As a seasoned crypto investor with several years of experience under my belt, I’ve seen the market go through its fair share of ups and downs. The recent Bitcoin price plunge and subsequent altcoin declines have been disheartening, to say the least. However, I remain optimistic about the future, especially given the upcoming Bitcoin Halving.

Despite Bitcoin‘s recent price drop causing significant declines of up to 70% for certain Altcoins, there’s a glimmer of optimism on the horizon.

As a crypto investor, I believe that the Bitcoin halving in April has the potential to breathe new life into the altcoin market. This event, which reduces the reward for mining new Bitcoins by half, could be just what’s needed for alternative digital currencies to regain their footing and reach new heights.

Bitcoin Halving: A Gateway to Altcoin Prosperity?

Bitcoin experiences a Halving approximately every four years, reducing the reward given to miners for each block by half. Subsequently, this decrease in new supply often leads to a surge in demand and corresponding price increases for Bitcoin, as well as other cryptocurrencies in the altcoin market.

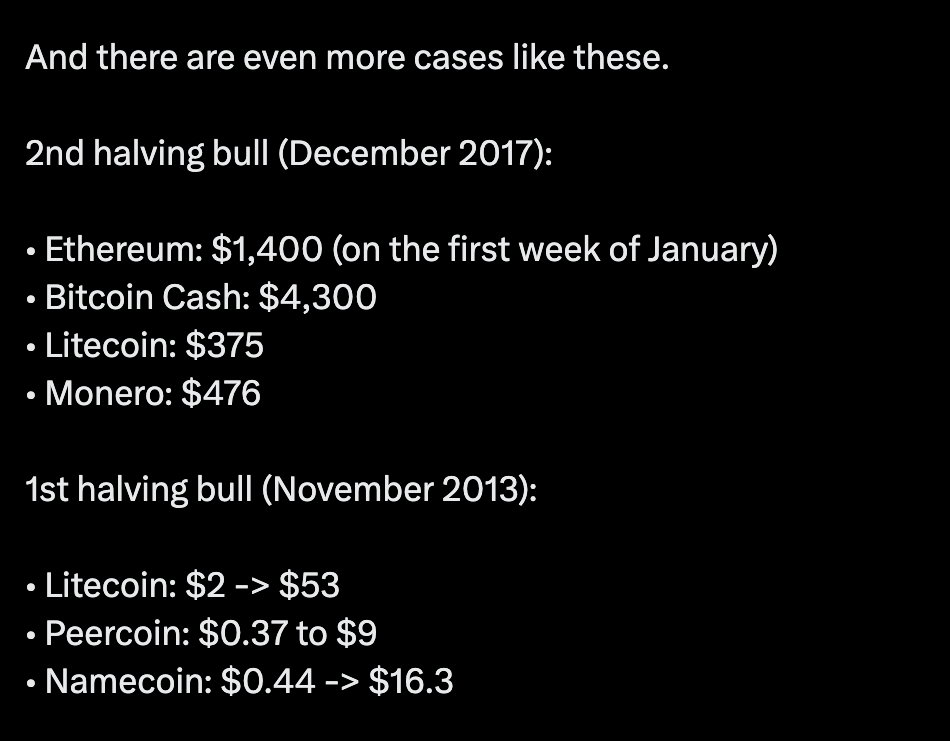

According to cryptocurrency expert Wise Advice, after every Bitcoin halving event, there is a significant possibility for altcoins to experience notable price increases. The analyst specifically highlighted this trend.

Based on the information you’ve provided,

Previously, the Halving process has sparked significant interest in alternative cryptocurrencies. The perceived scarcity resulting from Bitcoin’s halved production rate has fueled demand and price increases for these coins.

In the previous Bitcoin Halving on November 9, 2021, notable cryptocurrencies like Ethereum (ETH), Solana (SOL), Polkadot (DOT), and Avalanche (AVAX) reached new peak prices.

Regarding past price peaks, ETH reached its highest point of $4,800 on November 10, followed closely by SOL‘s new high of $250, which was achieved five days prior on November 5. DOT attained its peak price of $55 on November 4, while AVAX experienced its highest point at $144 later in the same month on November 21.

How Does The Halving Points To Alts Season Now?

