As a seasoned researcher with extensive experience in the crypto market, I’ve witnessed numerous price fluctuations and liquidation events over the years. The recent Bitcoin rally, which saw the asset surge from $53,000 to above $66,000 before retracing to its current trading price of $64,433, was no exception.

Bitcoin‘s price experienced a significant surge over the past few days, recovering from a low of around $53,000 last week to reach highs above $66,000 in the early hours of Wednesday. However, it has since pulled back and is currently trading at approximately $64,433.

I’ve experienced firsthand how the recent bullish price surge in the crypto market has resulted in rough waters for around 50,436 traders today. According to data from Coinglass, this unfortunate group of investors has faced significant liquidations, causing the total amount of liquidated funds to reach a staggering $145.58 million.

Bitcoin traders experienced significant losses as approximately $46.22 million was distributed between short and long positions, reflecting Bitcoin’s uncertain price direction over the last 24 hours.

Bitcoin: Bigger Liquidations Incoming

Recent trading activity has resulted in significant losses through liquidations, amounting to millions of dollars. However, if Bitcoin keeps climbing and reaches new record highs, the situation could worsen substantially, potentially leading to billions of dollars in liquidations.

According to MartyParty, a well-known figure in the cryptocurrency sphere, if Bitcoin’s value reaches $72,400, there will be significant repercussions. Approximately $19 billion worth of short positions on Bitcoin would be triggered for liquidation at this price level.

Marty Party shared on Elon Musk’s social media X that he obtained data from Coinglass, concluding his post with the observation: “Always keep in mind not to underestimate the power of technology.”

How Long For This Liquidation To Occur?

The $72,400 price point could appear far from today’s Bitcoin market value, but considering the present market dynamics, it may not take too long for BTC to reach that level. This is because significant liquidity exists at this price point, which could potentially accelerate the ongoing trend.

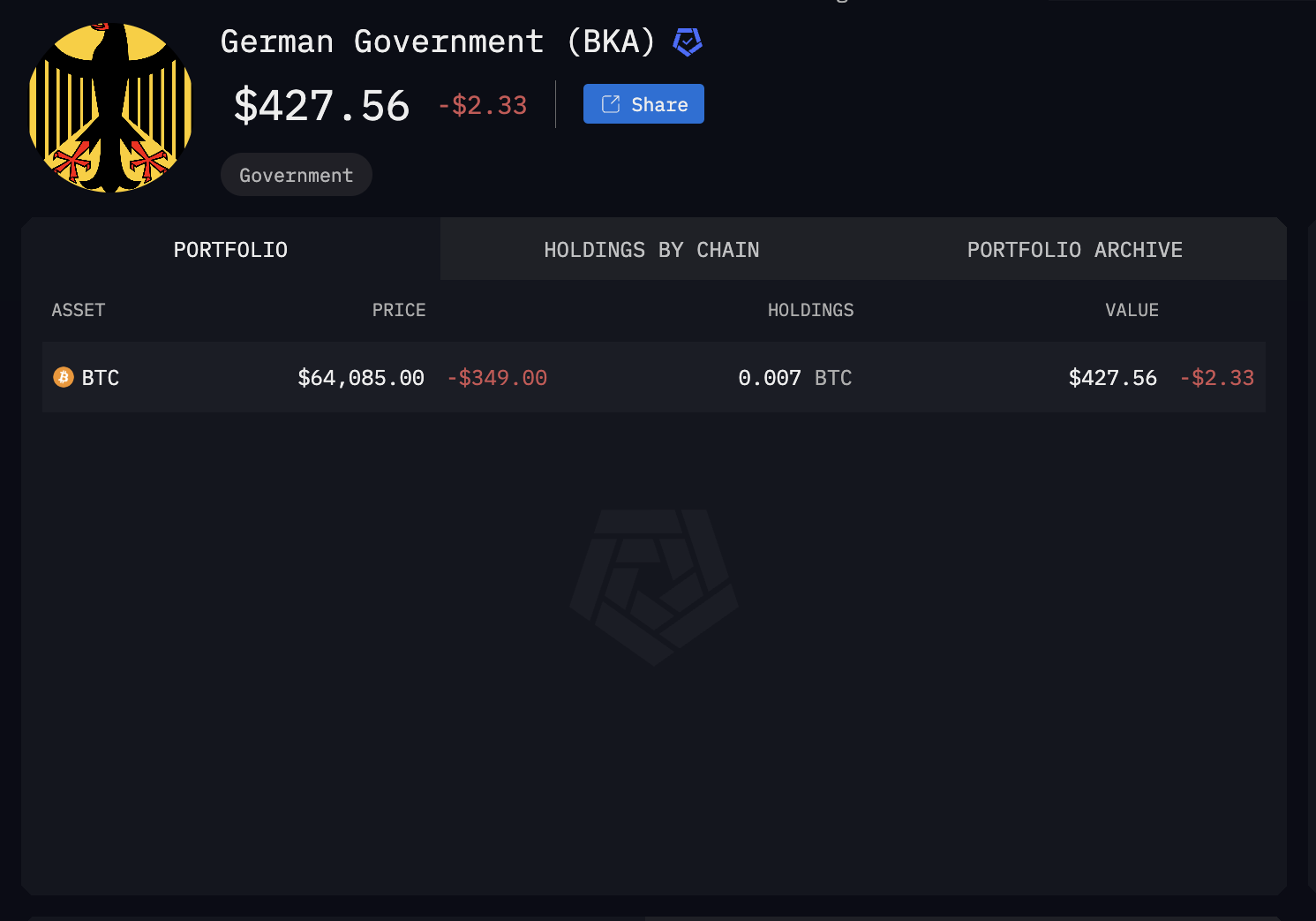

Besides that, no bears are presently obstructing the asset’s advancement towards its goal in the near term. Initially, the German government has liquidated approximately 49,858 BTC from its holdings, which currently have a value under $500 based on data from Arkham Intelligence.

Significantly, the present total of around 427 dollars in Bitcoin represents the accumulated satoshis (bitcoin’s smallest units) given from various digital wallets. Moreover, based on current information from CryptoQuant, approximately 36% of Mt. Gox’s Bitcoin has been redistributed to its creditors.

Despite the uneven distribution, Bitcoin’s price has yet to experience a significant decrease. This observation implies two possible scenarios: first, that the creditors are holding back from selling, and second, that the Bitcoin market is swiftly absorbing any sales, as suggested by the slight levelling off of Bitcoin’s price.

The significant sell-offs by the German government and Mt. Gox, once perceived as major risks to the cryptocurrency market, now appear to have limited influence. This suggests that no substantial bearish factors are holding Bitcoin back from reaching $72,400, potentially leading to a short squeeze.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- POPCAT PREDICTION. POPCAT cryptocurrency

2024-07-18 09:04