As a seasoned crypto investor with a deep understanding of market trends and technical analysis, I’m keeping a close eye on Bitcoin’s recent price action. The recovery from the five-month low at $53,500 is encouraging, but the bearish D1 trend indicator warns us not to get too optimistic just yet. Jackis’ analysis emphasizes that Bitcoin must reclaim the $64,000 zone to reverse the prevailing bearish daily trend.

The price of Bitcoin has bounced back somewhat in recent days, returning to around $58,000 following a five-month low at $53,500. Yet, based on technical assessments, it could face hurdles in moving beyond significant markers, and there’s a chance it might dip back down to lower prices.

On Social Media Platform X, marketing guru Jackis recently shared an insight: The ominous D1 trend signal on Bitcoin’s 12-hour chart, currently displayed on the former Twitter, warns of a bearish trend and underscores the importance for Bitcoin to regain the $64,000 mark in order to potentially change the direction of this daily downturn.

Although a note of caution is warranted, there are optimistic indicators emerging. For instance, Bitcoin ETFs have experienced substantial investment, and long-term investors have been amassing more Bitcoin.

BTC Struggles To Break Bearish Trend

Although Bitcoin has bounced back recently, its technical analysis indicates that the downtrend is still in effect. According to Jackis’ assessment, if Bitcoin’s price reaches a new high of $60,300, the D1 trend indicator will not turn bullish until Bitcoin successfully reclaims the $64,000 mark. This resistance level has previously frustrated the bulls as Bitcoin failed to break above it on its July 1st attempt.

Based on Jackis’ assessment, the anticipated range for the next day’s segment is estimated to be around $51,000 to $49,000. A significant level of $63,800 serves as a crucial milestone for bulls aiming to reverse the trend’s direction.

Despite the current downturn, there’s a chance for recovery as “dip buyers” have emerged, leading to substantial investments in the US Bitcoin ETF. This influx of funds has bolstered the Bitcoin price and prevented a more severe decline. Furthermore, consecutive days of inflows have helped mitigate selling pressure caused by the German government’s Bitcoin holdings.

ETF Inflow Data And Bitcoin Price Performance

During the week ending on July 11, data from JPMorgan reveals that investors poured $882 million into spot Bitcoin Exchange-Traded Funds (ETFs). This equates to an average of approximately $175 million per day, which is the largest inflow since May 23.

BlackRock’s IBIT ETF and Fidelity’s FBTC were the top two attractors of funds in the recent surge, pulling in $403 million and $361 million respectively. On the other hand, Grayscale’s ETF experienced further outflows, totaling approximately $87 million over the past three weeks, contributing to a total outflow of over $1.1 billion from the ETF market.

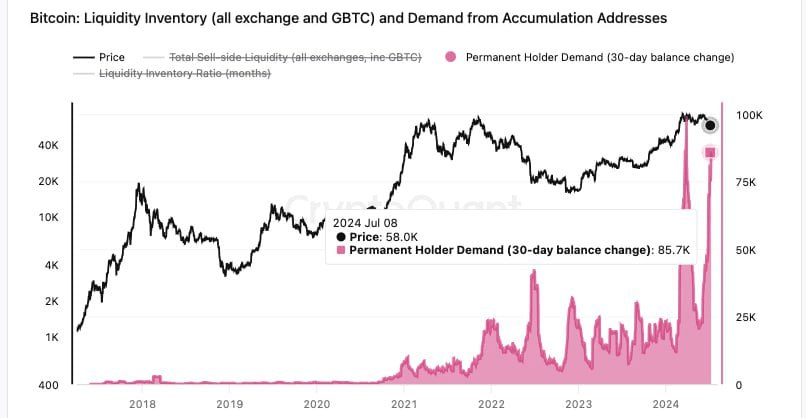

As a dedicated crypto investor, I’ve been optimistic about the market trend and recently delved into an exhaustive analysis of Bitcoin’s price behavior during last month. Notably, I discovered that long-term investors have been actively buying BTC, adding over 85,000 coins to their portfolios within the past 30 days.

As a researcher studying the Bitcoin market, I’ve observed that the continuous accumulation of Bitcoins by long-term investors serves as a promising sign for price growth. Their unwavering belief and faith in Bitcoin’s future potential fuels this bullish catalyst.

In simpler terms, CryptoSoulz, like Jackis, believes that Bitcoin’s current dip in price may soon reverse due to underlying support in the longer term perspective. Despite recent negative headlines, they expect a rebound from the current level.

The analyst added that should the Bitcoin price drop and be unable to stay above the $54,000 mark in the near future, it could potentially slide down to $49,500 as a new support point.

In simple terms, the current value of Bitcoin is $58,300, with a minimal increase of 0.7% over the past 24 hours. Bitcoin seems poised to stabilize above previously significant price points.

Read More

2024-07-13 07:17