As a researcher with a background in cryptocurrencies, I find Jamie Coutts’ analysis intriguing, especially his focus on the slowdown of Bitcoin’s hashrate decline and its potential implications for the market. Based on my own experience and observations, this trend aligns with previous market cycles where hash rate contractions have preceded bullish reversals. However, it is essential to note that a bullish reversal still depends on a stabilization in the downtrend.

As a crypto investor following the insights of Jamie Coutts, the chief crypto analyst at Real Vision, I’m excited to share that an optimistic signal has emerged for Bitcoin (BTC) according to an indicator he’s emphasized. This bullish sign might indicate that a reversal from the current trend is imminent for the leading cryptocurrency.

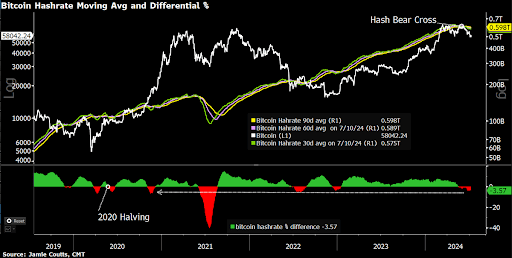

Bitcoin Hashrate Decline Is Slowing

In a recent X post (previously known as Twitter), Coutts indicated that Bitcoin’s hash rate decrease is beginning to level off. This trend, according to him, typically signals the approach of a bottom and potential reversal of the bearish cross following significant events like the halving. Nevertheless, Coutts cautioned that a bullish turnaround remains uncertain until there’s a clear halt in the downtrend.

As a researcher studying cryptocurrencies, I’ve observed that the gap between Bitcoin’s 30-day and 90-day moving averages closely mirrors past hash rate contractions. The current difference isn’t as drastic as what we witnessed following the 2020 halving. This less pronounced decline in Bitcoin’s hash rate is noteworthy because it could be a sign that miners’ capitulation might soon come to an end.

Crypto analyst Willy Woo predicted that the market would bounce back once “inefficient miners exit the scene,” allowing the hash rate to rebound. He elaborated by stating that less productive miners would be pushed into insolvency, while their competitors would be compelled to upgrade their equipment.

Ki Young Ju, CEO of Cryptoquant, has shared his expertise on when the current miner sell-off may come to an end. Typically, he explained, this trend concludes when the daily average value of cryptocurrency mined is only 40% of the yearly average. At present, the figure stands at 72%, implying that miners might continue offloading their reserves for some time yet, as they are currently far from reaching the threshold that usually signals an end to such selling pressure.

Ki Young Ju advised market players about a potential dullness in the crypto markets for the upcoming two to three months. He recommended maintaining a long-term bullish stance while exercising caution against unnecessary risks. Crypto analysts such as Mikybull Crypto share the belief that Bitcoin’s future trend is bullish, with the cryptocurrency yet to reach its peak during the bull market.

Market Still Recovering From Supply Overhang

Coutts pointed out that the Bitcoin market is currently in the process of bouncing back from an oversupply issue. This situation stemmed from the German government selling approximately 50,000 BTC on the market, causing increased selling pressure. Consequently, it may take some time before all this Bitcoin is absorbed by the market.

Although the selling pressure from the German government and Mt. Gox reserves has put downward pressure on the market, Coutts believes that disseminating these coins to a larger pool of owners can alleviate the bothersome surplus. By broadening the ownership base, the Bitcoin network will expand, making the primary cryptocurrency stronger and more robust than before.

Currently, Bitcoin is priced approximately at $58,300 based on data from CoinMarketCap, representing a 2% increase in value over the past 24 hours.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

2024-07-14 04:34