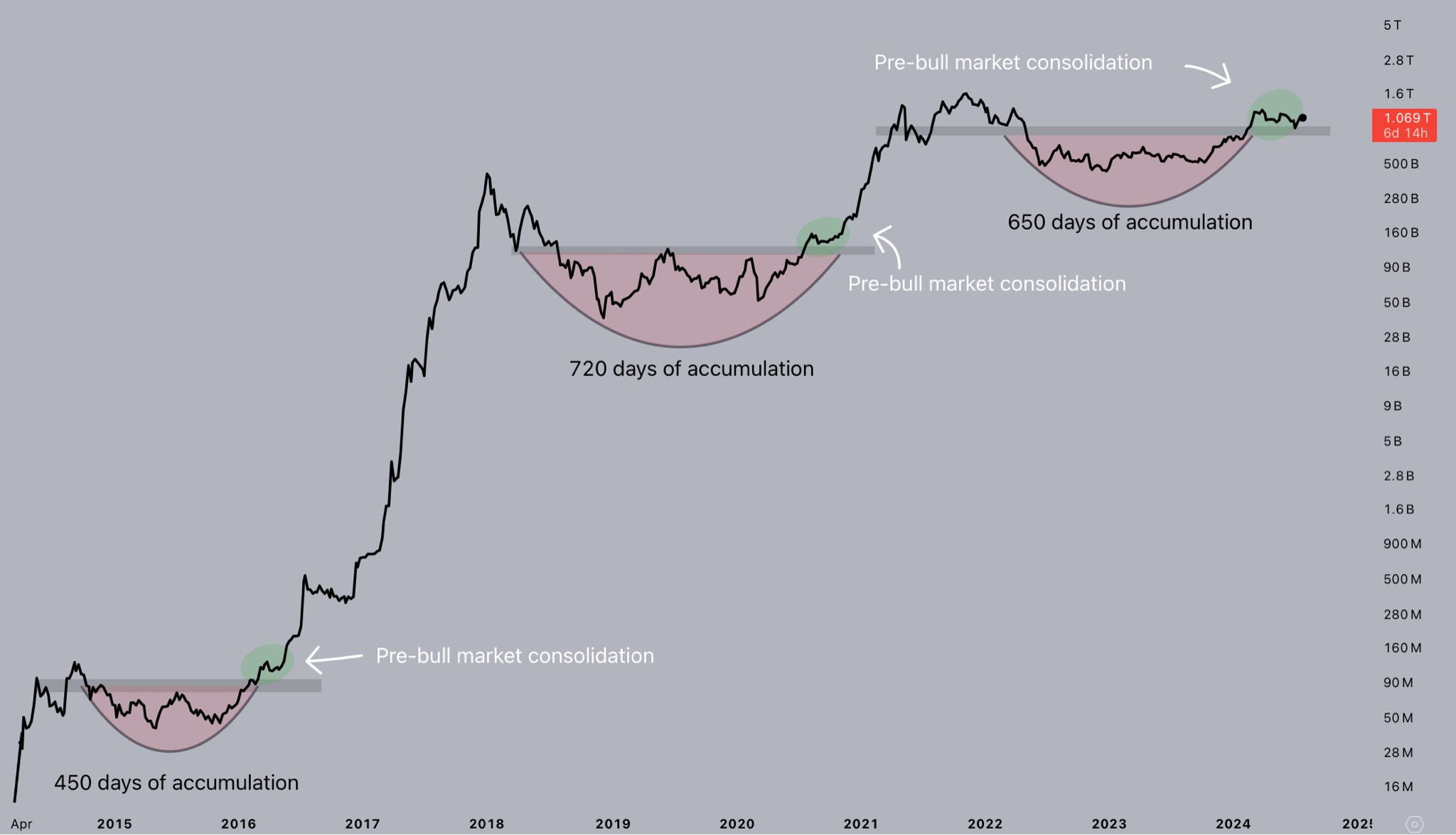

Prior to the ETFs’ debut, certain market observers predicted that their strong showing could spark a resurgence for Altcoins. Based on the analysis of several experts, the Altcoins’ price charts exhibit resemblances to the 2016-2017 trend, implying that an “Altseason” may be in the making.

To Crypto Jelle, “Altcoins are adhering to the standard script of a traditional bull market.” According to the large-scale graph, altcoins have exited their consolidation phase and have been bouncing around significant support thresholds as they have in past market upswings.

In simpler terms, before the cryptocurrency market experienced significant growth (bull market), there was a period of price stabilization or consolidation. Jelle noted that many altcoins are presently in this stage, much like they have been during past market cycles. He further anticipates that following the upcoming launch of Ethereum ETFs, a new wave of growth could emerge relatively soon.

MikyBull, a seasoned crypto trader, has drawn attention to the striking resemblances between past market cycles, indicating that an impressive “altcoin season” is on the horizon. Despite recent market fluctuations that may have led some investors to believe otherwise, MikyBull anticipates a powerful surge in altcoins, reminiscent of the explosive growth seen in 2017.

The trader believes that Ethereum’s price could significantly increase in the upcoming months due to the positive impact of ETH spot Exchange-Traded Funds (ETFs). He has predicted a price target of $10,000 for Ethereum based on this expected performance.

Market observers advised investors to stay calm if there’s a price decline, with Moustache, a pseudonymous analyst and trader, advocating for patience as he believed “it’s just a matter of time” until the market recovers. He drew parallels between the current Ethereum chart and its appearance during the last cycle before the altcoin bull market commenced.

At present, the crypto market’s second largest currency is priced at $3,419 – a decrease of 1.1% over the past 24-hour period.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Japanese BL Dramas to Watch

2024-07-24 11:10