As an experienced analyst, I believe that the recent trend of Chainlink (LINK) tokens leaving centralized exchanges in large quantities is a significant development worth paying attention to. Based on the data from IntoTheBlock and Santiment, it appears that investors are adopting a long-term holding strategy, potentially indicating a shift in sentiment towards LINK’s future potential.

As an analyst, I’ve noticed that Chainlink’s price has faced significant challenges over the past few weeks, reflecting the broader market’s stagnant state. Surprisingly, investors remain optimistic about this altcoin, choosing to maintain their trust instead of being disheartened by the recent sluggish price movements.

Based on recent on-chain insights, it seems that investors are adopting a long-term perspective when it comes to holding Chainlink (LINK). Their focus is on the potential future growth of the token. Given this shift in investor behavior, there’s a possibility that the LINK price could experience a rally.

$110 Million Worth Of LINK Leave Centralized Exchanges

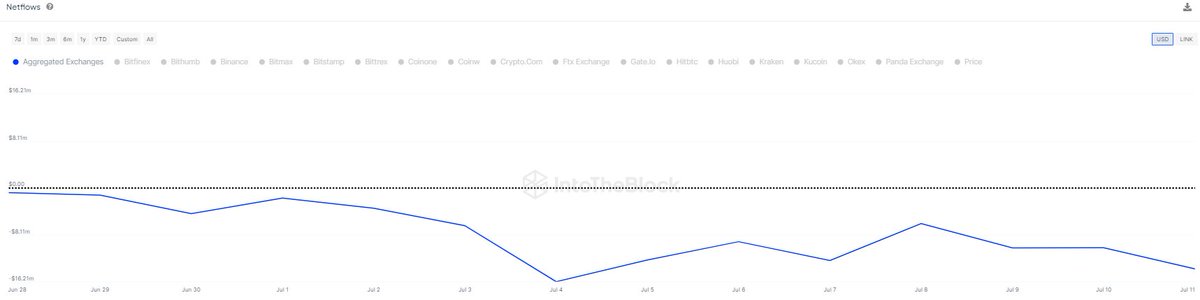

Based on recent on-chain analysis, it seems that there’s a trend towards accumulation of Chainlink tokens as investors transfer around 8.7 million LINK tokens, equivalent to approximately $110 million, away from cryptocurrency exchanges over the past fortnight.

The observation derives from the Netflows metric, which monitors the fluctuation of tokens moving between centralized exchanges. A negative Netflows value signifies a greater exit of assets compared to entries into crypto exchanges. In contrast, a positive Netflows value indicates that more assets are entering than leaving exchanges.

The reason behind the significant surge of Chainlink tokens leaving exchanges is not clear, but the large-scale departure of LINK tokens indicates a change in investor attitude. This trend implies that investors are becoming more confident and transferring their tokens out of trading platforms.

IntoTheBlock said in the post:

Investors often engage in this behavior during the amassing stage, implying they’re transferring their $LINK tokens from exchanges to more permanent storage, signifying a long-term investment stance.

Another blockchain company provided supporting evidence, indicating significant accumulation among Chainlink’s key investors. Based on Santiment’s analysis, investors owning between 10,000 and 1,000,000 coins have purchased approximately 9.2 million LINK since June 24. Consequently, the holdings of this investor group now reach a total of 207.29 million coins, marking an eight-month peak.

As an analyst, I’ve observed notable accumulation among Chainlink’s significant investors holding between 10,000 and 1 Million coins. This trend has been evident during the recent market downturn. Since June 24th, these stakeholders have purchased approximately 9.2 Million LINK tokens, representing a 4.65% expansion in their collective holdings since that date.

— Santiment (@santimentfeed) July 12, 2024

Chainlink Price At A Glance

From my current perspective as a researcher, the cost of LINK hovers around $12.94 at present, representing a modest 3.4% rise over the previous 24 hours based on CoinGecko’s latest figures. Additionally, I’ve uncovered that the Chainlink token has experienced a weekly growth of approximately 2.5%.

Despite the recent display of power, Chainlink’s price drop of nearly 10% over the last fortnight has yet to be reversed. On the bright side, the shrinking LINK token inventory on centralized trading platforms may serve as a catalyst for an uptrend in the altcoin’s value.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Etheria Restart Codes (May 2025)

- Is There a MobLand Episode 11 Release Date & Time?

2024-07-13 13:16