As a seasoned researcher with extensive experience in the cryptocurrency market, I have closely followed Ethereum’s (ETH) price action and its relative performance to Bitcoin (BTC) over the years. The upcoming launch of spot Ethereum ETFs has instilled a sense of optimism in me regarding Ethereum’s future market performance.

With the approaching debut of the Ethereum-based ETF for institutional investors, there’s growing interest in the Ethereum market and its price trends. According to Kaiko’s recent analysis, there’s a strong sense of enthusiasm about Ethereum’s potential future growth.

As an analyst, I believe that Kaiko’s prediction holds merit. The upcoming launch of spot Ethereum ETFs within the next two weeks could potentially result in Ethereum outperforming Bitcoin. Furthermore, this development is likely to catalyze broader market momentum, ultimately leading to increased institutional inflows.

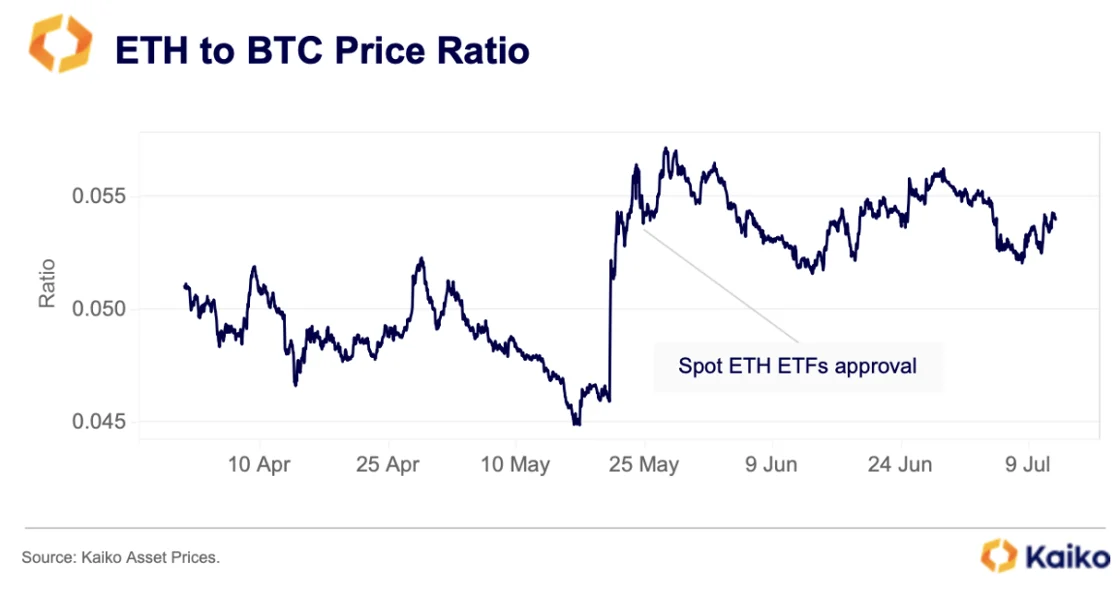

The Kaiko Research report highlights Ethereum’s market comparison with Bitcoin as its main topic. After the acceptance of Ethereum spot ETF 19b-4 applications on May 23, the ETH-to-BTC ratio significantly increased from 0.045 to 0.050.

The significance of this ratio as a key benchmark between the two investments implies that Ethereum may experience further growth, perhaps even more so with the arrival of Ethereum-based ETFs.

Photo: Kaiko

In the aftermath of the crypto market downturn, the Ethereum price plummeted to hit a low of $2,700. Yet, as the broader market recovers, Ethereum’s price has rebounded and is now hovering around $3,400.

Despite the typical drop in Ethereum (ETH) trading volumes during summer, Kaiko noted that the liquidity situation as a whole has remained constant.

The market depth for Ethereum, which is currently around $230 million and has remained stable since the approval of the spot ETFs, signifies the quantity of Ethereum that can be transacted close to its latest trading price without causing a noticeable price shift.

In its final analysis, Kaiko observed that the introduction of a spot Ethereum ETF might enhance Ethereum’s market liquidity. Furthermore, this development could potentially lead to more stable Ethereum prices in the long run.

Ethereum has been successful in drawing the interest of conventional investors for quite some time, thanks to its advanced smart contract feature and the substantial collection of decentralized apps (dApps) it supports.

Spot Ethereum ETFs Coming on July 23

As a researcher, I’ve come across Eric Balchunas’ prediction that the Ethereum ETF is expected to debut on Tuesday, July 23rd, according to his role as senior ETF analyst at Bloomberg. Additionally, he anticipates submitting the final S-1 forms this Wednesday.

From my experience as a crypto investor, I’ve noticed that the support for Ethereum ($ETH) was identified at the lower boundary of a rectangle pattern that had been forming over the past 4 months. This level represented a retest of the completion point of a “horn” bottom formation, which emerged during February. If this bullish pattern continues to unfold, the upside target for Ethereum could reach and even surpass the $5600 mark.

— Peter Brandt (@PeterLBrandt) July 15, 2024

Based on the current timeline and considering my analysis as a market observer, I anticipate that the Ethereum (ETH) price will continue its upward trend, potentially reaching $4,000 by the end of July. According to technical chart interpretations from experienced trader Peter Brandt, there is an expectation for ETH to surge even higher, possibly up to $5,600.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Green County secret bunker location – DayZ

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- POPCAT PREDICTION. POPCAT cryptocurrency

2024-07-16 13:55