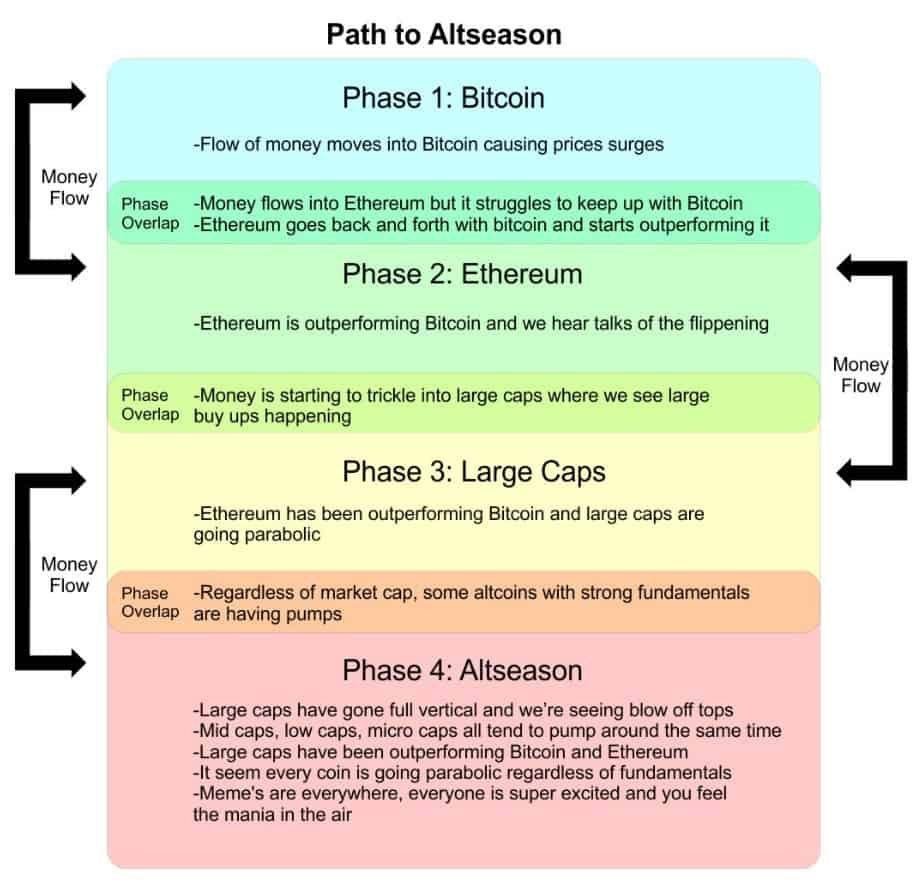

According to the “As Wise Advice” post, a consistent trend emerges after each Bitcoin halving event: funds shift from Bitcoin to altcoins, leading to noticeable gains in the market value of these alternatives.

The analyst explained:

As purchases increase, prices rise consequently, benefiting investors. They then offload a portion and transfer funds to lesser-capped tokens like Ethereum and others. Since their market caps are significantly smaller, an influx of $100 million can lead to substantial price changes (for instance, a month before the All-Time High, Bitcoin’s market cap was almost five times larger than Ethereum’s). That’s why Solana and Polkadot reached their All-Time Highs more quickly. Eventually, funds move towards even smaller altcoins, which often experience disproportionately larger growth.

Significantly, Bitcoin’s dominance index – which represents Bitcoin’s market value in comparison to the overall market value of all cryptocurrencies – frequently demonstrates this transition. Following a halving event, a decrease in this index indicates an increasing appetite for alternative cryptocurrencies (altcoins).

The current Bitcoin dominance amounts to 54.60%, representing a slight drop from the previous figure of more than 55% as observed earlier this month, according to TradingView data. Despite this decrease, it’s important to note that the index remains above the 50% threshold, signaling that Bitcoin continues to hold significant market influence.

The latest downturn in the crypto market might be indicative of an upcoming altcoin rally. Analogous to the situation in late 2020, Glassnode analysts suggest that current market conditions could foster a surge in smaller and riskier cryptocurrencies, foreshadowing an altcoin season.

Rotation coming?

Yesterday, we saw how #Nasdaq declined >2% – while #IWM rallied >3%.

This is a clear indication of Rotation. The move to riskier assets.

Will we also see this is #BTC and #Alts?

Well – in November 2020, we had a day just like yesterday. IWM soared and…

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) July 12, 2024

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-07-13 11:11